According to a new study by talent advisory firm Durlston Partners, salaries in the decentralized finance (DeFi) sector continue to be highly competitive. The financial scandals and volatility of the past year have not eroded all trust or crippled the compensation packages of highly skilled DeFi professionals. It may be that employers looking to avoid the next crash need their services all the more acutely.

DeFi engineers’ base salaries stayed the same in 2021 and 2022. Average salaries each quarter ranged from about £100,000 to £125,000. However, salaries rose significantly during the fourth quarter of 2022, reaching an average of £142,500. This indicates a positive trend for DeFi in 2023.

DeFi Engineers Commanding Generous Salaries

Salaries improved even though the crypto and DeFi economies saw a dramatic reversal following the multiple crises of 2022.

One of the factors pushing DeFi salaries against the grain of inflation is the relatively small pool of DeFi developers and engineers. Their skillset is incredibly specialized, and with so few in the industry, talent is able to command impressive remuneration packages.

Even during the market downturn in 2022, DeFi engineers have been crucial to maintaining business activity. They are among the last to face cost-cutting measures, unlike other jobs, which are usually more vulnerable in economic downturns.

Learn the basics of the decentralized financial system with our handy guide: How Decentralized Finance Works and Use Cases

Salaries are holding up despite the wider public paying less attention to the technology. According to Google Trends, interest in DeFi has been on a long-term decline since July 2021.

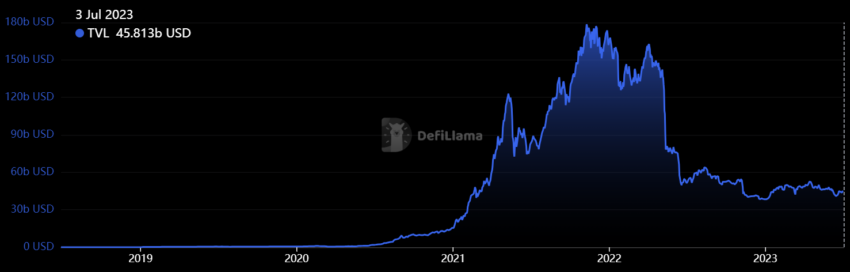

However, once users enter the growing ecosystem, they often stay. The year 2023 is shaping up as the longest period of relative stability for DeFi in the sector’s brief history. Currently, TVL sits at $45.813 billion, after being steady for much of the year, according to DeFiLlama.

Decentralized financial services took off in the second half of 2020, before seeing record growth during the bull market of 2021-22. And the demand for skilled professionals is as robust as ever.

Steady Salary Growth Expected in 2023

Meraj Bahram, the managing partner of Durlston Partners, said in a statement provided to BeInCrypto that he expected to see steady salary growth for the rest of the year.

“DeFi engineering jobs, such as software and DevOps engineers, have proven sturdy in the climate of volatility and uncertainty that has afflicted the crypto market,” he said. “As the crypto market recovers and companies regain stability, engineers will become increasingly scarce and highly sought-after resources.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.