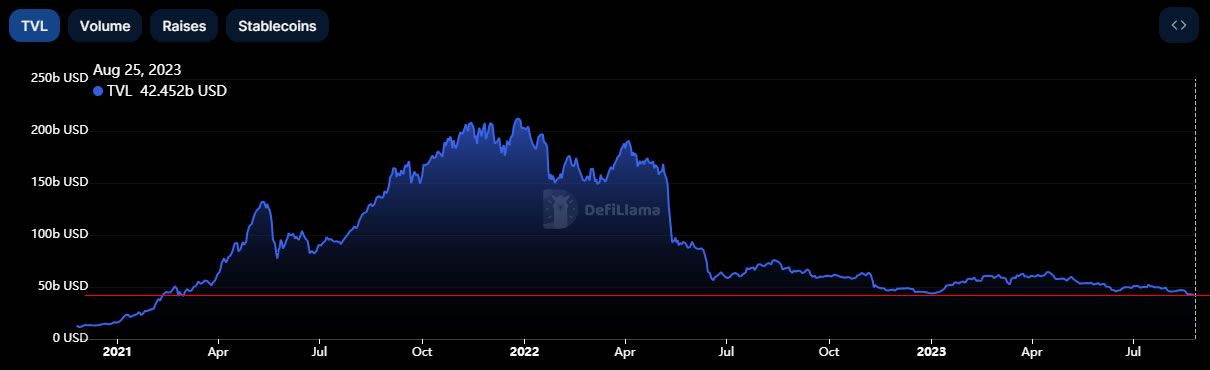

Collateral locked across the decentralized finance (DeFi) ecosystem has fallen to its lowest level for two and a half years as the bear market deepens. Moreover, the decline in DeFi total value locked (TVL) has accelerated over the past five months.

DeFi total value locked has fallen to $42.45 billion, according to industry analytics platform DeFiLlama.

DeFi Collateral Shrinking

The last time TVL fell below $40 billion was in February 2021, when the trend was going in the opposite direction.

Industry analyst “The DeFi Edge” lamented:

“This is the lowest since early 2021 – it didn’t even get this low after FTX’s collapse.”

DeFi TVL fell to a low of $43.6 billion in late December 2022 following the collapse of FTX and when crypto markets were at their cycle low. It is currently lower than that level.

“August 23rd marked a new low for TVL in DeFi at $37.51 billion,” reported DeFiLlama (excluding liquid staking platforms).

Collateral reached a 2023 peak in mid-April when it tapped $64.5 billion. However, it has declined 34% since then. Comparatively, crypto markets have declined by just 18% over the same period.

DeFi TVL peaked in December 2021 when it hit $212 billion. Since then, it has tanked 80%, which is more than the 64% crypto markets are down since their $3 trillion market cap all-time high in November 2021.

Reasons for the Decline

There are several possible reasons for the decline in DeFi collateral. Firstly, crypto markets have tanked more than 10% over the past fortnight, devaluing the underlying collateral.

DeFi yields are also nowhere near what they were during the 2021 bull market, so there isn’t much opportunity to earn on wrapped BTC or stablecoins, for example. Additionally, the Federal Reserve raising interest rates to multi-year highs makes it tricky for DeFi platforms to match the risk-free rates with safe yields.

DeFi has also come under the regulatory spotlight in America’s war on crypto. Financial regulators such as the SEC have made it clear that they want to quash the DeFi sector in its entirety since it cannot be regulated due to protocol decentralization.

Finally, the constant ongoing exploits in the ecosystem, resulting in millions of dollars lost every month, may have eroded investor confidence in the sector.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.