Friday has come, which means it’s time for cryptocurrency options expirations to occur. The settlement of $1.39 billion in Bitcoin (BTC) options and $1 billion in Ethereum (ETH) options is expected today. How will the prices of BTC and ETH react?

Approximately $1.39 billion in Bitcoin options contracts will expire today. The tranche is much lower than the 96,000 contracts settled last week.

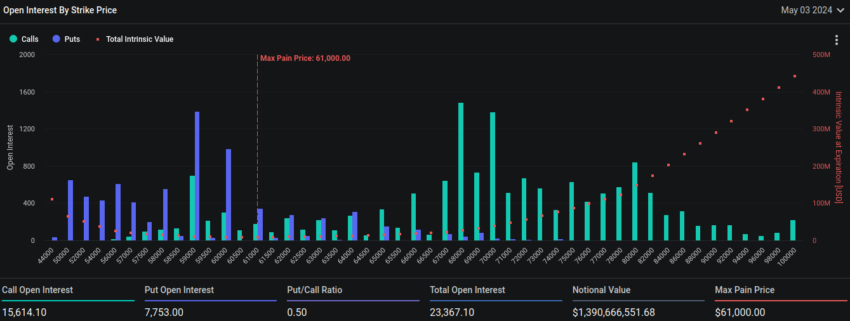

Bitcoin Faces $61,000 Maximum Pain Point in Options Expiry

Today, May 3, 23,367 Bitcoin contracts worth $1.39 billion are set to expire. According to Deribit data, Bitcoin’s put-to-call ratio is 0.50. The maximum pain point—the price at which the asset will cause financial losses to the greatest number of holders—is $61,000.

Read more: An Introduction to Crypto Options Trading

Greeks.live also highlighted the current state of the crypto market through its official account on X (formerly Twitter).

“Bitcoin and the cryptocurrency market as a whole are still experiencing a deep pullback, with April becoming the deepest pullback month in almost a year, Dvol fell directly from 74% to 55% this week, volatility expectations in the markets are falling extremely fast […] Short term one can choose lower IV and price and start buying options properly and profitably now,” noted Greeks.live

In addition to Bitcoin options, almost 334,248 Ethereum contracts will expire today. These expiring contracts have a notional value of approximately $1 billion, with a put-to-call ratio of 0.36 and a maximum pain point of $3,000.

Despite the strong correction experienced in recent days, the global cryptocurrency market has experienced a 4% increase in the last 24 hours, bringing its total global capitalization to $2.32 trillion, according to CoinGecko data.

Read more: 9 Best Crypto Options Trading Platforms

Recently, Bitcoin registered a sharp drop that took it below $57,000. However, it has rebounded and is in the range of $59,324. For its part, Ethereum has seen an increase of 1.5% to trade at $3,003.

Nonetheless, we must remember that the option expiration’s impact on the underlying asset’s price is short-term. Generally, the market will return to its normal state the next day and compensate for strong price deviations.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.