Goldman Sachs continues to back Bitcoin, even after its value slipped to $60,000. The investment giant’s digital assets chief, Mathew McDermott, has noted a significant shift.

Now, more institutional investors are entering the crypto market, previously led by retail investors.

Why Goldman Sachs is Bullish on Bitcoin

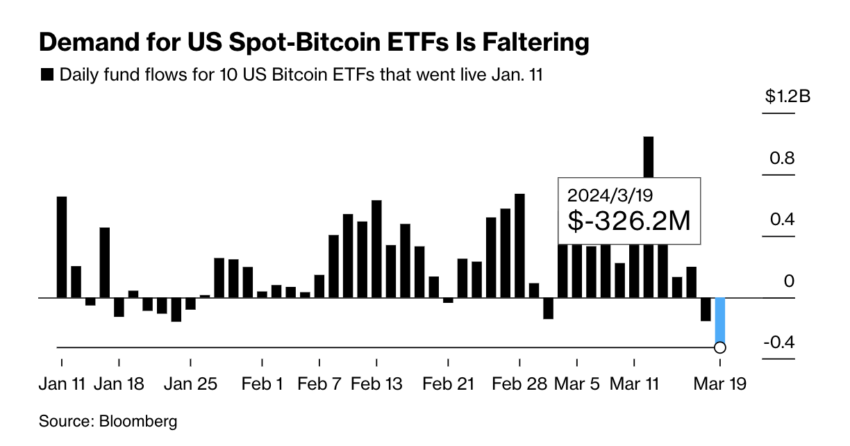

At the Digital Asset Summit in London, McDermott shed light on the changing tide of investment. Despite a recent fall in Bitcoin’s price from a high of nearly $73,798 to around $63,000, institutional interest has surged. This interest is evident in the fluctuating dynamics of Bitcoin exchange-traded funds (ETFs).

Early January saw the launch of spot Bitcoin ETFs, marking a pivotal change. McDermott referred to this as a “psychological shift” in investor sentiment.

Since launching its crypto trading desk in 2021, Goldman Sachs has been a key player in the digital assets field. This reflects the growing institutional interest in cryptocurrency. Despite market volatility, McDermott observed a notable change in client profiles and investment volumes.

“The price action has still been driven by retails primarily. But it’s the institutions that we’ve started to see come in,” McDermott said

Initially, these ETFs attracted substantial capital, with a total net inflow of $11.7 billion. However, recent data shows a decline in enthusiasm, with significant outflows in major ETFs. For example, on Tuesday, there was a net outflow of approximately $326.2 million from Bitcoin ETFs

Read more: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

Specifically, BlackRock’s spot Bitcoin ETF registered inflows of only $75.2 million, and Fidelity’s ETF saw $39.6 million. Other ETFs had minimal inflows or none, with Grayscale’s GBTC experiencing outflows of $443.5 million.

Amidst the outflow, the price of Bitcoin briefly touched $60,500 levels on Wednesday. This caused liquidations of over $430 million in the past 24 hours.

The recent behavior of these ETFs, with fluctuating inflows and significant outflows, suggests a cautious stance among investors. This caution stems from broader economic uncertainties, including debates over the Federal Reserve’s interest rate strategies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.