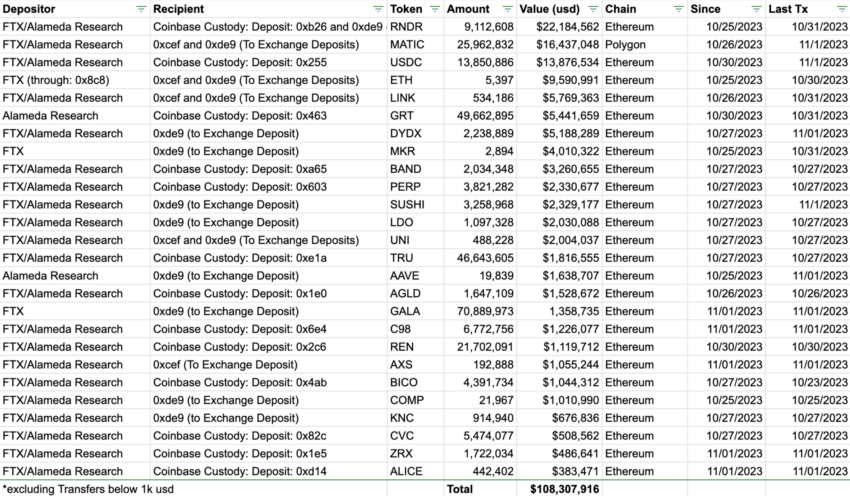

FTX advisers Alvarez & Marsal (A&M) sent information on FTX customer trades to at least five field offices of the US Federal Bureau of Investigation (FBI). The information was supplied in response to FBI subpoenas served during court proceedings of the bankrupt crypto firm.

According to an FTX court filing, the FBI’s Philadelphia office asked A&M for information “related to specific IDs” on Amazon Web Services (AWS). The agency’s Oakland and Portland offices asked for customer information and specific transactions in July and August.

FTX Risked Customer Data

In addition, FTX received subpoenas from the FBI’s Cleveland and Minneapolis establishments. The advisers reportedly billed the FTX bankruptcy estate $21,000 for the FBI requests across July, August, and September.

The FTX subpoenas highlight how users of centralized exchanges surrender anonymity when they sign up. The crypto wallet addresses assigned to customers can easily be linked to their real-world identities if the exchange needs to comply with anti-money laundering regulations.

Exchanges can also create a single point of failure by storing client information in a centralized location like a cloud server. A hack of the cloud provider may endanger customer assets, similar to how a recent breach of LastPass, a password manager holding crypto keys, saw $4.4 million in crypto assets lost.

The FTX advisers will get paid from FTX assets that are in varying stages of liquidation. A court recently allowed FTX debtors to sell crypto assets in weekly tranches of $100 million to minimize market impact.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

How Crypto Firms Respond to Subpoenas

US crypto companies follow a process to answer subpoenas to limit government overreach into customer transaction data. The agency must generally provide probable legal cause that could force the exchange to turn over the requested information. This is to prevent law enforcement from trying to drum up criminal activity through fishing expeditions.

Sometimes, like Coinbase did in response to a subpoena from the US Internal Revenue Service (IRS), the exchange can seek to limit the scope of the request. Coinbase fought the IRS’ overly-broad request and narrowed the subpoena’s scope to wallet information for 15,000 US account holders.

The exchange previously revealed it had received 12,320 law enforcement requests between Oct. 1, 2021, and Sep. 30, 2022. The US was the largest single solicitor of information, with 5,304 requests.

Read more: The Ultimate US Crypto Tax Guide for 2023

Do you have something to say about FTX disclosing customer data to the FBI, how US crypto firms handle subpoenas, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.