Chainlink’s LINK token could be a good opportunity for investors wanting to capitalize on the growing trend of real-world asset (RWA) tokenization. Furthermore, the findings come from a recently published report by K33 Research.

On October 11, K33 Research analyst David Zimmerman published a report on the growing trend of real-world asset tokenization.

Chainlink Narrative for RWA Tokenization

He said that Chainlink’s native token LINK might be the “safest bet” for investors seeking to profit from the RWA tokenization hype.

Tokenizing traditional financial assets like commodities, treasuries, and bonds on blockchains can reduce costs and increase transparency. Crypto investor Scott Melker commented on the report, highlighting:

“Chainlink, with its system of oracles and wide partnerships, is well-positioned to connect blockchains with real-world data, making it a strong player in the RWA narrative.”

Zimmerman said that the Chainlink token was a good bet for future exposure to this fledgling sector.

“If we wish to have exposure to the RWA narrative and avoid being sidelined when it takes off, LINK is the safest bet.”

Despite the potential hurdles for RWA, the analyst believes that the narrative will be compelling. He added that it could potentially kickstart “an isolated RWA crypto bubble before there is widespread substantial impact from RWA on the real world.”

Zimmerman added that Chainlink will not be the biggest gainer, “but few projects are better positioned to benefit from the narrative.”

In September, BeInCrypto reported that real-world asset tokenization on-chain value had reached an all-time high of over $3 billion.

Moreover, tokenized treasuries have seen explosive growth this year, increasing by around 500% since the beginning of 2023. According to rwa.xyz, the total value of tokenized treasuries is at an all-time high of $685 million.

However, nascent RWA markets also encountered their first distressed debt scenario in September.

LINK Price Outlook

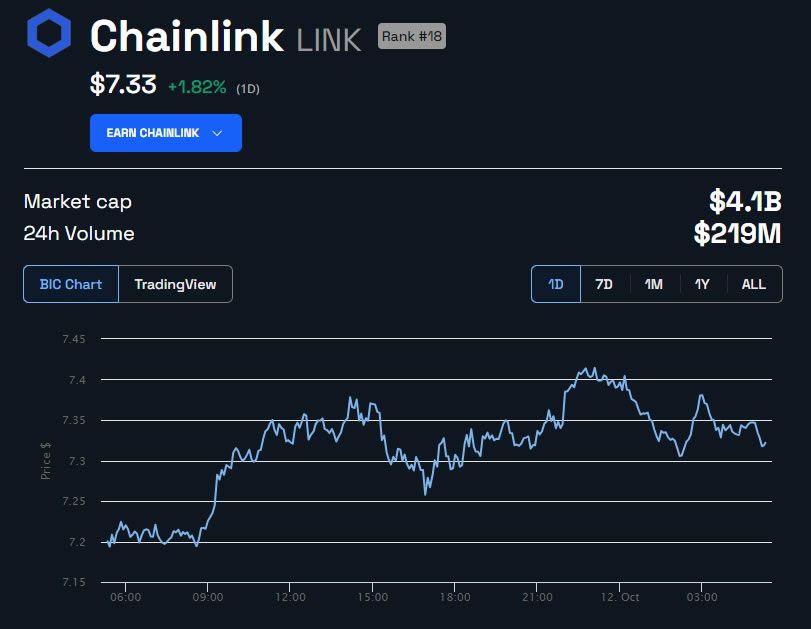

The Chainlink native token LINK is up 1.7% on the day at $7.32 at the time of writing. However, it has dropped 4% over the past week as the broader crypto market retreats.

Moreover, LINK has had a solid month, gaining 24% over the past 30 days.

Zimmerman advised investors to consider buying LINK at lower prices, indicating a long-term support level near $5.70.

However, current levels are not bad, considering the asset is still down 86% from its peak price of $52.70 in May 2021.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.