BlackRock’s bullish artificial intelligence (AI) outlook argues the tech’s multi-sector reach is a “mega force” demanding its overweight allocation in investment portfolios.

According to the company’s 2023 mid-year report, companies with a large slice of operations that can be automated could enjoy higher profit margins.

BlackRock’s Bullish AI Thesis

Market excitement has seen AI mentions in corporate earnings calls rise to just under 15,000, almost doubling from a year ago. Companies are trying to grasp AI’s potential for their businesses.

According to BlackRock’s bullish outlook, companies sitting on vast troves of data stand to benefit the most from the technology.

On the other hand, companies slow to adapt could end up falling behind. Investments in the semiconductors crunching the models offering business value will determine the technology’s progress.

Because AI spans multiple industries, its novel role in investments do not neatly align with traditional portfolio building blocks. Additionally, higher volatility and tight global monetary policy argue for a more agile approach.

Tensions Favor Technology and Defense Investments

The rewiring of the geopolitical landscape post-Cold War means that technology, clean energy, infrastructure, and defense could also offer investment options, according to BlackRock.

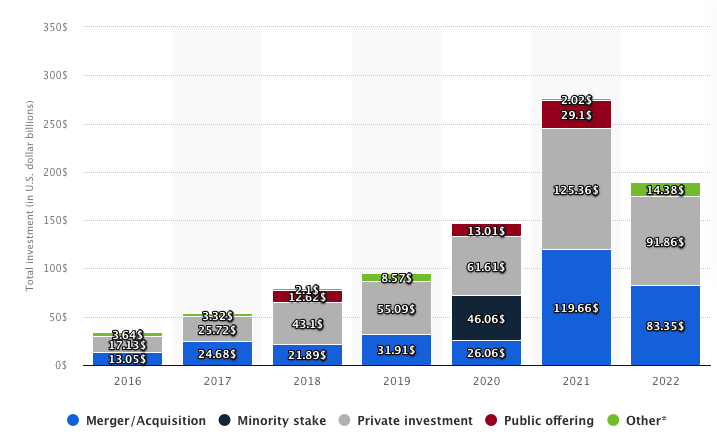

Already, China recognizes AI as the newest battle for global dominance. It attracted $4 billion in investment since the start of the year. Its share of global venture capital deals rose to two-thirds of the US share, up from 50% in the last two years.

Daniel Ives of Wedbush Securities recently said,

“This is an AI arms race going on both in the US and China.”

However, censorship and US sanctions may limit the expression of engineers and companies. The China’s internet body assigns censorship responsibility to the companies themselves.

Interested incorporating AI into your trading strategy? Click here for our Learn guide to trading bots.

Still, the US bars the increasingly powerful semiconductors AI needs which could hinder its efforts. The Biden government is expected to pressure chipmaker Nvidia to stop selling lower-grade products in the US.

BlackRock sees rising risks for legacy banking from tighter control, monopolies, changes in payment processes, and competition for deposits.

Got something to say about BlackRock’s bullishness on AI or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.