Binance, the world’s largest crypto exchange, has announced the delisting of DREP (DREP), MobileCoin (MOB), and pNetwork (PNT).

This action, taking effect on April 3, 2024, at 03:00 UTC, will see the removal of associated trading pairs from its platform.

Why Binance Will Delist These Altcoins

In their evaluation process, Binance scrutinizes several factors. These include the team’s commitment to the project and the level of development activity. Also considered are trading volume, liquidity, and network stability.

Additionally, the exchange assesses compliance with new regulatory standards and the contribution to a sustainable crypto ecosystem.

“When a coin or token no longer meets these standards or the industry landscape changes, we conduct a more in-depth review and potentially delist it,” Binance explained.

The trading pairs affected are DREP/BTC, DREP/USDT, MOB/BTC, MOB/USDT, and PNT/USDT. Post-delisting, all active trade orders will be automatically canceled.

Read more: Binance Review 2024: Is It the Right Crypto Exchange for You?

Moreover, deposits of these tokens will not be credited after the cessation of trading. Withdrawal support for these tokens will end on July 3, 2024. Binance also hints at the possible conversion of these tokens into stablecoins, although this is not assured.

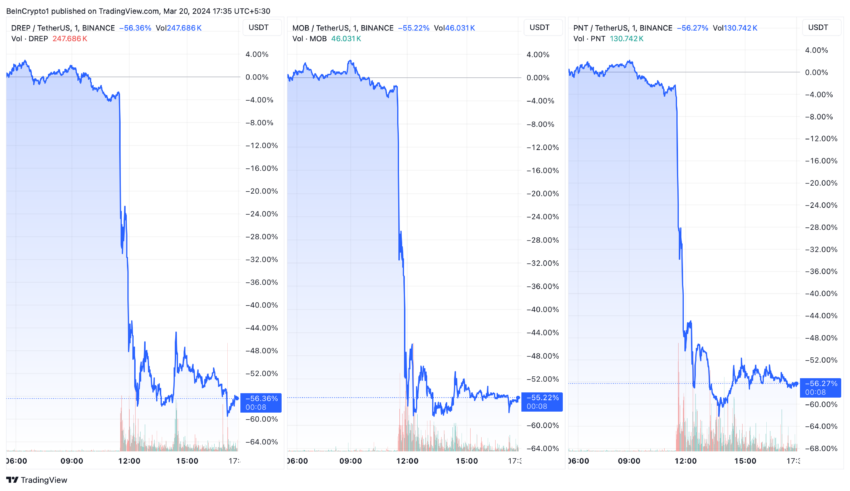

Following the announcement, the market reacted sharply. The value of the mentioned altcoins fell by more than 50%. This plunge highlights the influence of exchange listings on cryptocurrency values and investor outlook.

Binance claims to maintain a strict vetting process to ensure a secure trading environment. This approach is evident in their history of delisting tokens that do not meet their standards. As a matter of fact, in February 2024, Binance delisted Monero (XMR) and other altcoins.

As part of its ongoing efforts to safeguard its trading environment, Binance has tightened its monitoring of certain cryptocurrencies through its monitoring system.

Read more: 7 Best Binance Alternatives in 2024

It scrutinizes tokens for volatility and risk, leading to the “Monitoring Tag” label. This tag signals heightened oversight and potential delisting if tokens fall short of Binance’s criteria.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.