In the relatively short history of Bitcoin, the journey has been a roller-coaster of investor sentiment. The digital currency has already experienced several cycles of hyper-optimism and exaggerated pessimism from the community.

Many are already familiar with the infamous Bitcoin (BTC) obituaries given in the past, in which high-profile names mention Bitcoin’s imminent death. Still, the Bitcoin network lives on and continues to fulfill its purpose.

Naturally, as Bitcoin goes through these boom-and-bust cycles, the discussion about the cryptocurrency bubble starts heating up. Is Bitcoin just a speculative asset with no intrinsic value?

What Makes a Bubble?

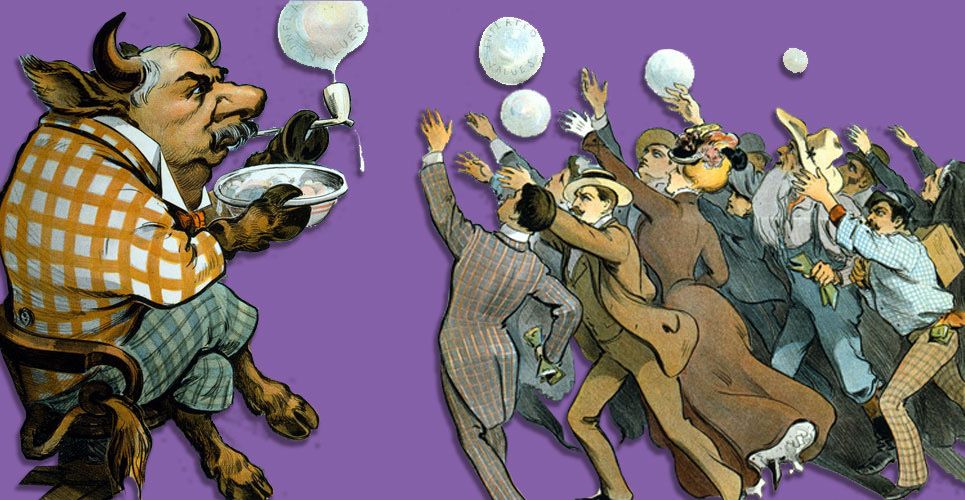

The notion of a bubble comes from the traditional asset bubbles that can be observed throughout the history of mankind. An economic bubble generally occurs when investors have increased expectations regarding a specific asset. Taking this into consideration, investors start speculating on its future value driving prices higher. As certain price levels are reached, even more investors fall prey to the fear of missing out and buy into the speculated asset. However, there is a certain threshold when demand starts drying up and prices cannot indefinitely push to higher levels. When investors observe a perceived weakness in the underlying asset and their expectations are not met, they slowly begin to sell their holdings. Just as during the rallying phase, pressure can be observed on the way down when investors start selling in masses. When this happens it means that the bubble has ‘popped,’ however, this can only be observed in retrospective.

Bubbles of the Past

Formally, an asset bubble is a sharp increase followed by an abrupt fall in price. While there are different theories on what causes economic bubbles, the most influential factors remain socio-psychological. The most popular example of an economic bubble is the tulip market mania which occurred in the 17th century in the Netherlands. At the time the price for a specific type of tulip had skyrocketed only to plunge in a short period of time. This is the first account of such an event and analyzing it 300 years later easily reveals the irrationality of market participants at the time. After all, investors were paying for tulips – a perishable good that could be easily reproduced and distributed. These type of market movements can be observed all throughout history with different asset types going through bubble cycles, including real estate, debt obligations, public stock companies, and national currencies.Is Bitcoin a Bubble?

Due to Bitcoin’s novelty as a piece of technology and its potential impact on money as a concept, it is easy to brand it as a bubble. Assigning a value to something that is difficult to grasp and with a short history leads to varying perceived valuations, which are often led by sentiment. This has already been observed in cryptocurrency markets, which have been known for high price volatility. Not even cryptocurrency or financial experts are able to ascertain a well-defined valuation method to Bitcoin Thus far. Deriving from a lack of understanding its intrinsic value, which may materialize in the future, the call for Bitcoin’s demise is sounded every boom-and-bust cycle it goes through. There have been calls for Bitcoin going to zero when it was at $0.70, $120, $700 and even currently at $3,400. Eliminating the short term bias by switching to a long term view of Bitcoin’s markets will show how every Bitcoin bubble has actually been an adoption cycle. Each of them were driven by irrational investor behavior during the FOMO (fear of missing out) phase, but the long term upward trend is being sustained.The evolution of Bitcoin as an asset is quite remarkable since there is none other to relate it to. In only 10 years the digital currency has gone through four ‘bubble bursts,’ probably more than any other asset class in such a time-frame.When people compare Bitcoin to Tulip Mania and other bubbles…But does Bitcoin's last decade REALLY look like those bubbles??? pic.twitter.com/tuMtBa9qKV

— James Todaro, MD (@JamesTodaroMD) January 31, 2019

Bitcoin’s Limited Reserve

The socio-psychological factors cannot be fully eliminated from markets — meaning that Bitcoin will go through the bubble phase multiple times on its path to establishing itself as a separate asset class. Moreover, as a brand new asset class, it cannot escape increased volatility as markets are on a journey to fully discover Bitcoin’s price. The fact that Bitcoin has a fully predictable issuance calendar is alien to any other existing asset class. As such the process of finding a price equilibrium will take place over time and in an erratic way. [bctt tweet=”Investors’ uncertainty towards Bitcoin in the short term is compensated by the certainty of the cryptocurrency’s attributes as a monetary base in the long term.” username=”beincrypto”] Nobody can predict whether Bitcoin will become the main global currency or will just be an experiment in monetary theory. However, as time goes by Bitcoin proves to be even more resilient, both in the face of adversity and plunging prices. Every bubble the cryptocurrency goes through is merely a step on its staircase. What is your long-term prediction for Bitcoin? Is it a bubble that will go to zero? Is this a familiar cycle of adoption for a novel currency? Tell us your thoughts in the comments below!

What is your long-term prediction for Bitcoin? Is it a bubble that will go to zero? Is this a familiar cycle of adoption for a novel currency? Tell us your thoughts in the comments below!

Image courtesy of Shutterstock, Twitter

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Christian Gundiuc

After finishing his studies in International Business Administration at the Frankfurt School of Finance & Management, Christian started working at a real estate development company. Upon discovering Bitcoin and the cryptocurrency space, he switched his focus to learn, analyze and write about all things digital.

After finishing his studies in International Business Administration at the Frankfurt School of Finance & Management, Christian started working at a real estate development company. Upon discovering Bitcoin and the cryptocurrency space, he switched his focus to learn, analyze and write about all things digital.

READ FULL BIO

Sponsored

Sponsored