Binance’s native token, BNB, marked a new all-time high after weeks of waiting while observing a slow uptrend.

While BNB price is currently above the $700 mark, broader market cues suggest that a drawdown could be next.

Binance CEO in Jail, BNB on a High

BNB’s price broke the previous all-time high of $686, which had been held for over three years. The new ATH sits at $716, which BNB rose to during the intra-day rise.

The timing of the new all-time high, however, is interesting. The founder and former CEO of crypto exchange Binance, Chengpeng Zhao, also known as CZ, began his four-month prison sentence this Monday. CZ has been incarcerated in a federal prison in California for violating the Bank Secrecy Act (BSA) he pled guilty to in April this year.

However, as the price rose, the chances of a decline also shot up, according to the Relative Strength Index (RSI). RSI is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100.

It helps identify overbought or oversold conditions in a market, typically using thresholds of 70 and 30, respectively.

Read More: How To Buy BNB and Everything You Need To Know

Currently, the indicator is well above the threshold of 70.0, sitting in the overbought zone. This zone is synonymous with corrections, as noted during the mid-March rally.

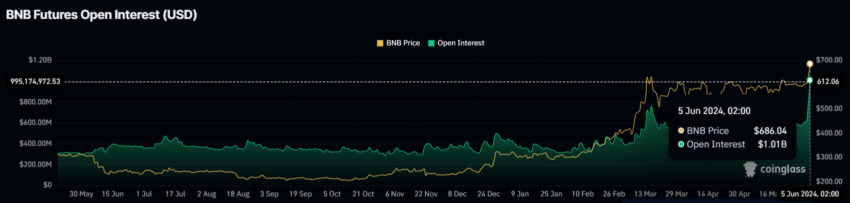

Secondly, Open Interest has risen rapidly in the last few days. Open Interest represents the total value of all open contracts in the futures market, including long and short contracts.

Currently, BNB’s Open Interest is at $1.1 billion, having risen by $400 million in four days. This shows that investors are optimistic about both a further rise and a decline, making BNB vulnerable.

BNB Price Prediction: Watch Key Support Floor

BNB price reaching the new high resulted from a 15% increase noted in the last five days. During this period, the altcoin broke past the critical resistance of $618, which had been preventing a rally for almost three months.

But with the bullishness saturating, the BNB price could notice a correction in the face of the market cool-down. The aforementioned factors show that while a dip is likely, it may not be too hurtful to the recent gains.

The altcoin could slip to $656; losing this support could cause it to fall back to $618.

Read More: Binance Coin (BNB) Price Prediction 2024/2025/2030

However, a bounce back from $656 could keep BNB’s price above the $650 mark. This way, the altcoin could stick to moving sideways, invalidating the bearish thesis and stoking the fire of a rise.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.