In recent years, BlackRock has attempted to reinvent itself as a socially conscious investor. However, this week activists have gathered outside the asset manager’s headquarters in New York City. They protest the firm’s ownership of developing world debt.

BlackRock is currently waiting for the US Securities and Exchange Commission (SEC) to approve its spot Bitcoin ETF. If approved, it will be one of the very first spot Bitcoin ETFs available to US investors. The asset manager was the first in the latest round of applications, submitting on June 16. Other firms, including Invesco, WisdomTree, ARK Invest, and Valkyrie, followed soon after.

BlackRock Under Fire for Owning One Percent of Zambian GDP in Debt

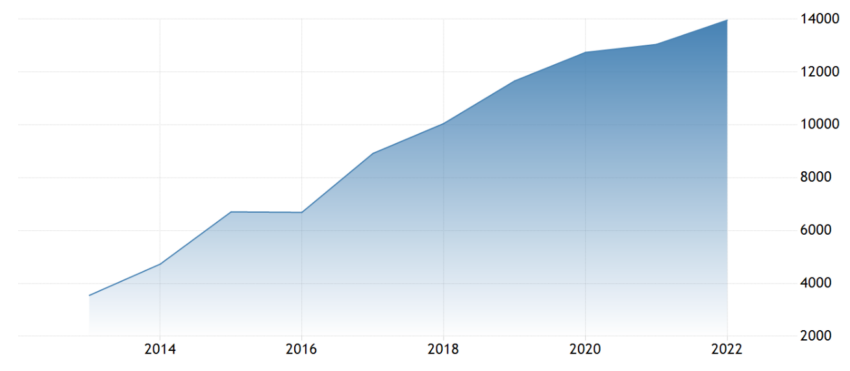

However, BlackRock, which had $8.59 trillion in assets under management as of December 31, 2022, is under fire for owning $220 million in Zambian government debt.

Yesterday, protestors gathered outside the BlackRock world headquarters in New York City. They demanded the asset manager cancel Zambia’s external debt, which accounts for approximately one percent of Zambia’s $22 billion GDP (as of 2021).

Expecting an economic downturn where you are? Read our tips on how to prepare: How To Prepare for a Recession: 11 Quick Tips

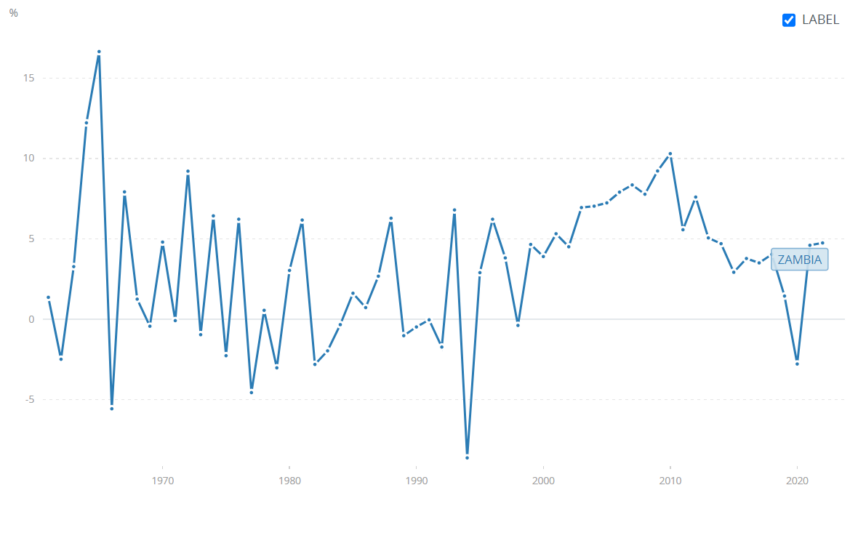

Zambia is known for its diverse wildlife and scenic landscapes. But it is also one of the poorest nations in the world. Its purchasing power parity (PPP) is only $3,680, the 28th lowest in the world.

In April, the UN expressed concern about Zambia’s debt burden. It emphasized that delays in debt restructuring may hinder the country’s ability to fulfill its human rights obligations under international law.

While Zambia’s recent reforms are a start, the experts warned that continued delays in debt restructuring could impede progress and hurt living standards.

They called for a globally coordinated multilateral sovereign debt mechanism to address the issue and ensure a rights-aligned recovery, urging the Official Creditor Committee for Zambia to establish a timeframe for their deliberations.

In August 2022, Zambia secured a 38-month Extended Credit Facility of $1.3 billion from the International Monetary Fund (IMF).

In spite of the modest steps, BlackRock’s creditor status remains highly unpopular with some humanitarian organizations. Didier Jacobs, Oxfam’s debt policy and advocacy chief, said in an email to BeInCrypto that he feared that taxpayers would have to bail out private creditors who already received high interest on their loans. Hence it is incumbent on private creditors to forgive at least some of Zambia’s debt.

“As the biggest private creditor to Zambia, Blackrock ought to play a leadership role in that regard,” Jacobs stated.

Zambia Seeks a Copper Mining Revival

Currently, the Southern African country is looking to change its economic fortunes by fueling a revival in copper mining. Copper remains Zambia’s biggest export and source of taxpayer revenue. The metal is also crucial for electronics, consumer goods, and telecommunications, which presents a crucial opportunity.

But with its high debt burden, the country is unlikely to have the spare resources to fuel its growth.

The saga is an unfortunate one for BlackRock, which has tried to present a more ethical face to the world in recent times. BlackRock recently faced charges of hypocrisy for adding former Saudi Aramco CEO, Amin Nasser, to its board.

Critics accuse Saudi Aramco of being the world’s largest corporate greenhouse gas emitter, responsible for over 4% of the entire world’s GHG emissions since 1965.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.