Cardano’s (ADA) price is not reaping the benefits of the broader market cues as it remains sideways bound.

The reason is that no one other than the ADA whales opted to sell, creating a bearish atmosphere.

Cardano Whales Selling Sends Bearish Ripples

Cardano’s price has been influenced by its investors in the past, and this influence has only grown stronger now. The best example is the recent move from ADA whales, which the altcoin can still not recover from.

Addresses holding between 10 million and 100 million ADA sold over 290 million ADA in a single day at the end of May. This $130 million worth of supply could likely have been to either secure gains or prevent further losses.

Regardless, since such large wallet holders’ selling and buying affect the direction of the price action, it wasn’t surprising that ADA consolidated following the selling.

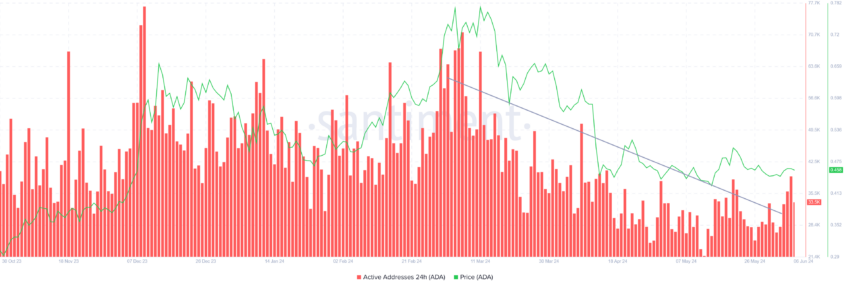

However, this could change, and the investors who caused the dip also have the power to do so. At the time of writing, the addresses conducting transactions on the network have registered a surge.

Cardano’s growing participation is a positive sign for the asset, which translates to increased demand and higher liquidity. However, the mixed cues generated could lead to consolidation. Plus, rising participation combined with falling prices or slow growth creates a deviation between the two.

Read More: Who Is Charles Hoskinson, the Founder of Cardano?

This deviation tends to flash a sell single, which causes further issues with the price action.

ADA Price Prediction: Breakout Will Be a While Away

Cardano’s price moved within a symmetrical triangle for two months. A symmetrical triangle is a chart pattern characterized by converging trendlines connecting a series of sequential peaks and troughs.

This pattern typically indicates a period of consolidation before the price breaks out in the direction of the existing trend. While the outcome is likely bullish, this would warrant further sideways movement before something substantial. This would require ADA first to secure the $0.46 as a support floor.

Read More: Cardano (ADA) Price Prediction 2024/2025/2030

Considering the aforementioned factors, bearish-neutral price action will likely continue its sideways movement.

However, if $0.46 is tested as a support floor, the bearish thesis could be invalidated. As a result, ADA could also rise to $0.50 and above, effectively eliminating all recent losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.