BlackRock, the world’s largest asset manager, has invested in four of the five largest Bitcoin (BTC) mining companies by market cap. The move is especially notable since BlackRock is a traditional financial institution whose values are sometimes at odds with those of the free-spirited world of cryptocurrencies.

Nevertheless, the Wall Street giant recently raised its white flag by applying for approval to launch a Bitcoin exchange-traded fund (ETF). It is currently the second-largest shareholder in the top four mining companies.

BlackRock Secures Bigger Stakes Amid Steep Miner Losses

CompaniesMarketCap estimates the total market capitalization of the companies BlackRock invested in at $5.4 billion. The miners have suffered significant losses over the past month, allowing BlackRock to buy shares cheaply and increase its presence in the industry.

Learn more here about the economics of crypto mining.

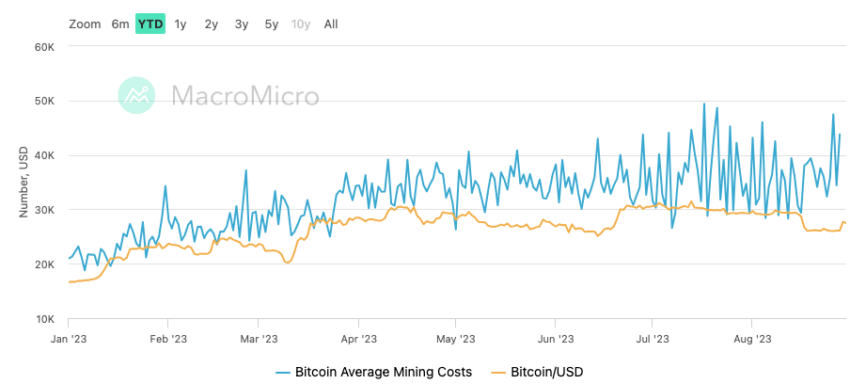

Miners face growing profitability challenges amid rising operating costs.

BlackRock Invested In These Companies

BlackRock’s vast financial resources allow the company to help comparatively smaller mining companies. Its most recent investments were spread across Riot Platforms Inc., Marathon Digital Holdings, Cipher Mining Inc., and TeraWulf Inc.

The value of its mining investments is about $411.5 million. While substantial, the shares only account for about 0.35% of the company’s assets.

Still, its holdings increase the influence of BlackRock Funds Advisors in the Bitcoin Mining Council. BMC is an American Bitcoin mining lobby group.

Got something to say about BlackRock increasing its investment in mining companies or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.