Central bankers predicted further policy tightening to combat stubborn inflation at the annual ECB forum on Wednesday. But some sounded optimistic notes on their ability to keep interest rates high without causing an outright recession.

Representatives from the European Central Bank, the Federal Reserve, the Bank of Japan, and the Bank of England were present at the event hosted in the Portuguese mountain resort of Sintra. The four are the custodians of the most traded currencies. They share a common goal as economies struggle to deal with rising prices following the war in Ukraine and the economic reopening post-COVID.

Central Bankers Hint at Further Interest Rate Rises

Jerome Powell, the chair of the Federal Reserve, said he believed “policy [hadn’t] been restrictive enough for long enough.” The 70-year-old former investment banker acknowledged there was a significant chance of a recession in the US but said it was not the most likely scenario.

Christine Lagarde, the chair of the European Central Bank (ECB), recognized the risk of a European recession. However, like the Fed, it was not the ECB’s baseline expectation. “We are not seeing enough tangible evidence of [that] underlying inflation, particularly domestic prices, are stabilizing and moving down,” she said.

Bitcoin and other crypto assets are one strategy you can use to hedge against inflation. Learn more here: How to Protect Yourself From Inflation Using Cryptocurrency

The Bank of England (BOE), the central bank of the United Kingdom, and the issuer of the Pound Sterling currency (GBP), admitted that its forecasts had become unworkable. Earlier this month, the Bank of England announced an external review of its forecasting. The move comes after several of its predictions for the UK economy failed to come to pass.

Last Thursday, it announced another interest rate rise to 5 percent, a 15-year high. The BOE’s governor Andrew Bailey also did not predict a recession for the UK, where inflation is highest among the G7. However, it acknowledged that “we have to watch it very carefully.”

Japan Bucks the Trend

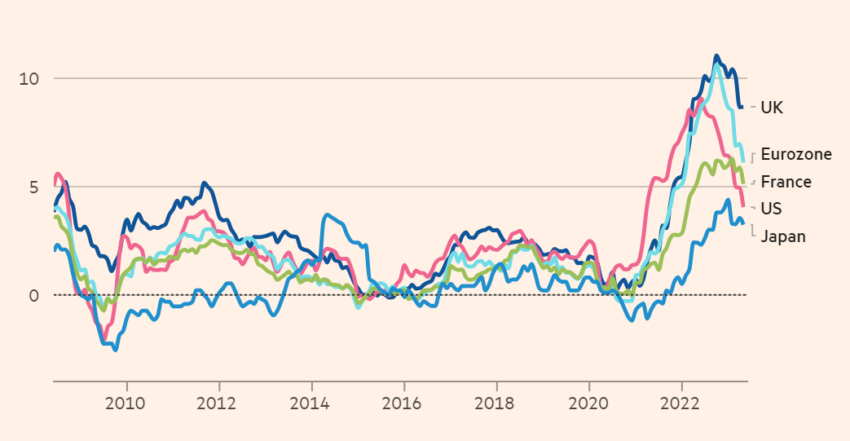

Not all voices at the summit were in accord. Bank of Japan Governor Kazuo Ueda wanted to see sustained and significant inflation before making any policy changes. Despite Japanese inflation being above 3%, the BOJ is keeping the policy loose because long-term inflation remains below its target of 2%.

In April, the BOJ projected core consumer inflation to reach 1.8% in the current fiscal year ending in March 2024. Japan’s inflation rate has been consistently at or near the bottom of the G7 league table since 2016.

Rising prices have been a new and mounting concern since prices began to climb in 2021. Since the year 2000, global inflation rates have ranged between three and five percent annually, according to Statistica. The current crisis has been the biggest inflation shock since the 1980s and 1990s.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.