Binance offers Dutch users the option to move client assets to a competitor after failing to secure a local license amid a broader regulatory clampdown.

Clients of Binance can move assets to Coinmerce, an exchange that secured a license from the Dutch central bank in 2020.

Binance Offers Dutch Users Seamless Transition to Licensed Exchange

Binance will cease Dutch operations on July 17.

Coinmerce CEO Nick Smits van Oyen let Binance users know that the changeover should be easy.

“The transition will be smooth and is, in consultation with Binance we have made the transition for users as easy as possible. The user will receive an email from Binance and from there the simple step-by-step process will start.”

The move will likely bode well for users when Europe’s Markets-in-Crypto-Assets bill comes into force next year. The bill delegates licensing to local market regulators and allows exchanges to passport them across to other European Union member states.

Read about other Binance alternatives here.

In the meantime, Coinmerce says it “complies with all European laws and regulations.”

Earlier this month, Binance confirmed it failed to meet Dutch licensing requirements but was looking at other options.

CZ Hints at Short-Term Effects of Regulatory Clampdowns

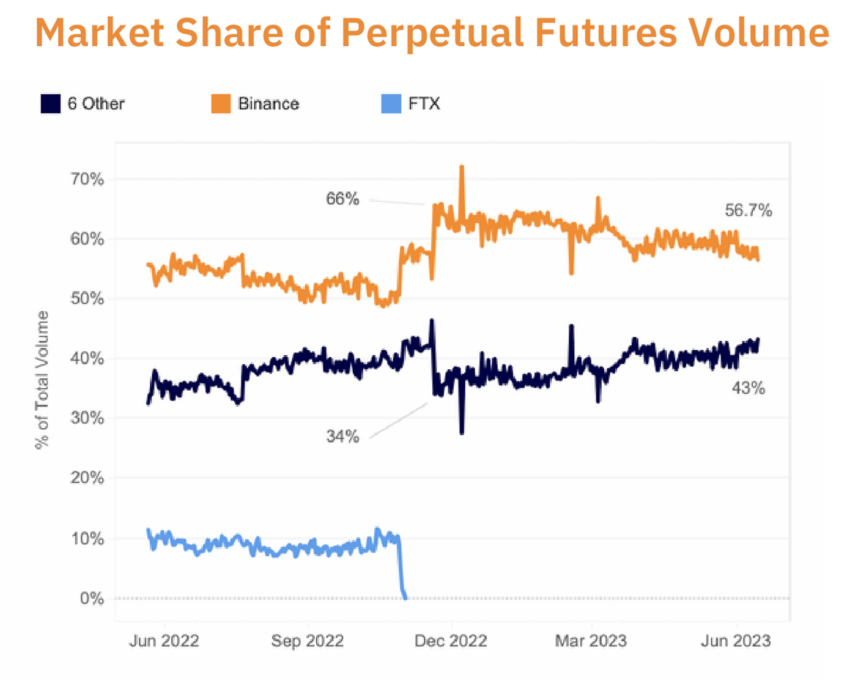

Recent regulatory clampdowns in Australia, Canada, Germany, and the United States have negatively affected Binance’s spot and derivatives volumes.

Binance CEO Changpeng Zhao confirmed yesterday in a Twitter Spaces AMA that outside pressures are hurting their business. Its share of spot volume fell 41.6% in May, while its share of the derivatives pie dropped 10% to 56%.

Yesterday, Australia’s financial markets regulator searched the exchange’s local offices as part of a derivatives probe. The Australian Securities and Investments Commission started investigating how the exchange identified wholesale investors earlier this year.

Under Australian law, only wholesale investors can trade derivatives like futures and options. After the agency commenced its investigation, Binance asked ASIC to cancel its derivatives license.

Additionally, the exchange has suffered regional banking clampdowns. Banks have limited Binance users’ access to payment gateways, while Westpac recently introduced stricter due diligence when considering whether to onboard crypto clients.

Got something to say about Binance offloading Dutch users to its rival or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.