Trading volumes on major centralized exchanges suffer heavily during crypto bear markets, and Coinbase is no exception. For those that charge hefty transaction fees, such as Coinbase, a slump in volume could hurt profits.

On October 11, Bloomberg reported that Coinbase’s quarterly crypto trading volume is likely to be its lowest since before the firm went public.

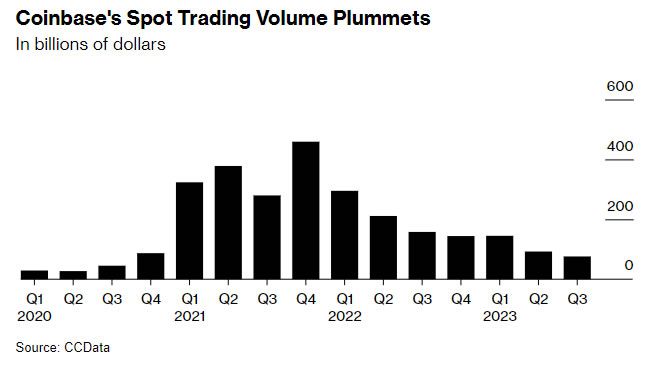

Coinbase Dwindling Volumes

Citing data compiled by researcher CCData, the outlet reported that Coinbase spot trading volume has likely plummeted by more than half during the third quarter.

The data showed that Q3 trading volume on Coinbase was around $76 billion. Moreover, this is less than half of the $158 billion it reported for the same period last year.

The figure is the lowest since Q3 2020, according to the data. This was before the firm was listed on the Nasdaq Stock Market in April 2021.

Coinbase derives the lion’s share of its revenue from higher-than-industry-average transaction fees.

In the second quarter, Coinbase transaction revenue accounted for 54% of its total revenue. In previous years and quarters, it has been as high as 88% of the total revenue.

Owen Lau, an analyst at Oppenheimer & Co., told the outlet,

“Overall it looks like a challenging quarter.”

The firm is forecast to post a seventh consecutive quarterly loss when it releases results on Nov. 2, according to analysts surveyed by Bloomberg. Moreover, Mizuho Securities expects Coinbase’s revenue to be 10% below forecasts.

Coinbase is facing increasing regulatory pressure in its home country, the United States. This, combined with a drawn-out crypto bear market, has impacted its trading volumes.

Coinbase stock (COIN) is down 2.85% on the day, trading after-hours at $77.43. A weak Q3 report is likely to put further downside pressure on share prices, which have gained 130% so far this year.

Exchanges Feeling the Pain

Coinbase isn’t the only centralized exchange feeling the bear market blues. World leader Binance is also under pressure in the US, where it has been forced to severely curtail its services.

Binance daily spot trading volume is around $5 billion, according to CoinGecko. This is less than half of the $13 billion in volume in November last year following the demise of its biggest rival, FTX.

Volumes, liquidity, and volatility have fallen across the board as the bear market comes to the end of its second year.

Crypto market capitalization has declined again today to $1.09 trillion at the time of writing. However, markets have been trading sideways for the past seven months.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.