The US Federal Reserve’s (Fed) interest rate hikes might have reached their peak, says Philadelphia Federal Reserve President Patrick Harker.

As a voting member of the Federal Open Market Committee (FOMC), Harker’s insights hold significant influence in financial circles.

Fed Can Afford to be Patient

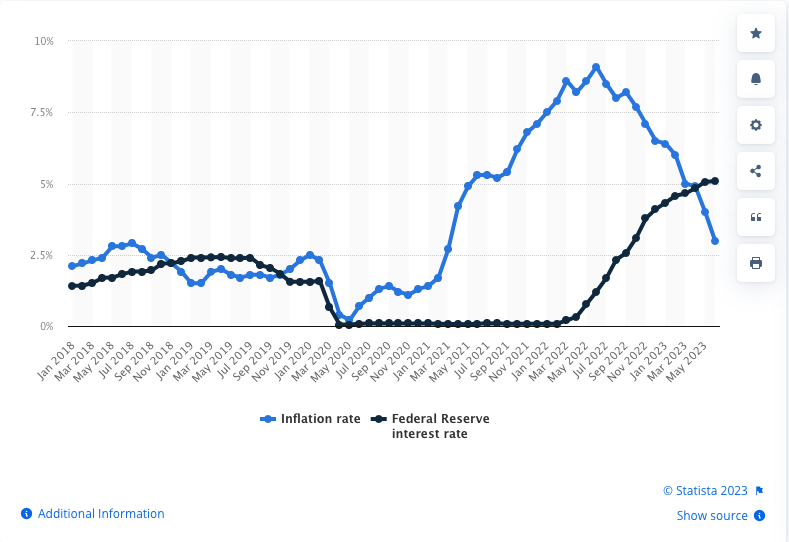

Harker’s statement suggests that unless any drastic new data emerges, the Fed could afford to adopt a patient stance. This would allow the effects of recent monetary policy actions to take effect. This comment follows the FOMC’s sanctioning of its 11th rate hike since March 2022. The strategic move was targeted at curbing inflation, which had soared to its highest level in over 40 years.

Want to learn how to become immune to the Fed’s inflation policy? Find out here how cryptocurrencies can help.

The Fed initially dismissed the surge in prices as transitory. However, it later felt compelled to implement a series of tightening measures, including four consecutive three-quarter point increases. This shift in policy ignited concerns among economists, who feared that the aggressive rate hikes could potentially push the economy into a recession.

Despite these apprehensions, Harker projected a gradual return to the Fed’s 2% inflation target. He also predicts a slight uptick in unemployment, and a modest deceleration in economic growth.

Harker also signaled that rate cuts are unlikely in the near term, stating:

“The pandemic taught us to never say never, but I do not foresee any likely circumstance for an immediate easing of the policy rate.”

Harker’s optimistic projections, however, are not universally accepted. While New York Fed President John Williams has also hinted that rate increases could be over, Fed Governor Michelle Bowman believes additional hikes are probably necessary.

Market Thinks Rates Will Hold Steady

Despite these conflicting views, market data suggests an over 85% probability that the central bank will maintain its current stance at its Sept. 19-20 meeting, according to CME Group data. The first decrease could potentially occur as early as March 2024.

Where’s best to invest your money in 2023? Crypto or stocks? Our Learn guide explores the options.

While the Fed’s actions have primarily targeted inflation, Harker voiced concerns about the impact of commercial real estate and the resumption of student loan payments on the broader economy. Policymakers will gain a clearer insight into the progress against inflation when the Bureau of Labor Statistics releases its July reading on the consumer price index.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.