As Bitcoin nears its next halving, attention is shifting towards an exciting development – the launch of the Runes protocol by developer Casey Rodarmor. Runes will go live after Bitcoin completes halving.

This new framework enables the creation of altcoins directly on the Bitcoin blockchain. This feature was once exclusive to networks like Ethereum and Solana.

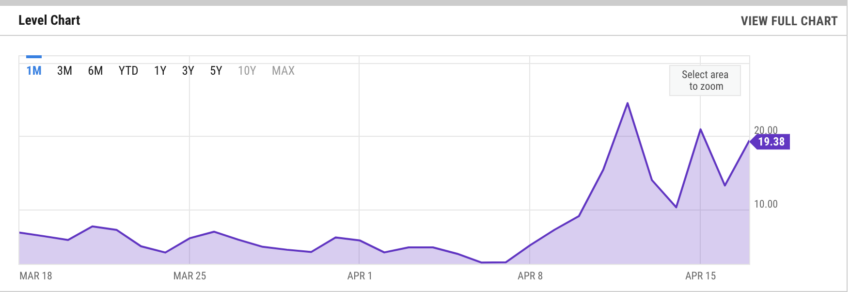

Runes Anticipation Spike Up Bitcoin Transaction Fees

The buzz around Runes stems from the success of Rodarmor’s previous project, the Ordinals protocol. Ordinals introduced NFT-like “inscriptions” to Bitcoin, infusing innovation and increased mining revenue into the community.

However, this led to network congestion and higher transaction fees.

As the launch approaches, its effects are already noticeable, with transaction fees on the Bitcoin network increasing dramatically. Fees have surged by over 45% in just one day and a staggering 892.7% compared to last year. This rise highlights the growing excitement and activity around the new protocol.

Read more: Bitcoin NFTs: Everything You Need To Know About Ordinals

Runes expands on these capabilities by using Bitcoin’s UTXOs (unspent transaction outputs) to support a broad token system. Essentially, a single Rune can represent varying amounts of multiple tokens, enhancing Bitcoin’s functionality.

Bitcoin entrepreneur Dan Held describes this method as a “simple strict improvement over BRC-20.”

“Runes operations do not create a leftover useless UTXO. I’ve learned the hard way that the market doesn’t particularly care about technical improvements so I’m glad that the market is hyped about Runes even if it’s for speculative reasons and hopefully it results in a general improvement on the network,” Held wrote.

However, Runes also marks a major cultural shift within Bitcoin. Traditionally, Bitcoin has focused on its native cryptocurrency. Runes disrupt this by enabling the proliferation of various speculative altcoins on Bitcoin.

Yet, the short-term success of Runes and its tokens is under scrutiny. Some analysts predict initial enthusiasm similar to the NFT boom, but concerns about sustained interest and value remain.

DeFi researcher Ignas warns that real investment opportunities may only appear after the initial hype cools down. Ignas explains that the influx of Rune tokens could initially dilute trader attention and investment per token, potentially causing their novelty and value to diminish quickly.

Read more: Top 5 BRC-20 Platforms To Trade Ordinals in 2024

“Utility-wise, Runes will trade as meme coins like BRC20s. At least at first, so the excitement of “new” will fade away. Especially if no Rune token manages to sustain the pump and degens lose money,” Ignas wrote.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.