A recent report by CoinGecko underscores Solana’s dominance, revealing it as the fastest among significant blockchains.

With an average of 1,504 transactions per second (TPS), Solana outpaces Ethereum by 46 times and is over five times quicker than Polygon, the top Ethereum scaling solution.

Solana’s TPS: 46x Faster than Ethereum

On April 6, 2024, during a surge in memecoin activity, Solana demonstrated its peak performance, hitting the highest recorded daily TPS.

“Despite this impressive feat, it’s important to note that Solana operates at just 1.6% of its theoretical maximum speed of 65,000 TPS,” CoinGecko noted.

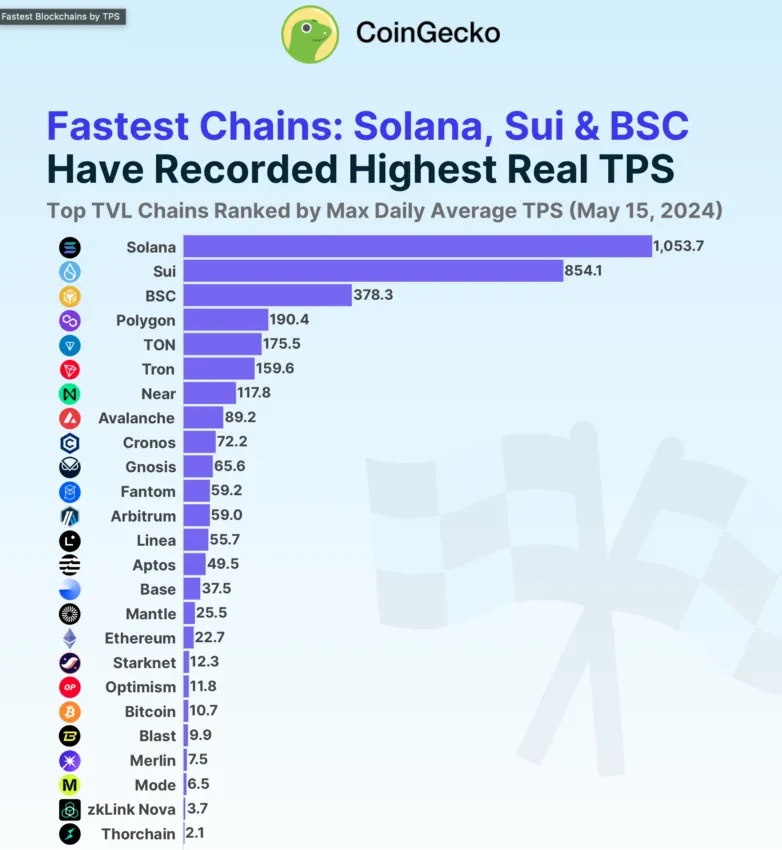

Non-EVM blockchains generally outperform EVM-compatible ones in speed. On average, non-EVM blockchains are 3.9 times faster than their EVM counterparts. Sui, another non-EVM blockchain, recorded the second-highest actual TPS at 854, driven by the popularity of the on-chain game Sui 8192. Other fast non-EVM blockchains include TON with 175 TPS and Near Protocol at 118 TPS.

In contrast, the EVM and EVM-compatible blockchains average just 74 TPS. BNB Smart Chain (BSC) leads the EVM category with 378 TPS, achieved during a surge in on-chain activity on December 7, 2023. Polygon follows, recording 190 TPS on November 16, 2023, making it the fastest among Ethereum scaling solutions and 8.4 times faster than Ethereum itself.

Read more: What Is Solana (SOL)?

Ethereum and its most extensive scaling solutions collectively achieved an actual TPS of 500, lagging behind Solana and Sui. Other notable Ethereum scaling solutions include Arbitrum with 59 TPS, Linea at 56 TPS, Base with 37 TPS, and Mantle at 25 TPS.

The study highlights that almost all significant blockchains set their highest actual TPS within the past year. The only exception is Thorchain, which reached its peak in May 2022.

The Challenges Remain

Despite Solana’s impressive speed, it faced network reliability issues. In February 2024, Solana experienced a significant outage due to performance degradation. Validators reported a temporary transaction halt, putting the network’s efficiency under scrutiny.

Additionally, Solana’s DeFi protocol Pump.fun was attacked on Tuesday. An exploiter used flash loans to compromise the contracts, leading to a loss of 12,000 SOL, or roughly $2 million. The Pump.fun team responded by upgrading the contracts and pausing trading to prevent further exploitation.

While Solana’s leading position in blockchain speed is undeniable, it also faces significant challenges. This dichotomy punctuates the complexity of blockchain technology, with Solana’s potential shining through its speed but also highlighting the need for continuous efforts in maintaining network reliability and security.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.