The Securities and Exchange Commission (SEC) came down hard on 3M Company on Friday, fining it over $6.5 million. The charges? Funneling bribes to Chinese hospital officials through extravagant “business trips” abroad.

The American multinational conglomerate, which works across multiple industries, including healthcare and consumer goods, recently boasted about its Chinese subsidiary’s use of digital assets to “enhance the customer experience.”

SEC Accuses 3M of Corruption

Officially, it’s not its adventures in digital assets that have caused 3M’s problems. But, rather, a series of violations of the Foreign Corrupt Practices Act (FCPA).

For years, according to the SEC, 3M’s Chinese subsidiary secretly funded overseas junkets for administrators of state-owned hospitals and healthcare facilities.

These luxurious trips had little to do with business conferences or hospital visits. They were actually exotic vacations packed with leisure activities to influence officials to purchase more 3M medical products. At least that is the SEC’s view.

From 2014 to 2017, 3M footed the bill for at least 24 of these lavish getaways, costing the company nearly $1 million. The Chinese officials were treated to hot air balloon rides, private vineyard tours, spa treatments, golf outings, and other upscale tourism activities. The Chinese officials often skipped conference days entirely to enjoy the trips and activities.

Get an informed view on two different kinds of investment assets: Crypto vs. Stocks: Where To Invest Your Money in 2023

Behind the scenes, meanwhile, 3M employees schemed with Chinese travel agencies to arrange two sets of itineraries for each trip.

One detailed legitimate conferences and hospital visits – to get internal compliance approval. The other outlined extravagant tourism activities, shared secretly with officials.

The Multinational’s Stock Took a Temporary Hit on Friday

Furthermore, 3M even directly transferred over $250,000 to a Chinese travel agency between 2016-2018. An explicit payment to fund bribery through overseas tourism.

On Friday, the SEC lowered the boom on 3M’s illegal largesse. The company will cough up over $6.5 million in fines and disgorgement. And faces a whopping $2 million civil penalty.

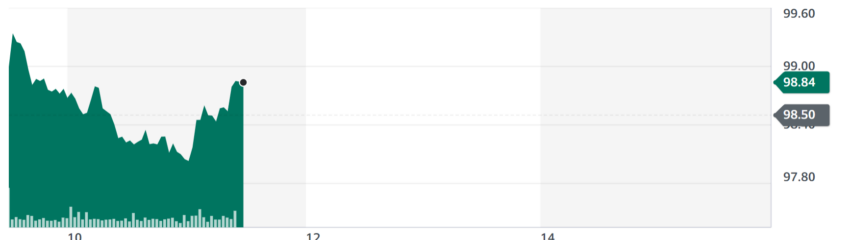

3M’s stock (MMM) took a hit on Friday, following the indictment. The stock opened at approximately $99.00, and rose briefly to $99.34 at 09:33 EDT before falling to $98.00 at approximately 11.00 EDT. However, by 11:30 ETD, its stock performance had made up for the day’s losses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.