A large number of Bitcoin options contracts are set to expire today, but will they increase selling pressure on BTC, which has fallen below $30,000 again? It is not the largest options expiry in recent weeks, but the put/call ratio could be telling.

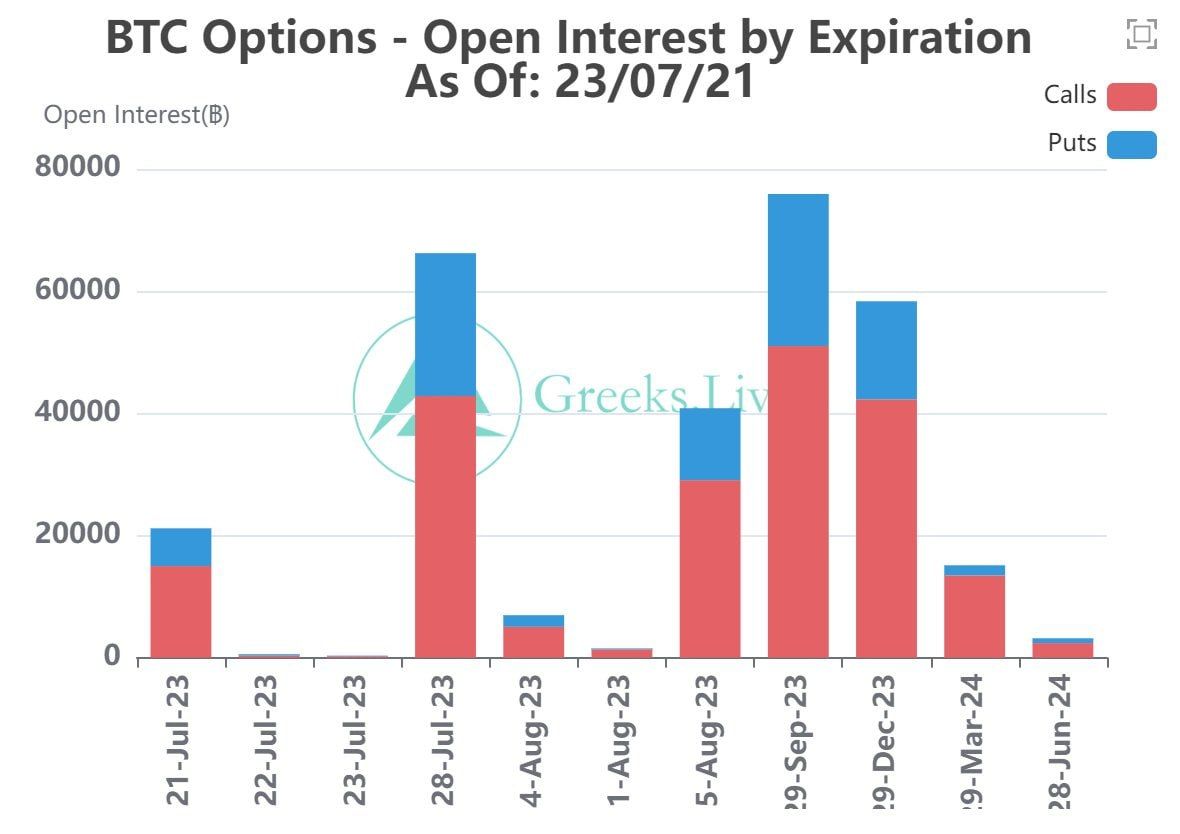

Around 21,000 Bitcoin options contracts are set to expire on July 21. Their notional value is $630 million, which isn’t huge compared to previous expiries.

Bitcoin Options Expiry

Friday is BTC options expiry day. This batch has a max pain point of $30,250, slightly higher than the current spot price.

The max pain point is the price level with the most open contracts and also the level at which most losses will be made upon contract expiry.

Today’s expiring tranche of BTC options contracts has a put/call ratio of 0.41 which remains bullish.

The ratio is derived by dividing the number of short seller contacts (puts) by the number of long seller contracts (calls). Additionally, values below 1 mean that there are more call contracts, indicating bullish sentiment for the underlying asset.

July 28 will see a much larger options expiry with open interest over 60,000. OI is the number of open contracts that have yet to be settled. GreeksLive commented on sentiment:

“The market was generally negative this week, with selling July calls virtually monopolizing the market volume.” It added that the options data suggests that the rally is clearly unsustainable.

“The current market participants are very not optimistic about the subsequent rise, but there is no incentive to short futures, selling calls became the only choice.”

Learn more about crypto derivatives: What are Perpetual Futures Contracts in Cryptocurrency?

Around 180,000 Ethereum options contracts will also expire today. These have a notional value of $340 million and a max pain point of $1,900.

The put/call ratio for ETH contracts is 0.43, which is similar to the Bitcoin options ratio. This simply means that more than twice as many call contracts are being sold than puts.

BTC Price Outlook

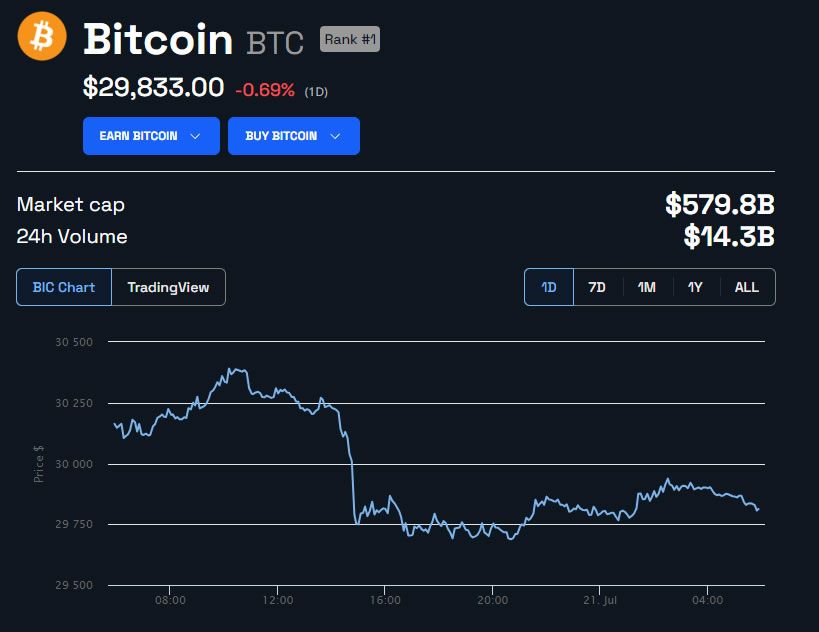

Bitcoin has failed to maintain momentum above $30,000 and has retreated 1% on the day. As a result, the asset has fallen to $29,830 at the time of writing.

BTC prices remain tightly range-bound. However, the longer it consolidates at resistance, the more likely it is to pull back further.

Since the Ripple-induced market pump last Friday, BTC has lost 5% and appears to be weakening in the short term.

Moreover, Ethereum is not faring any better, with a similar daily decline to $1,891 at the time of writing.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.