Solana (SOL) price is observing a potential rally that could validate the bullish pattern the altcoin has been observing for days now.

The primary catalyst will most likely be the institutional investors whose interest has noted a sudden surge.

Solana Investors Push for a Rise

Solana’s price is close to breaking out of the double-bottom pattern it is stuck in. In order to make this happen, though, the cryptocurrency would need support from the market as well as its investors, which seems to be the case at the moment.

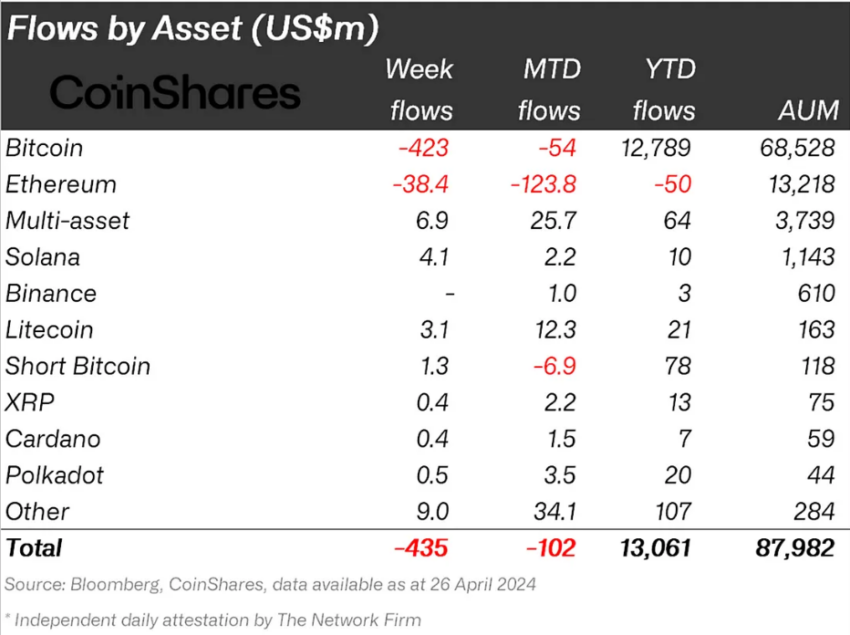

For the past couple of days, SOL seems to have regained the backing of institutional investors, which it had lost since the beginning of the year. According to CoinShare’s weekly report, the “Ethereum-killer” observed inflows of $4.1 million for the week ending April 26.

This was a surprising shift for Solana, given that not only did it have a bad Q1 2024 but an equally bad April in terms of net flows. From the beginning of the year to the end of April, SOL noted only $10 million worth of inflows.

However, this could likely change heading into May as Solana’s price initiates recovery.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

Furthermore, cryptocurrency has also observed a considerable increase in bullishness from retail investors. Solana’s funding rate has grown from negative to positive and is rising consistently.

Funding rate refers to the fee paid by one side of a perpetual contract to the other to keep the contract’s price aligned with the underlying asset’s market price. Negative rates hint at a dominance of short contracts in the futures market, while positive hints at long contracts taking the lead.

Given SOL’s funding rate is increasingly positive, SOL holders are likely betting on an increase in price.

SOL Price Prediction: Rally Ahead?

SOL investors’ behavior is likely in line with what is ahead for Solana’s price. The altcoin is trading at $155 at the time of writing, right under the resistance of $156. This price marks the neckline of the double bottom pattern, the digital asset has been noting for the past month.

The double bottom pattern is a bullish reversal signal formed by two consecutive troughs, suggesting a potential shift from a downtrend to an uptrend. Based on the pattern, the likely target for SOL’s upside is at $187.

Read More: How to Buy Solana (SOL) and Everything You Need To Know

This could lead to a 20% rally for the altcoin, provided it can break out and flip $169 into a support floor.

However, if the breach fails, Solana’s price could note a reversal, with the altcoin potentially testing the support at $138. Falling through this stop-loss support could lead to a drawdown to $126, invalidating any bullish outcome.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.