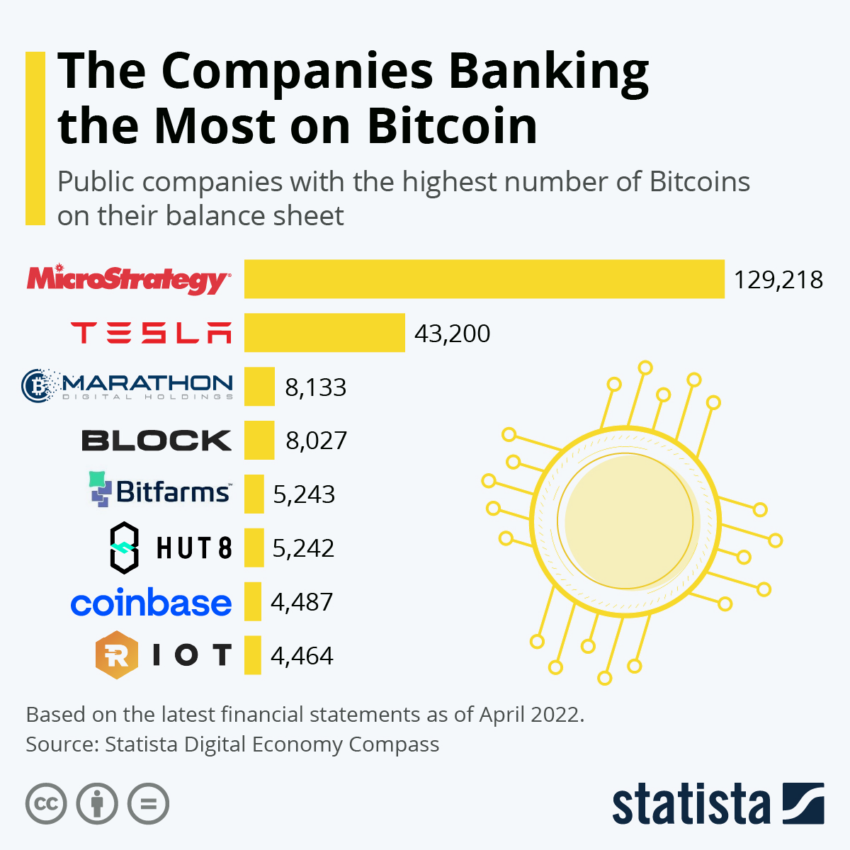

Michael Saylor’s MicroStrategy has further consolidated its position as one of the largest corporate holders of Bitcoin.

As per recent SEC filings, the company added another 12,333 Bitcoin to its portfolio, shelling out a staggering $347 million.

MicroStrategy’s Bitcoin Buying Spree

The average purchase price for MicroStrategy’s latest batch of Bitcoin was around $28,136. This number denotes the company’s ability to capitalize on market fluctuations to maximize return.

The latest acquisition period spanned from April 29 to June 27. Consequently, increasing MicroStrategy’s total Bitcoin holdings to approximately 152,333, valued at an astonishing $4.6 billion, based on the current Bitcoin price of around $30,300.

Despite the cryptocurrency market’s volatility, the latest purchase underscores MicroStrategy’s unwavering confidence in Bitcoin. Since its first investment in Bitcoin, MicroStrategy has purchased Bitcoin at an average price of around $29,668, including fees and expenses, totaling an overall investment of around $4.52 billion.

The magnitude of MicroStrategy’s Bitcoin buying spree is highlighted further when considering its previous buy in April. The company acquired an additional 1,045 Bitcoin for $23.9 million at the time.

Regardless of market conditions, the enterprise software company’s unabashed drive to buy Bitcoin signals a strong, future-oriented commitment to crypto. This move may well set a precedent for other companies.

This is a developing story…

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.