A non-fungible token (NFT), specifically CryptoPunk #3100, has been sold for a staggering 4,500 Ethereum (ETH). This sum translates to over $16 million, highlighting a renewed enthusiasm in the NFT market.

This transaction is the second largest in the illustrious history of the blue-chip NFT collection, only surpassed by a $23.7 million sale in February 2022.

NFT Sale Reignites Bull Market Discussions

Originally purchased for a mere $2,127 in 2017, CryptoPunk #3100’s worth has exponentially increased, with its last transaction before this reaching $7.51 million in 2021. Belonging to a unique set of 10,000 CryptoPunks, each with distinct features, its significant value is largely due to its rarity.

Specifically, it is one of only nine Alien CryptoPunks recognized by their unique blueish skin tone. Consequently, Alien CryptoPunks have become the most coveted among collectors.

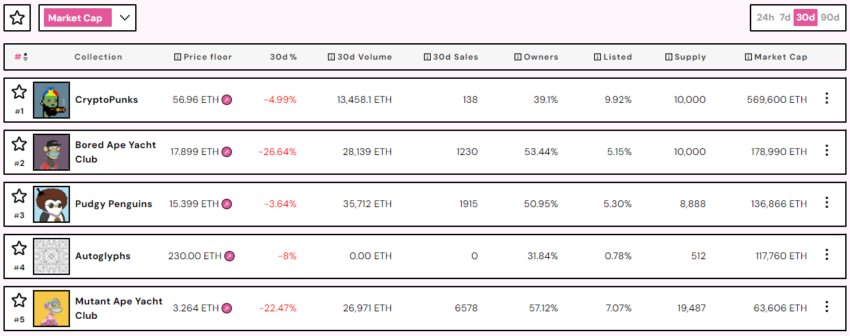

That being said, the CryptoPunks collection has witnessed a surge in trading activity. It boasts a 24-hour trading volume of $18.09 million and a market cap nearing 569,600 ETH, equivalent to approximately $2.12 billion. This places it at the forefront of today’s NFT collections.

Read more: What are CryptoPunks? The Complete Guide

Moreover, the recent sale of CryptoPunk #3100 for such an extraordinary amount has sparked conversations about a potential bull market resurgence within the crypto space. Many enthusiasts have drawn parallels between this investment and high-profile real estate acquisitions.

“He also could have bought Sam Bankman-Fried’s house for $16 million,” an X user Cryptoleon commented.

NFT Sector Revival

Even large institutions such as VanEck have ventured into the NFT market with the launch of SegMint, marking a significant step towards integrating traditional finance with blockchain technology. The SegMint platform introduces a “Lock & Key Model,” which aims to offer a secure and user-friendly NFT custody solution.

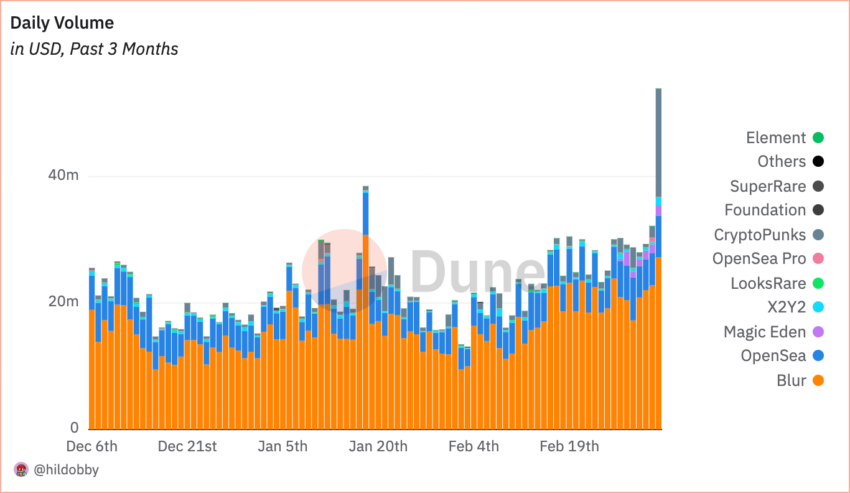

Following a period of downturn in 2022, the NFT sector is on a path to recovery, demonstrating notable resilience. Monday’s trading volume reached a three-month high, although it still represents an over 80% decline from 2022’s peaks.

Furthermore, the spotlight has recently shifted towards Bitcoin NFTs, thanks to their record-breaking sales volume. Surpassing Ethereum in weekly sales, Bitcoin NFTs have seen a remarkable 80% increase from the previous week. This surge is largely attributed to the Ordinals protocol, which has unlocked the potential for embedding files into Bitcoin’s smallest units, satoshis.

Read more: Bitcoin NFTs: Everything You Need To Know About Ordinals

Among these, the NodeMonkes collection has emerged as a frontrunner, showcasing the growing appeal of Bitcoin as a utility network.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.