As Bitcoin (BTC) teeters on the brink of significant price movements, five leading analysts offer their insights on the future trajectory of the world’s premier cryptocurrency.

These projections come at a critical juncture as the digital asset market reacts to a variety of economic signals.

Bitcoin Battles Between Key Support and Resistance Levels

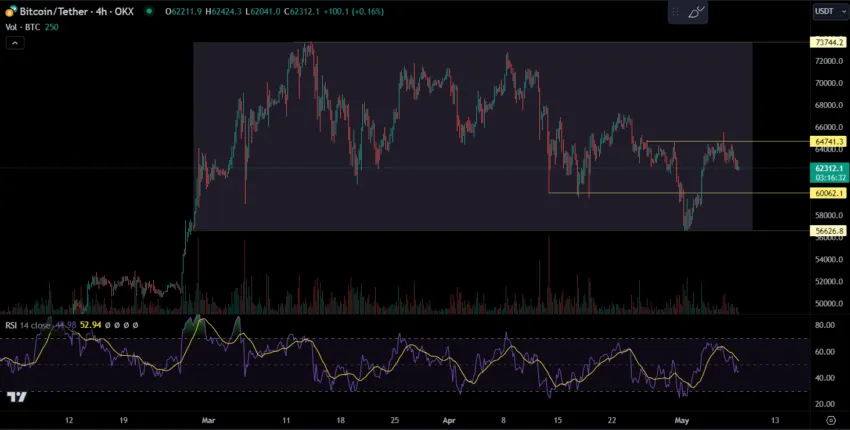

CryptoTony__ foresees a crucial point at $64,300, suggesting that reclaiming this level could pave the way for a safer entry for traders. This perspective highlights the importance of resistance-turned-support levels in Bitcoin’s price dynamics.

Meanwhile, Crypto_Chase emphasizes the need for Bitcoin to maintain a foothold at the $60,000 to $61,000 range to keep bullish hopes alive. This support zone is critical for Bitcoin to avoid a bearish downturn and sustain its upward momentum.

ColdBloodShill provides a nuanced view, pointing out the immediate hopes tied to low-time-frame (LTF) charts but also cautioning about potential high-time-frame (HTF) concerns.

Read More: Who Owns the Most Bitcoin in 2024?

In his video describing the current market structure on the daily price chart, he suggests that while short-term gains may be on the horizon, long-term forecasts remain clouded by uncertainty.

“We’ve got this kind of horrible little mixture of both lower time frame hope and higher time frame concern,” ColdBloodShill added.

Comparatively, CarpeNoctom delves into daily chart patterns, noting that Bitcoin is back within the daily Ichumoku cloud, indicating a neutral trend. The analyst predicts that the market might remain in this state for at least another ten days, advising traders to watch for an emerging inverse head-and-shoulders pattern, which could signal upcoming price movements.

“Trend remains NEUTRAL so long as price remains in cloud and BEARISH once we get a daily close beflow the cloud.” CarpeNoctom stated.

Crypto_birb predicts a potential May price target of around $70,000, bolstered by positive underpinnings from the Bitcoin ETF market and a solid correlation with the S&P 500. Furthermore, the analysis includes technical support at the $61,000 level with resistance near $64,000, setting the stage for possible bullish behavior if these levels are effectively managed.

Bitcoin Price Prediction: Consolidation Remains Center Stage

These insights collectively suggest that the immediate future of Bitcoin could swing based on key technical levels and broader market sentiment. Currently, the price action remains in a consolidation phase.

Conversely, $60,000 remains a crucial and psychological support level for BTC. While a bearish scenario could still trigger a sell-off to the mid-$50,000 area.

Also, the bullish thesis is mixed, with $64,000 playing a crucial resistance zone for BTC. Should this level be reclaimed and held, the price could continue its journey back to $70,000 once again.

Read More: Bitcoin Price Prediction 2024/2025/2030

Finally, The Relative Strength Index (RSI) also remains just below 50, indicating that the price is neither oversold nor overbought. This adds credence to the fact that the price is consolidating before its next major move.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.