Bitcoin, the digital gold of the modern era, is on the brink of undergoing another ‘halving’ in 2024. This event has raised alarms across the mining community, especially for those operating with razor-thin margins.

But what is this ‘halving,’ and how might it affect Bitcoin miners around the globe?

What Will the Next Bitcoin Halving Bring?

At its core, Bitcoin’s halving is a pre-programmed event wherein the rewards for mining new blocks get cut in half. Historically, this event has triggered price booms, but not without initial jolts to the miner community. The most significant concern for miners is the potential for their operations to become unprofitable.

Nick Cote, founder of Second Lane, candidly expresses his perspective:

“I continue to stand on the hill that most miners will not be able to effectively compete in the next phase of participation in the mining space. The amount of network hash outside the US will continue to grow, leading to stiff competition.”

Further concerns arise from estimates by Blockware Solutions. It predicts that “Bitcoin mining difficulty could drop by as much as 24% after the 2024 halving,” hinting that miners with inefficient machines and high energy rates might struggle.

In simple terms, if miners are not equipped with the most efficient ASICs and are grappling with high electricity rates, the aftermath of the halving could see their operations plunged deep into the red.

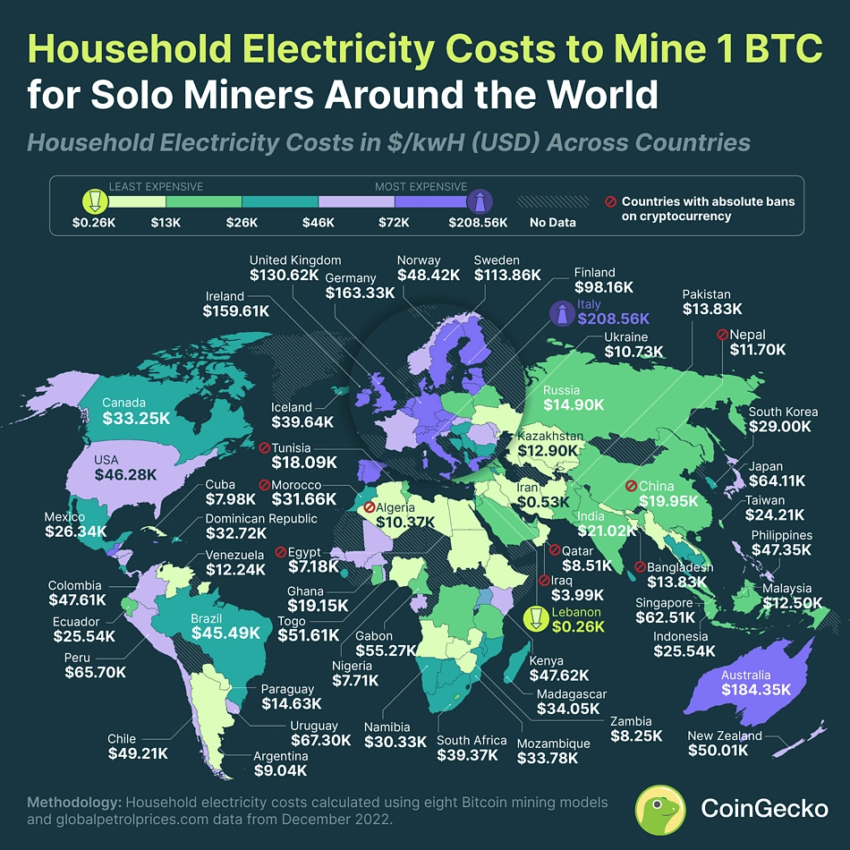

But what does it cost to mine a Bitcoin in terms of electricity? On average, mining a single Bitcoin requires a staggering 266,000 kilowatt-hours (kWh) of electricity, equating to around seven years for a solo miner. To put this colossal figure into context, the average American household consumed just a fraction of this in 2021.

The Cost to Mine Bitcoin Is Getting Costlier

When breaking down the costs, the situation becomes even grimmer. Mining a Bitcoin with household electricity averages out to $46,291.24 in the US, which is significantly higher than the prevailing Bitcoin price.

Regional disparities further complicate the matter. While Europe grapples with the highest household electricity costs for Bitcoin mining, Asia emerges as a more promising region. Countries like Lebanon, Iran, and Syria offer the most cost-effective mining environments due to their low electricity costs.

Indeed, mining a single Bitcoin varies drastically in cost across countries, largely due to disparities in electricity prices. The most economical countries to mine Bitcoin include Lebanon, where it costs a mere $266.02 per BTC, followed by Iran at $532.04, Syria at $1,330.10, Ethiopia at $1,596.12, and Sudan rounding out the top five at $2,128.17.

Conversely, European countries bear the brunt of exorbitant mining expenses. Italy tops the list with a staggering $208,560.33 per BTC. Austria follows at $184,352.44, Belgium at $172,381.50, Denmark at $166,795.06, and Germany, where it costs a hefty $163,336.79 to mine a single Bitcoin.

However, this doesn’t mean Asia is without its challenges. Despite low electricity costs, some countries, like Iran, face grid overloads, leading to blackouts. Their solution? A cyclical pattern of cryptocurrency mining bans during power consumption spikes.

Meanwhile, European nations are less fortunate. Skyrocketing electricity prices, exacerbated by factors like the COVID-19 pandemic, heatwaves, and geopolitical tensions, have made countries like Italy, Austria, and Belgium the most unprofitable territories for Bitcoin mining.

The 2024 Bitcoin halving promises to be a defining moment for miners. The dynamics of profitability, influenced by regional electricity costs and the looming reduction in mining rewards, will decide the fate of many in the community.

Bitcoin miners will need to stay agile, adapting their strategies to be able to survive in this cutthroat environment.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.