Fantom (FTM) price is in a downtrend, restricted under the $1 mark since the beginning of the month.

However, the altcoin has a shot at recovery, provided the investors can back FTM with accumulation.

Fantom Is Ripe for Buying

Fantom’s price largely depends on either the broader market cues or the actions of the investors. The case for the past few days was the former, while the next two trading sessions are expected to be the latter.

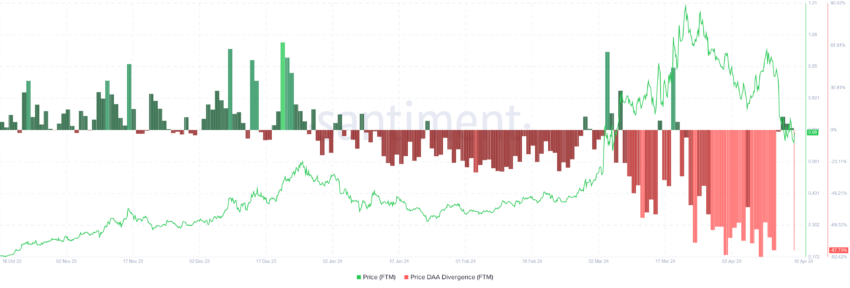

This is because on-chain indicators are flashing bullish cues hinting at potential buying opportunities. The strongest signal comes from the Price-Daily Active Addresses (DAA) Divergence. This metric indicates a disparity between cryptocurrency price movements and the number of active addresses transacting daily on the network.

When prices rise while daily active addresses decline, it could suggest speculative trading or price manipulation. Conversely, if prices fall while daily active addresses increase, it may indicate growing network utility and long-term value despite short-term price fluctuations.

FTM is witnessing the latter situation, flashing a “buy” signal.

Read More: 9 Best Fantom (FTM) Wallets in 2024

The Market Value further backs this to Realized Value (MVRV) ratio. The MVRV ratio tracks investor gains/losses.

Fantom’s 30-day MVRV of -27% suggests losses, possibly prompting a sale halt. Historically, MVRV between -12% to -27% often precedes rallies for FTM, terming it an accumulation opportunity zone.

Thus, if investors opt to bag FTM at the low prices of the altcoin, it would provide Fantom with a solid boost.

FTM Price Prediction: A Slow but Sure Recovery

Fantom’s price, propelled by the investors’ accumulation, could escape the downtrend, breaching through the trend line to test the resistance box. This resistance range, marked from $0.80 to $0.88, has been tested for support and resistance in the past couple of weeks.

If FTM manages to breach this range and flip the upper limit into a support floor, it will gain the potential of eventually hitting $1 to reclaim a portion of the recent losses.

Read More: Fantom (FTM) Price Prediction 2024/2025/2030

However, if the breach fails, Fantom’s price trickles back down to test $0.63 as support. Losing this support would invalidate the bearish thesis, leaving FTM vulnerable to a fall below $0.60.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.