In a strategic move reflecting confidence in decentralized finance (DeFi), Binance Labs, the venture capital arm of Binance, has invested $5 million in Curve DAO Token (CRV).

Curve, a major player in the DeFi ecosystem, currently boasts the title of the largest stableswap and the second-largest decentralized exchange (DEX).

Binance Investment in DeFi

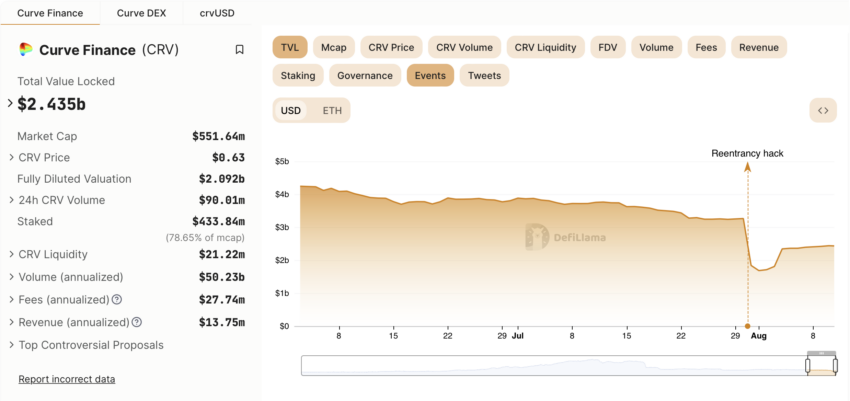

Curve boasts a total value locked (TVL) of approximately $2.4 billion and a daily volume of $215 million. Moreover, it allows users to exchange ERC-20 tokens efficiently with minimal fees and slippage.

The Curve DAO Token (CRV), also an integral part of this ecosystem, plays a pivotal role in transactions, staking, and governance voting.

Binance Labs’ investment represents a collaborative effort to leverage both entities’ combined potential. The venture seeks to explore Curve’s potential deployment to BNB Chain. Subsequently, expanding the DeFi offerings on the chain.

“Our collaboration with Curve signifies our unwavering support for DeFi’s growth in 2023. Recognizing Curve’s profound impact on the DeFi space, we’re excited to partner and foster further innovations,” Yi He, Head of Binance Labs, stated.

Curve operates on multiple chains, aiming to combine speed with cost efficiency. Additionally, its planned integration with the BNB Chain will enhance its reach and influence in the DeFi sector.

“BNB Chain’s prominence in DeFi presents a perfect environment for Curve’s products. We anticipate that our joint efforts will catalyze unprecedented growth and innovation in the DeFi space,” Michael Egorov, founder of Curve, stated.

Curve’s Resilience Post-Crisis

The Curve ecosystem recently experienced challenges with security breaches. Yet, the community’s response demonstrated DeFi’s robust resilience. Collaborative efforts have been instrumental in mitigating exploit impacts, emphasizing the sector’s adaptability and strength.

Read more: Curve Finance and Other DeFi Entities Offer 10% Bounty for Recovery of Stolen Funds

Furthermore, Curve’s potential deployment to BNB Chain signifies a forward momentum for DeFi. It is a sign of continual growth and innovation.

With Curve’s forward thinking and Binance Labs’ support, the DeFi sector is poised for transformative developments in the future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.