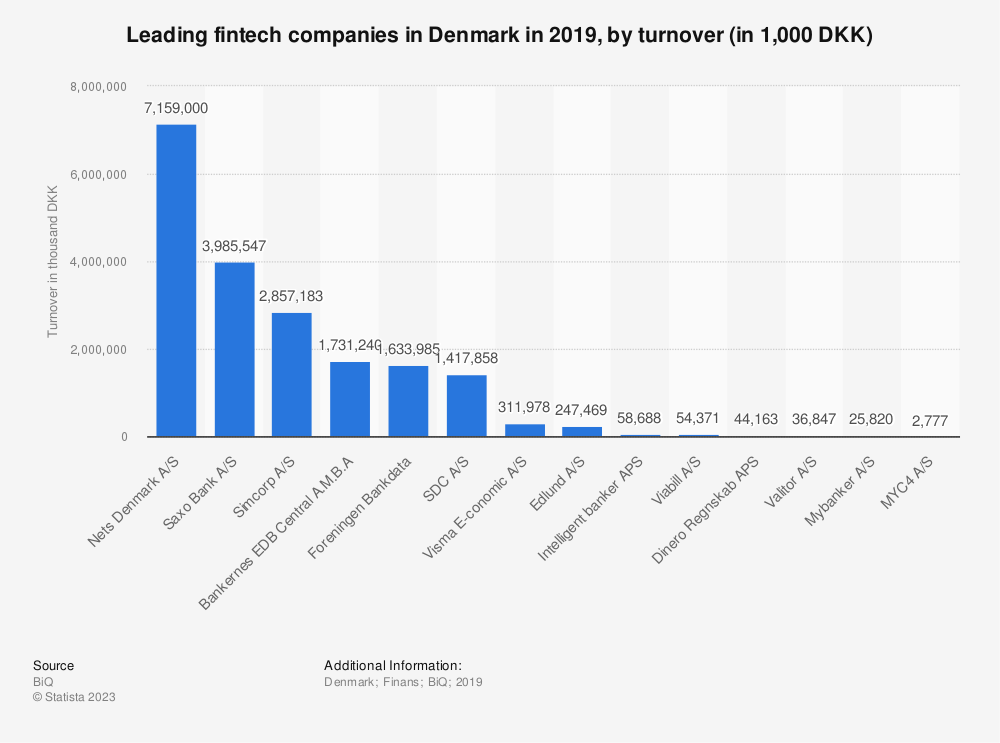

The Danish Financial Supervisory Authority has ordered Saxo Bank to dispose of crypto assets violating Section 24 of the Financial Business Act as Asia struggles to secure crypto bank partners.

The watchdog said crypto business activities are illegal and not covered in Annex 1 of the Financial Business Act.

FSA Says Saxo Must Dispose of Crypto Regardless of Its Use

It said crypto remains unregulated until Annex 1 embraces rules in the European Union’s Markets-in-Crypto assets bill in December of next year. Moreover, the FSA implies that crypto assets can generate distrust in the financial system, and banks’ engagement in such activity threatens financial stability.

While the Danish bank used crypto to hedge risk from other products it offers, the law does not permit any crypto-related activity. The bank must hence dispose of its crypto assets.

The US Federal Reserve does not allow members to hold most crypto assets. Banks using “dollar tokens” must prove security measures and receive formal approval. Risks cited by the Fed include fraud, legal ambiguity, and volatility. Bills lawmakers hope will clear up confusion have been mired in bureaucracy for several months to a year.

This slow progress has resulted in several attempts by the US Securities and Exchange Commission to build case law through aggressive enforcement actions. As a result, several firms, such as JP Morgan and Citigroup, are testing blockchain technology’s potential for hastening asset transfers.

Read more here about tokenization banks use to transfer assets over blockchains.

As a result, crypto trading activity is slowly migrating east, where jurisdictions like Singapore and Hong Kong are slowly emerging as leaders of the next bull run.

Bank Support in Asia Slow But Steady

However, bank support remains a sore point for Asia’s crypto entrants. Hong Kong executives are engaged in a delicate dance trying to reconcile Western and Eastern ideals.

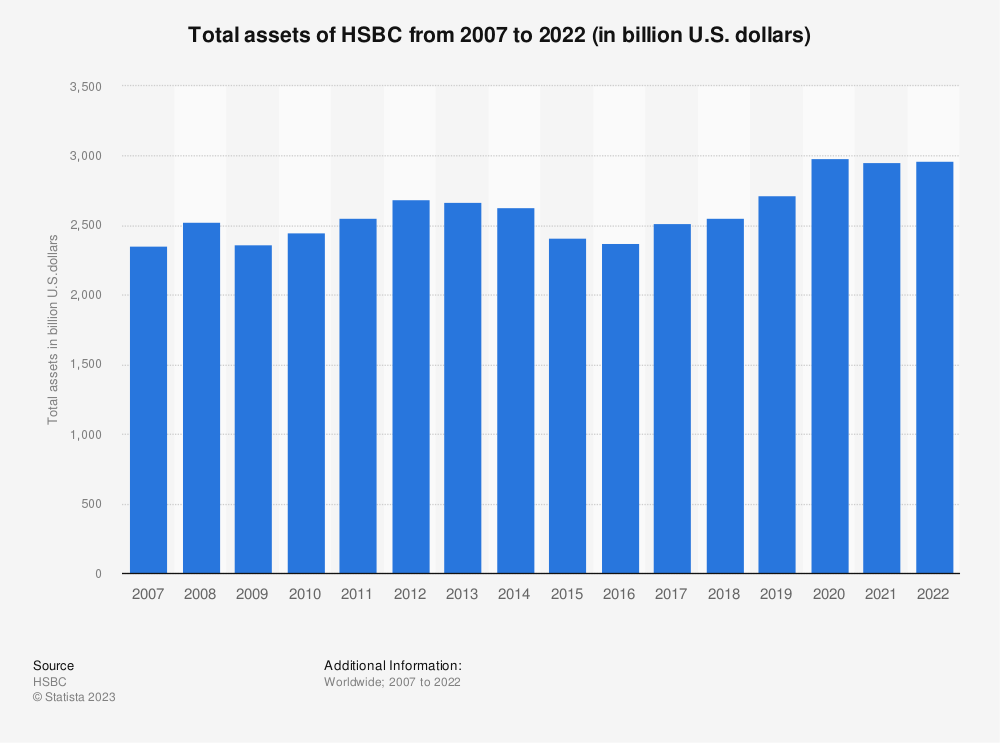

The Hong Kong Monetary Authority recently asked the HSBC and Standard Chartered regional branches to reconsider servicing crypto firms. Earlier brushes with money laundering and allegations of criminal activity at top exchanges have discouraged executives from supporting the industry.

If they are found to have facilitated money laundering while trying to satisfy the HKMA’s request, they may face the wrath of the US Department of Justice.

However, banks would not need to handle detailed Know-Your-Customer processes except for transfers over HKD8,000 ($1,000). This limit follows the latest money laundering guidelines from the Financial Action Task Force.

Moreover, all virtual asset service providers can only earn licenses by complying with risk policies that include the crypto Travel Rule.

Still, regional support remains crucial if Asia is to fill the trading void created by US regulatory ambiguity.

Hong Kong’s ZA Bank allows exchange customers to convert between crypto and fiat. Meanwhile, the Bank of China’s Hong Kong branch already has several clients. Swiss Bank SEBA AG is reportedly looking to earn licenses in Singapore and Hong Kong.

Got something to say about the Danish FSA’s order for Saxo Bank to dispose of its crypto or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.