Bitcoin’s price surged to $67,500, recovering from a 22% correction.

Last week, we emphasized the significance of the $60,000 price level. Now, with more data, BeInCrypto solidifies the analysis.

Bitcoin Technical Outlook

Bitcoin’s recent price action has validated last week’s insights. The price broke above the 1D Ichimoku Cloud, reaching $67,500. Currently, it has encountered short-term resistance at $67,300.

If Bitcoin breaks above this level, it could easily surge to $70,000, with resistance at $68,300.

Delving Deeper Into Bitcoin On-Chain Data

Realized capitalization (realized cap) is the total value of all Bitcoins in circulation, calculated based on the price at which each Bitcoin was last bought or moved. It’s like adding up all the purchase prices of every Bitcoin currently held.

It shows how much money has been invested into Bitcoin, considering the historical prices at which these coins were acquired.

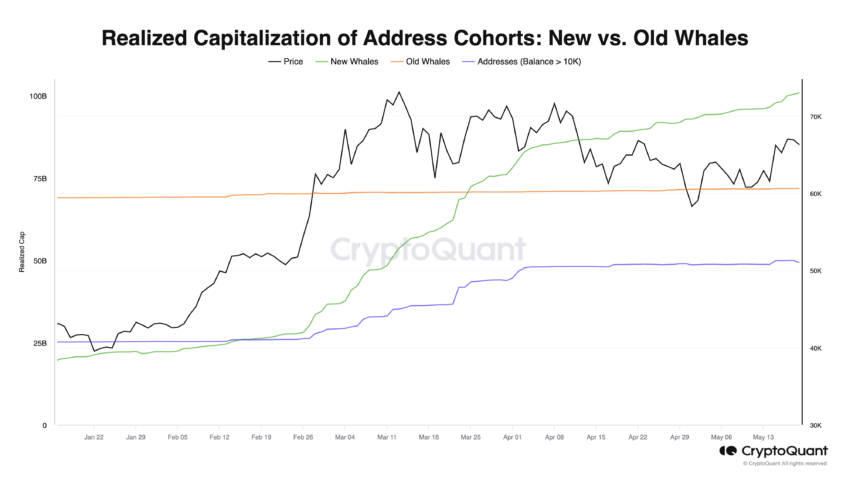

This chart illustrates the realized capitalization of different Bitcoin address cohorts over time:

New Whales: Addresses holding more than 1,000 BTC with an average coin age of less than 6 months.

Old Whales: Addresses holding more than 1,000 BTC with an average coin age of more than 6 months.

Addresses (Balance > 10K): Addresses holding more than 10, 000 BTC.

Since January, the realized capitalization for new whales has steadily increased, indicating active accumulation of BTC by new large investors. In contrast, the realized cap for old whales remains relatively stable, showing that long-term investors hold onto their Bitcoin.

The gradual growth in the realized cap for addresses holding over 10,000 BTC reflects the slow but steady accumulation by the largest Bitcoin holders. This indicates that even the biggest investors are gradually increasing their Bitcoin positions.

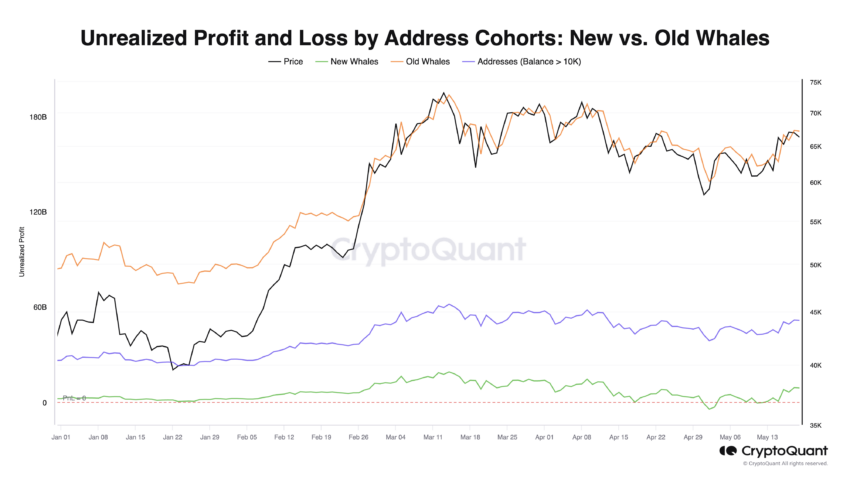

Unrealized profit and loss reflect the potential gains or losses if the holders were to sell their BTCs at the current market price.

These charts illustrate the unrealized profit and loss of different Bitcoin address cohorts: new whales, old whales, and addresses with balances over 10,000 BTC.

Since the beginning of the year, the unrealized profit has been steadily increasing, peaking around mid-March, indicating that these large holders have seen significant potential gains.

The profit levels for new whales have been more volatile than for old whales and large holders. While old whales and the largest holders show stable and substantial unrealized profits, indicating a strong holding mentality, new whales display more volatility but are still in profit.

Read more: Bitcoin Price Prediction 2024/2025/2030

This overall positive unrealized profit scenario bodes well for Bitcoin’s market stability and future price appreciation.

Strategic Recommendations and Price Prediction

Bullish to Neutral: The on-chain data shows new whales actively accumulating Bitcoin. Meanwhile, old whales are holding their positions with significant unrealized profits. This strong holding behavior suggests a bullish sentiment in the market.

Price Target: Given the current trends and accumulation patterns, it is recommended to hold BTC positions until the price reaches $73,000. This target aligns with the ongoing bullish momentum and the historical behavior of major holders.

Exit Strategy (Daily Ichimoku Cloud): Traders should set a clear exit strategy to protect their investments. If the price falls to enter the Ichimoku cloud on the daily chart, this should trigger an immediate exit. This action will help mitigate potential losses and preserve capital during downturns.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.