Litecoin (LTC) may have lost 94 percent from its all-time high of $365 in 2018 but is showing a strong comeback, approaching the year’s end.

Since hitting a 2018 low of $23 at the beginning of December, LTC has bounced back nearly 40 percent — holding on just above the $31 support (orange).

Below $23 is a dangerous zone for Litecoin, as there is a lot of empty space on the way down to the $3 and $4 level. A dip below $23 would also negate all the growth made by Litecoin between May and December of 2017.

At the time of writing LTC is trading at $32.05 and is ranked 8th with a total market cap of $1.8 billion.

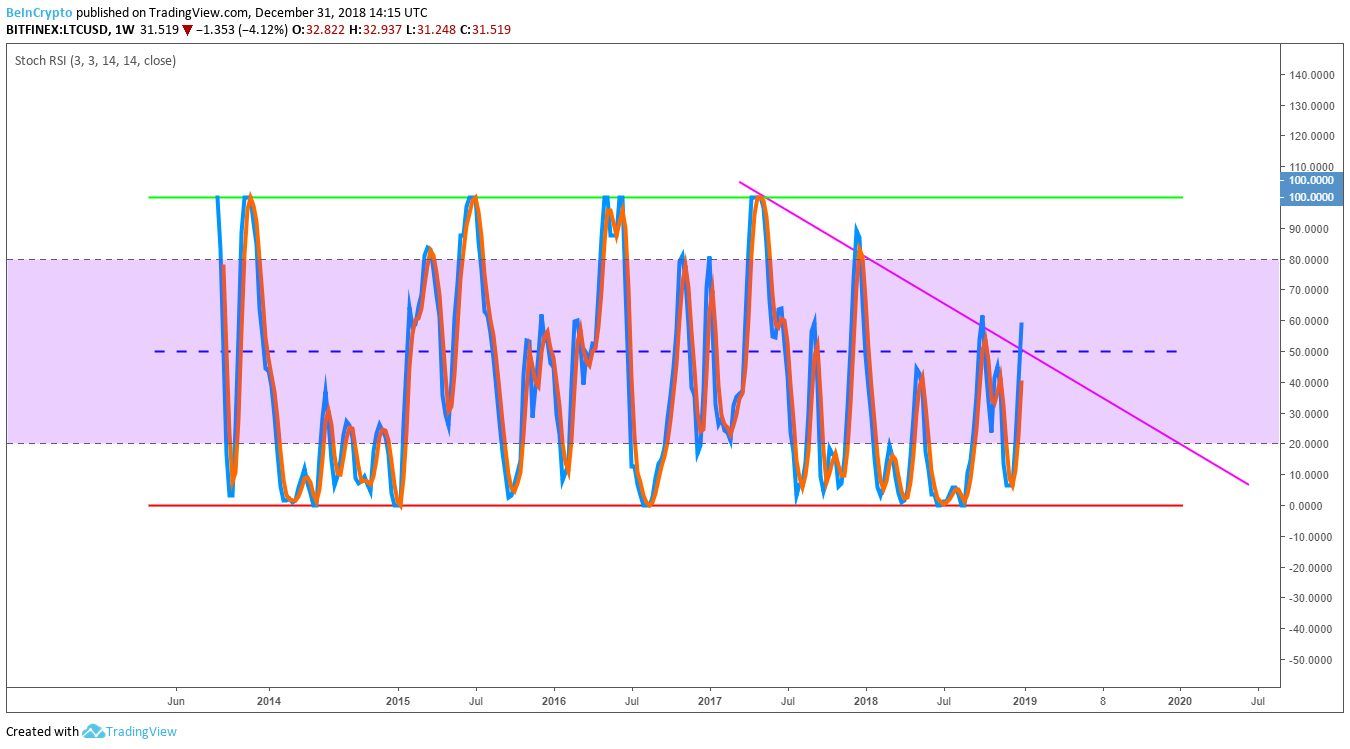

Stochastic RSI

The Climb

A look at the four-hour chart looks positive for the short-term price movement. LTC has an ascending support (upward pink) as well as strong horizontal support in the $30 range (orange). It is likely, considering the stochastic RSI and supports, that Litecoin should be able to hold on to continue climbing the support upwards to meet the resistance somewhere in the neighborhood between $36 and $40. In the event that LTC slips off the upward slope, it is probable that a retest of the $30 horizontal support (orange) would be the first target to look out for. Below that and a double bottom at $23 could present another opportunity of accumulation in a maximum profitability zone. Investors should keep in mind that Litecoin remains in a bearish trend and could continue to move down going into 2019. Traders should always set stop losses as well as buy triggers at a level that suits their personal strategy and risk allowance. Do you think LTC will go under $20 in 2019? Will Litecoin ever see a new all-time high? Let us know your thoughts in the comments below!

Disclaimer: The contents of this article are not intended as financial advice, and should not be taken as such. BeInCrypto and the author are not responsible for any financial gains or losses made after reading this article. Readers are always encouraged to do their own research before investing in cryptocurrency, as the market is particularly volatile. The author of this article does not hold LTC.

Do you think LTC will go under $20 in 2019? Will Litecoin ever see a new all-time high? Let us know your thoughts in the comments below!

Disclaimer: The contents of this article are not intended as financial advice, and should not be taken as such. BeInCrypto and the author are not responsible for any financial gains or losses made after reading this article. Readers are always encouraged to do their own research before investing in cryptocurrency, as the market is particularly volatile. The author of this article does not hold LTC.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kyle Baird

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

READ FULL BIO

Sponsored

Sponsored