Symbiotic has made a notable entry into the decentralized finance (DeFi) space, launching on June 12 with $5.8 million in seed funding from Paradigm and Cyber Fund.

This debut marks a significant challenge to EigenLayer, a major player in the Ethereum restaking sector.

Symbiotic Restaking Protocol Launches

Symbiotic’s launch follows a May 15 commitment from Lido co-founders and Paradigm. The project, secretly backed by Lido executives Konstantin Lomashuk and Vasiliy Shapovalov through Cyber Fund, aims to disrupt the existing restaking narrative dominated by EigenLayer.

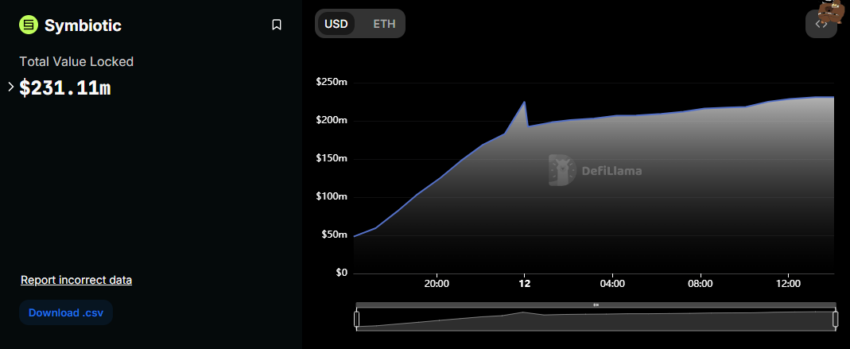

With an impressive Total Value Locked (TVL) of $231.11 million shortly after launch, Symbiotic advertises itself as “a generalized shared security system enabling decentralized networks to bootstrap powerful, fully sovereign ecosystems.” The TVL metric measures the overall activity and popularity of a DeFi project, giving insights into how much capital is being utilized within a DeFi ecosystem.

“Among other things, it broke every possible and imaginable record, reaching over $200M in TVL in just a few hours,” said Alessandro Mazza.

Read more: Ethereum Restaking: What Is It And How Does It Work?

The support from Paradigm comes in the wake of a decision by EigenLayer co-founder Sreeram Kannan to opt for investment from Andreessen Horowitz (a16z) instead. Undeterred, and as DeFi battled along the “restaking narrative” form between Ethereum and Lido, the venture capital firm approached Symbiotic. Paradigm is also the biggest backer of Lido.

Lido is Ethereum’s largest liquid staking protocol on TVL, with DefiLlama showing a TVL of $33.6 billion at press time. EigenLayer ranks second, with a TVL of $18.78 billion.

EigenLayer ascended the ranks relatively quickly, with its presence threatening Lido. Its growth came at the expense of Lido as some users withdrew their stake from Lido to funnel more assets into the newer restaking platform. This has sparked speculation that Lido backing EigenLayer’s competitor, Symbiotic, is a strategy to maintain its dominance.

Lido Forays Into Restaking Space Through Symbiotic

Lido is a powerhouse in the decentralized finance (DeFi) sector. It offers a protocol where users stake their ETH and receive Lido Staked ETH (stETH) tokens for various uses. EigenLayer is a newer service in which users restake assets like ETH and stETH to help secure other networks in exchange for additional rewards.

Amid dominance battles, the Lido stake-taking platform has been grappling with the restaking narrative, threatening to sidestep its grip on decentralized finance with EigenLayer on the frontline.

The Lido DAO consortium, composed of LDO token-holders, manages the Lido protocol. They make decisions on strategy and key upgrades. In a new initiative, Lido has partnered with Mellow Finance. This platform allows users to generate yield by depositing into restaking “vaults.” These vaults are built using Symbiotic’s technology. This initiative gives traders access to advanced restaking tools, helping Lido reclaim its dominance with stETH.

Read more: The Ultimate Guide to Lido Staked ETH (stETH)

EigenLayer only accepts ETH, EIGEN, and a few ETH derivatives. In contrast, Symbiotic accepts any crypto asset based on Ethereum’s ERC-20 token standard. With Symbiotic’s launch, EigenLayer’s dominance may face stronger competition, leading to a more selective market presence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.