Spot Ethereum-ETFs began trading in the United States today, marking an important step for the cryptocurrency market.

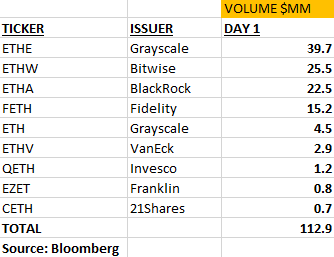

According to Bloomberg ETF analysts Eric Balchunas and James Seyffart, spot ETH-based exchange-traded funds reached $112 million in trading volume within the first 15 minutes.

Spot Ethereum ETFs Debut in US

On July 22, the US Securities and Exchange Commission (SEC) approved final filings on Form S-1 for the launch of the spot Ethereum ETF. The funds from nine issuing companies, including Bitwise, flooded major exchanges like Nasdaq, the Chicago Board Options Exchange, and the New York Stock Exchange (NYSE).

Bloomberg ETF analyst James Seyffart reported that the total asset size of the new funds is just under $10.3 billion.

“Here are the starting asset levels for the Ethereum ETFs launching today. The whole complex starts trading with just shy of $10.3 billion, pretty much all from $ETHE’s assets,” he wrote.

Read more: Ethereum ETF Explained: What It Is and How It Works

Meanwhile, Eric Balchunas highlighted the impressive early trading volume. He noted that the $112 million figure represents about 25% of the first-day trading volume for Bitcoin funds. Bitwise leads the group with an inflow of $25.5 million.

“Total of $112m traded for the group, which is A TON vs a normal ETF launch but only about half of what bitcoin ETFs’ volume pace was on DAY ONE, altho 50% would exceed expectations,” Balchunas said.

The launch of spot Ethereum ETFs in the US shows that cryptocurrencies are becoming more accepted in mainstream financial markets. This development is likely to attract more institutional and retail investors, which could lead to more innovation and growth in the sector.

Amid the excitement of the spot Ethereum-ETF debut, ETH experienced volatility. Initially showing intraday gains, the second-largest cryptocurrency’s price dropped below $3,500. At the time of writing, Ethereum is trading at $3,444, according to BeInCrypto data.

“Ether prices traded below 3,000 in early July despite the initial rally to 3,959 in late May. This alone signals that traders are relatively indifferent to the idea that ETH prices will sustainably rally this year. Although ETH rallied back to 3,500 into this ETF launch, we suspect many will take profit once the ETF launches,” Markus Thielen, 10x Research Founder & CEO, told BeInCrypto.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Either way, the strong initial trading volume highlights the high demand and interest in Ethereum-based financial products. Stakeholders will closely watch the market as it adapts to this new financial tool and observe its impact on ETH price dynamics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.