The crypto market is reverberating with cheers as Bitcoin breaks past $31,000, marking its first since July and propelling MicroStrategy into profitability once again.

This upswing is not just a figure but represents a testament to the growing belief in the potential approval of a spot Bitcoin ETF (Exchange Traded Fund).

Bitcoin Breaks $31,000 on ETF Speculation

As Monday dawned, Bitcoin soared, continuing a rally stretching into its second week. This surge of over 4% in the last 24 hours pushed Bitcoin past the significant $31,000 threshold. This is a figure not seen since the summer rays of July shone down.

At the time of writing, Bitcoin was trading at $31,300, a figure that reflects its individual strength and pushed the global cryptocurrency market capitalization up by 3.7% to a whopping $1.22 trillion.

Read more: How To Buy Bitcoin (BTC) and Everything You Need To Know

This rally, analysts say, is fueled by multiple bullish signals. Among them, the narrowing GBTC discount now stands at -11%.

According to BlackRock CEO Larry Fink, this reflects a growing consensus of a spot Bitcoin ETF approval come Q1 2024, a catalyst anticipated to trigger substantial capital inflows. Moreover, the decoupling of Bitcoin from altcoins has been highlighted by Bitnomial Exchange’s Michael Dunn, especially with the market’s eyes set on a spot ETF approval.

“We’re seeing Bitcoin decoupling from altcoins due to bitcoin’s status as a digital gold, coupled with the market’s anticipation of a spot ETF approval. The Bitcoin dominance metric, which has been increasing since the end of 2022, highlights its outperformance compared to other cryptocurrencies,” Dunn said.

MicroStrategy Is Back In Profits

This Bitcoin rally brings more than just market dynamics to the table. It has reinvigorated MicroStrategy’s multi-billion-dollar bet on Bitcoin. With the largest cryptocurrency surpassing $31,000, MicroStrategy’s average purchase price of $29,582 is now profitable.

This victory lap follows a meticulous and aggressive Bitcoin purchasing strategy. Its co-founder, Michael Saylor, has spearheaded acquisitions since 2020.

Read more: Top 11 Public Companies Investing in Bitcoin

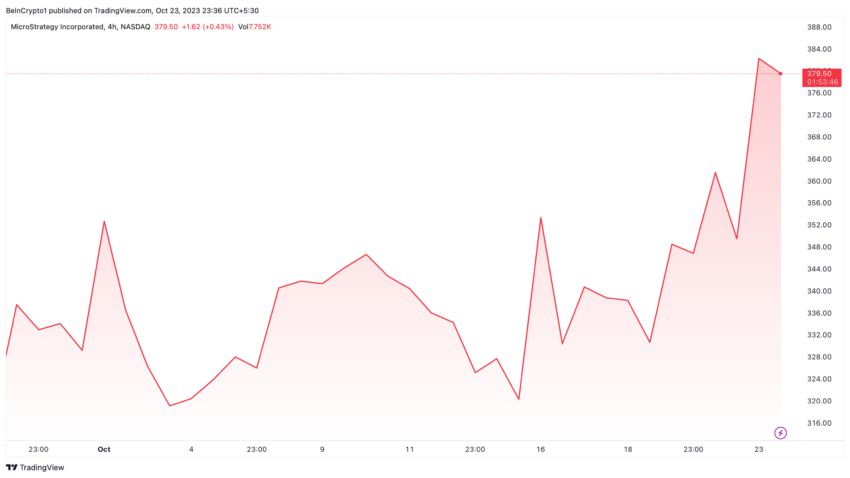

MicroStrategy’s shares have mirrored this triumph, with a surge of about 160% this year. Subsequently contrasting the gloom of 2022 when the stock plummeted by 74%. This turnaround is a ripple effect of Bitcoin’s 85% upsurge this year.

Stephane Ouellette, FRNT Financial’s CEO, stressed that the upward trajectory of MicroStrategy’s treasury will likely reflect in a stronger quarter report.

“Given the degree to which MicroStrategy’s treasury is dominated by Bitcoin, their stock should ostensibly trade well or at least they’ll report a stronger quarter on the back of the gains. To the extent that they’ve tried to build around the services of the space, they could outright see increased demand for their services,” Ouellette said.

As Bitcoin scales upwards, it is a beacon of renewed optimism for stakeholders like MicroStrategy. And as the crypto giant continues its ascent, all eyes remain fixated on how high Bitcoin will soar.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.