A large volume of Bitcoin (BTC) and Ethereum (ETH) options, worth approximately $9.26 billion in notional value expired on April 26, 2024.

This event involved 96,172 BTC contracts and 987,000 ETH contracts. It requires analysis to determine its potential impact on market dynamics and pricing for these digital assets.

$9.26 Billion Bitcoin and Ethereum Options Are Set to Expire

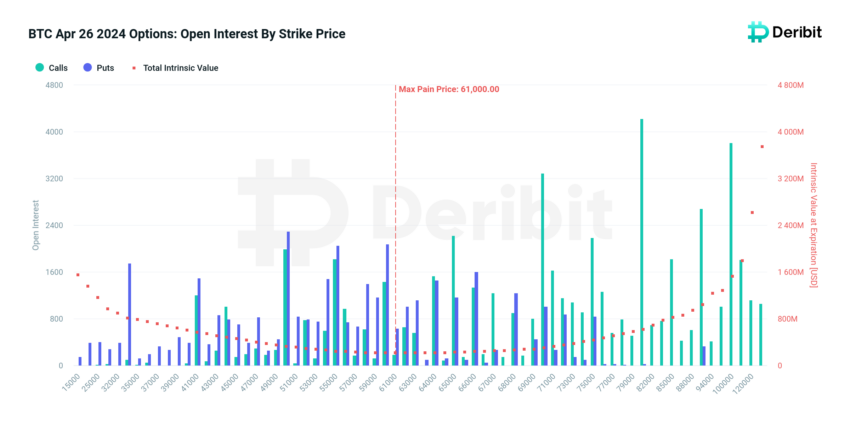

According to Deribit, BTC’s put-to-call ratio remains at 0.68. This means traders still sell more calls (long contracts) than puts (short contracts).

The maximum pain point (the price at which the asset will cause financial losses to the largest number of holders) stands at $61,000 for BTC. However, during the expiry time, Bitcoin surged to $64,600.

Read more: An Introduction to Crypto Options Trading

Meanwhile, the scenario is slightly different for Ethereum. The second largest cryptocurrency has a put/call ratio of 0.51 and a maximum pain point of $3,100.

Analysts from Deribit caution traders about heightened vigilance due to the convergence of various factors.

“The expiration is the first monthly expiration since the recent halving and may also be affected by the gains of some of the big tech companies this week, such as Tesla, Meta, and Google. Geopolitical tensions remain, as do concerns about further delays in rate cuts. All of this, coupled with strong open interest in Bitcoin and Ethereum options, could mean we’re in for some fireworks around the expiry,” Deribit analysts shared.

However, during the expiry, there was minimum price volatility as Bitcoin traded in the tight range between $64,200 and $64,600.

In a broader timeframe, Bitcoin has oscillated between $62,000 and $67,000, with its current price hovering around $64,200. Ethereum has mirrored this consolidation pattern. Such behavior shows the market’s sensitivity to underlying currents and the significance of strategic trading decisions during option expiries.

Further complicating the market outlook are the spot Bitcoin exchange-traded funds (ETFs) dynamics.

According to data from SoSo Value, there has been a significant net outflow of $218 million from US Bitcoin spot ETFs as of April 25, 2024. Prominent funds such as Grayscale’s GBTC, Fidelity’s FBTC, and Valkyrie’s BRRR have recorded notable withdrawals. However, Franklin Templeton’s EZBC was an exception, registering a net inflow of $1.87 million.

Interestingly, BlackRock’s IBIT still recorded no inflows in the reporting period. This marks two consecutive days of IBIT recording no inflows.

These ETF movements are critical as they reflect investor sentiment and market liquidity, which can cushion the impact of options expirations or exacerbate price volatility. The net outflows suggest a cautious or bearish stance among investors, potentially preparing for price adjustments post-expiration.

Read more: 9 Best Crypto Options Trading Platforms

However, readers must note that the market typically recalibrates post-expiration, stabilizing price trajectories as new positions are established.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.