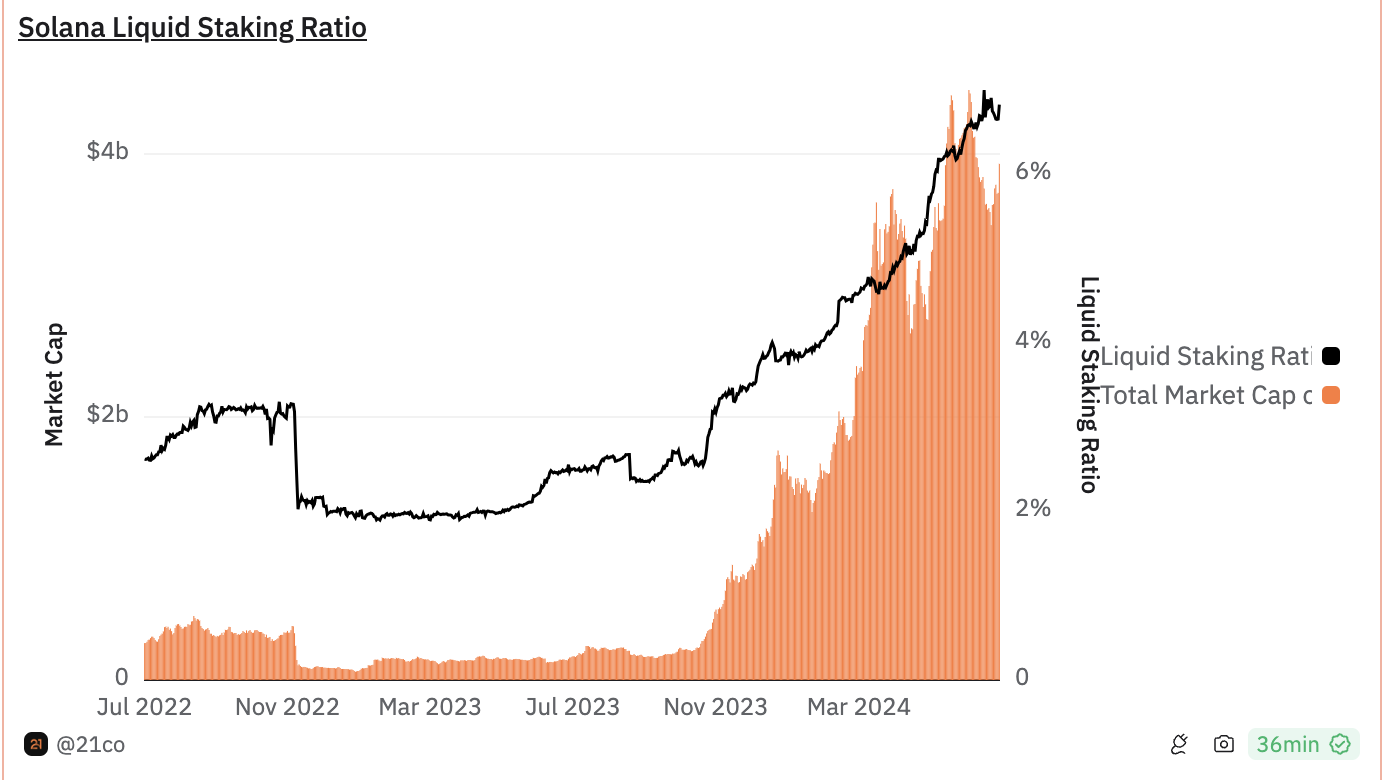

Solana, the fifth-largest crypto asset by market size and the third-largest proof-of-stake (POS) network, saw its liquid staking ratio rise by 1.76% quarter-over-quarter.

DefiLlama reports that liquid staking platforms hold over $54 billion worth of crypto assets. Liquid staking, unlike traditional staking, lets users earn extra yield and retain liquidity with a derivative token for DeFi.

The Rise of Liquid Staking on Solana

Data from Dune Analytics reveals that over 23 million SOL, worth more than $3.6 billion, is staked on liquid staking platforms. Solana boasts a higher staking ratio than Ethereum, at around 60%, yet only 6% of staked SOL is in liquid staking. This disparity highlights significant untapped potential in the liquid staking sector, pointing to promising growth opportunities.

Read more: What Is Liquid Staking in Crypto?

SOL two-day unbonding period, shorter than many other blockchains, might also impact the popularity of liquid staking. Konstantin Boyko-Romanovsky, founder and CEO of Allnodes, explains how this can be an advantage over other blockchains like Polkadot or Ethereum.

“Since Solana’s unbonding period is only two days, liquid staking might not be as popular as blockchains with unbonding periods of 2-3 weeks. In the context of staking, the unbonding period is when staked assets are unlocked and available for use after a user decides to unstake them,” Boyko-Romanovsky, told BeInCrypto.

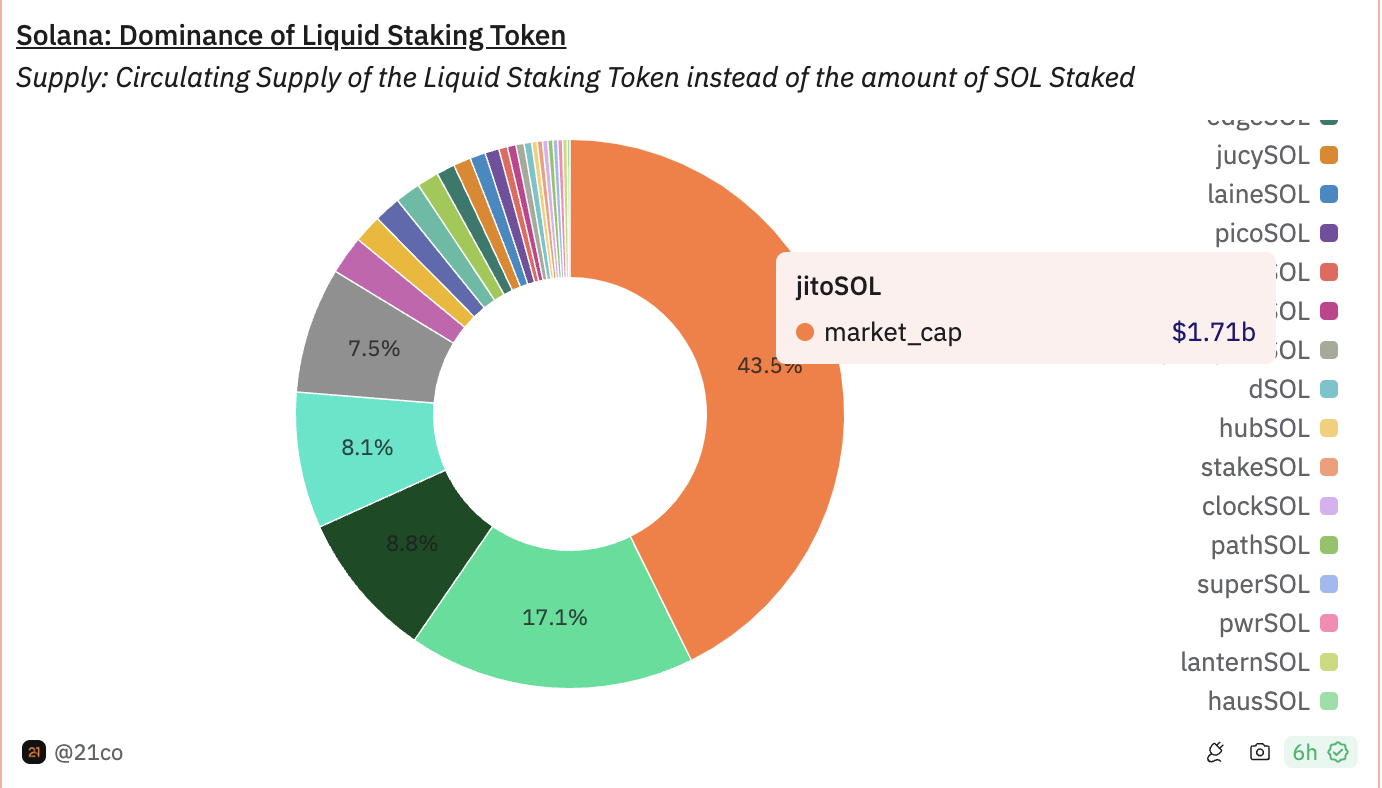

Platforms like Sanctum and Jito Labs are also driving the liquid staking boom on Solana. According to researcher and analyst Tom Wan, Sanctum lowered the barrier of entry and is helping projects build their own liquid staking tokens (LSTs) and scale.

Jito currently has about 91,000 Solana investors staking on the platform, with an APR of over 8% and over 10.6 million SOL staked.

“Sanctum is able to take the torch. The launch of INF, Sanctum Router, and Sanctum Reserve, has lowered the barrier to entry, buklding foundation of a Cambrain explosion of the liquid staking sector on Solana,” Wan shared in a post.

Boyko-Romanosvky also highlights the influence emerging trends like re-staking can have on liquid staking’s growth in Solana.

“Emerging technologies like re-staking can potentially influence the development and adoption of liquid staking on Solana and similar blockchains. By providing continuous liquidity, increasing yield opportunities, and offering greater flexibility, re-staking can enhance the attractiveness of liquid staking even on platforms with short unbonding periods like Solana. However, ensuring the security and reliability of these technologies, alongside effective market and liquidity management, will be crucial for their success and widespread adoption,” Boyko-Romanosvky shared.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

As liquid staking continues to grow in popularity, SOL could benefit from increased user participation and enhanced network security. So far, two major filings for a Solana ETF have been made in the US. If liquid staking popularity continues to grow, it can give Solana a competitive advantage and attract investment firms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.