The price of Curve DAO (CRV) plummeted by up to 35% within a few hours. This sharp decline came after news broke that Michael Egorov, the founder of Curve, might face liquidation.

Egorov, a key figure in the decentralized finance (DeFi) sector, is currently navigating a precarious trading situation.

Curve Founder’s Potential Liquidation Causes Panic

According to Arkham, an on-chain analysis platform, Egorov is close to seeing $140 million worth of CRV liquidated. He has borrowed around $95.7 million in stablecoins, primarily crvUSD, against $141 million in CRV distributed across five accounts on various lending protocols.

“Based on current rates, Egorov is paying $60 million annually in order to keep his positions open on Llamalend,” Arkham said.

Read more: What Is Curve (CRV)?

Egorov borrowed $50 million through the DeFi platform – Llamalend at an annual percentage yield (APY) of roughly 120%. This high rate is largely due to the near absence of crvUSD available to borrow against CRV on Llamalend. Notably, three of Egorov’s accounts comprise more than 90% of the crvUSD borrowed on this protocol.

Additionally, data from Spot On Chain reveals that Egorov presently has 139 million CRV tokens worth $37 million as collateral, with debts amounting to $27 million across three platforms. According to the latest update from Arkham, Egorov’s $140 million positions were liquidated.

“The price of CRV fell through Egorov’s liquidation threshold this morning, with his entire 9-figure lending position liquidated across five protocols,” Arkham said.

The falling price of CRV has also impacted other major players in the market. For example, a crypto whale, 0xF07, was compelled to transfer 29.62 million CRV, valued at approximately $7.68 million, to Binance due to a liquidation on Fraxlend.

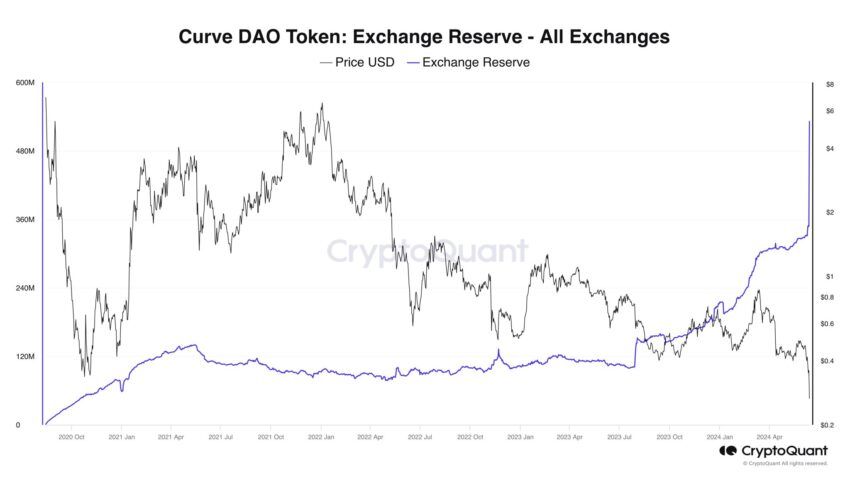

That being said, Ki Young Ju, founder of another on-chain analysis platform – CryptoQuant, observed a significant increase in the CRV balance on exchanges, reaching an all-time high. It surged by 57% in just four hours.

After initially dropping from $0.35 to $0.21, the price of CRV has since shown resilience, recovering to about $0.26, marking an 18% rebound. This scenario highlights the volatile and unpredictable nature of the crypto markets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.