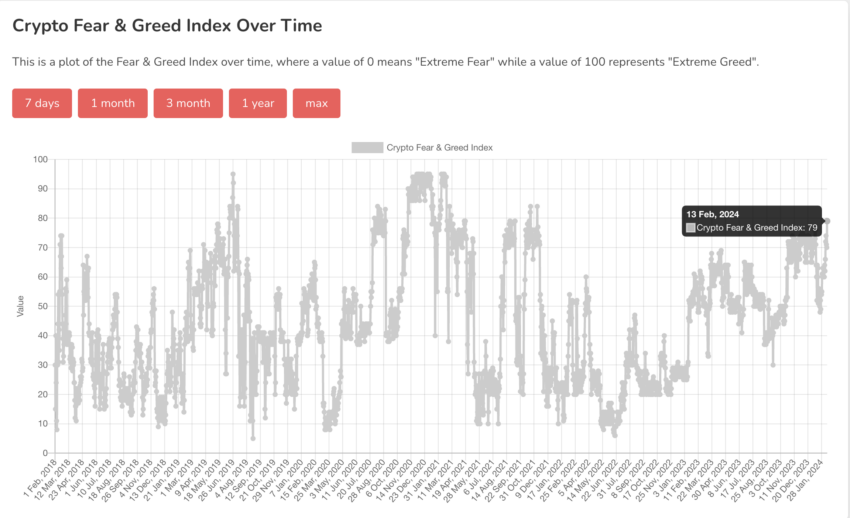

The Crypto Fear and Greed Index, a pivotal gauge of market sentiment, has soared to unprecedented levels since Bitcoin’s all-time high. Recent data reveals that on February 13, the index surged to 79, marking its highest point since mid-November 2021, when Bitcoin skyrocketed to $69,000.

The ongoing rally in Bitcoin, coupled with this latest surge of greed, follows the introduction of US-based spot Bitcoin exchange-traded funds (ETFs).

Industry Leaders Warn of Potential Dip Amidst Extreme Crypto Greed

This surge in greed follows closely on the heels of Bitcoin’s breach of the $50,000 mark on February 12. BTC has been on a robust rally for several months, boasting a 17% increase in value year-to-date.

Reaching a score of 79 indicates that the Crypto Fear and Greed Index has ventured into the territory of “extreme greed.” This recent spike mirrors a previous instance in January when the index hit 76, coinciding with the fervor surrounding the launch of spot Bitcoin exchange-traded funds (ETFs) in the United States.

Read more: What Is the Crypto Fear and Greed Index?

Bitget Chief analyst Ryan Lee told BeInCrypto about the possibility of a price retracement amidst the prevailing greed. Lee emphasized the psychological significance of Bitcoin’s price levels, particularly between $50,000 and its previous all-time high.

“It’s important to take the market’s psychological levels into consideration such as BTC prices ranging from $50,000 to previous ATH, which may cause larger price retracements. With the Lunar New Year break, the Asian crypto market may participate less which can lead to a drop in trading action and a probable dip in market volatility. BTC isn’t likely to break out yet; it’s looking at a stable sideways hustle in the range of $35,000 to $45,000,” Lee said.

Likewise, Manhar Garegrat, Head of Global Partnerships at Liminal Custody Solutions, echoed concerns about the sustainability of the price rally.

“If we look at today’s data, BTC is facing some resistance at the $50,000 level. It’s fair to assume that we may see a further dip in the coming days till there is a fresh breakout above $50,000 level for at least a week,” Garegrat told BeInCrypto.

Despite the extreme greed pervading the market, MicroStrategy co-founder Michael Saylor remains bullish on Bitcoin’s long-term value. Saylor attributed the surge in capital inflow to Bitcoin’s growing popularity as an asset class, highlighting its unique characteristics and detachment from traditional risk assets.

“Bitcoin is now the world’s most popular investment asset. People have been waiting for these ETFs and finally, mainstream investors are able to access Bitcoin… People are beginning to realize there’s 10 times much demand for Bitcoin, coming in through these ETFs as there is supply coming from the miners,” Saylor explained.

Read more: Bitcoin Price Prediction 2024/2025/2030

Meanwhile, BlackRock, the world’s largest asset manager, might be poised to increase its exposure to Bitcoin in the coming years. Rick Rieder, BlackRock’s Chief Investment Officer acknowledged the institution’s minimal exposure to Bitcoin currently. However, he hinted at a potential shift in their asset allocation framework in response to evolving public attitudes towards Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.