Avalanche (AVAX) price has been moving sideways for the past two weeks and was expected to continue this way until it found bullish momentum.

However, by the looks of it, the altcoin is set to face bearishness thanks to its own investors.

Avalanche Investors Might Move to Sell

The Avalanche price is currently trading around $53 and preparing for further decline. However, should the altcoin dip, it will take nearly $1 billion worth of tokens out of the realm of possible profits to certain losses.

The Global In/Out of Money (GIOM) metric highlights the supply bought at certain price levels and where it currently stands. Nearly 22 million AVAX bought between $51 and $56 will fall into the clutches of bears should Avalanche price note a fall below $51.

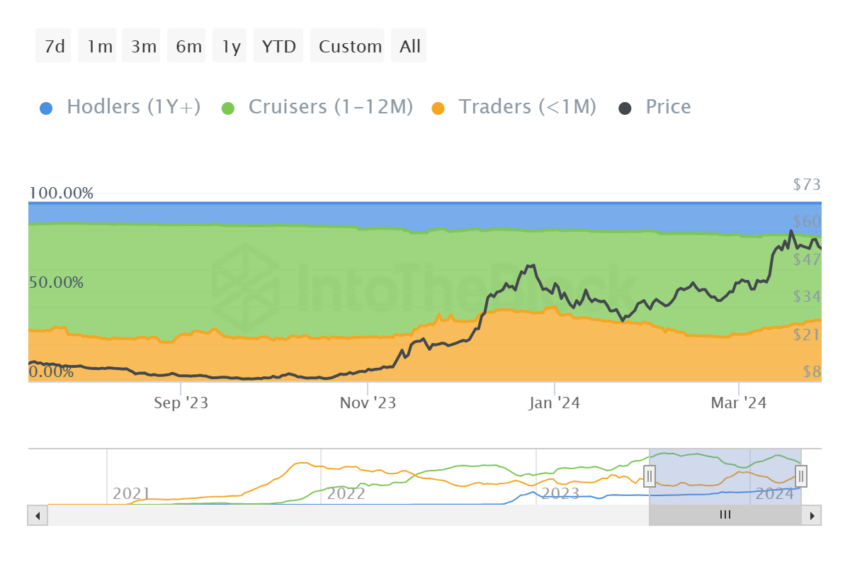

Although the market conditions do play a hand in dictating the price action of the cryptocurrency, Avalanche is facing a much larger threat from its own investors. Specifically, one single cohort of short-term traders. These investors are known to hold an asset in their wallets for less than a month, making it highly susceptible to selling.

At the moment, about 34.15% of the entire circulating supply sits in the hands of these investors.

Read More: What Is Avalanche (AVAX)?

If they move to sell their holdings to offset any potential losses, Avalanche price could observe a substantial drawdown.

Read More: How to Add Avalanche to MetaMask: A Step-by-Step Guide

AVAX Price Prediction: Decline is Likely Possible

Avalanche price, trading at $53, is set to lose the support marked at the same price level; this would result in the cryptocurrency likely testing $50. However, should selling intensify or bearish momentum gain strength, this support would be lost too, pushing AVAX down towards $47, which is the confluence with the 100-day Exponential Moving Average (EMA).

Read More: How To Buy Avalanche (AVAX) and Everything You Need To Know

On the other hand, if the winds shift, AVAX could flip the 50-day EMA into support from resistance. This could reignite a recovery. This would result in the price continuing its consolidation. Furthermore, the same could even extend to the altcoin, potentially breaching the $58 resistance and invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.