All eyes are on the world’s largest crypto exchange due to recent enforcement actions from the SEC, but Binance outflows have been minimal so far.

Crypto markets have shed more than $50 billion over the past 12 hours or so. The move follows the latest enforcement action from the U.S. Securities and Exchange Commission (SEC).

Binance was the target of this week’s round of regulatory wrath. However, there has not been an exodus from the exchange yet.

Binance Outflows Minimal

According to Glassnode, around 10,000 BTC has been withdrawn from Binance since the SEC lawsuit was issued on June 5. This works out as a decline of around 1.5% in Binance’s Bitcoin balance.

A larger decline was seen when crypto markets tanked in mid-March 2023.

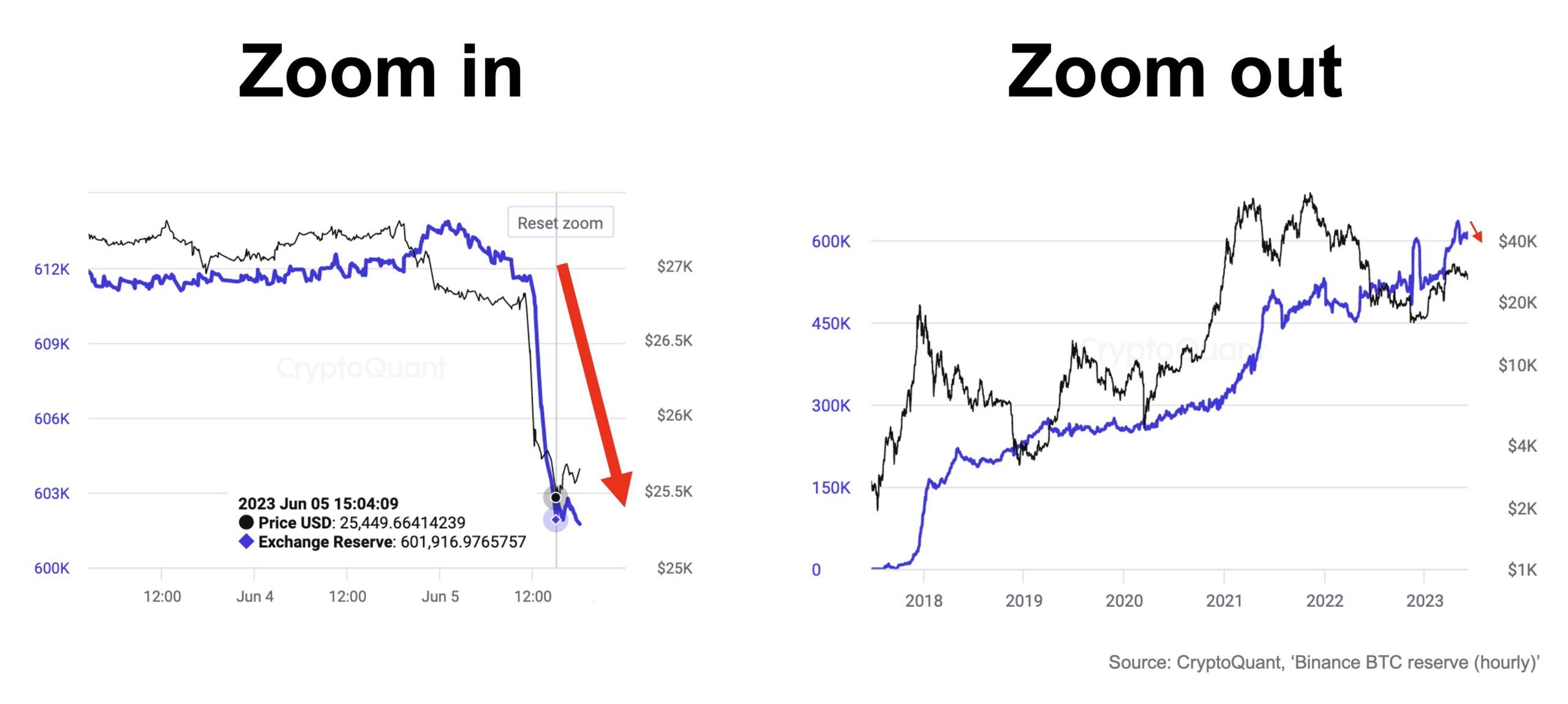

CryptoQuant founder and CEO Ki Young Ju posted a couple of charts to demonstrate the statistical significance of the “biggest BTC outflows on Binance this year.”

It confirms that about that reserves have shrunk by about 10K-12K BTC. However, zooming out shows that it is just a blip in the grand scheme of things.

Binance CEO Changpeng Zhao commented on Gary Gensler’s tweet announcing his latest salvo in the war on crypto.

“Wonder if he ever reads the comments under his post, from the consumers he is supposed to protect.”

In the name of “investor protection,” the SEC has caused a great deal of financial losses for many investors today.

According to CoinGlass, 111,545 traders were liquidated, with a total figure of $301.3 million liquidated over the past 24 hours.

Furthermore, long positions were the lion’s share of liquidations, with $292 million liquidated on June 5. Binance has seen nearly $100 million in exchange liquidations from derivatives positions over the past 24 hours.

If you want to read more about the best crypto exchange alternatives to Binance, check out our guide here!

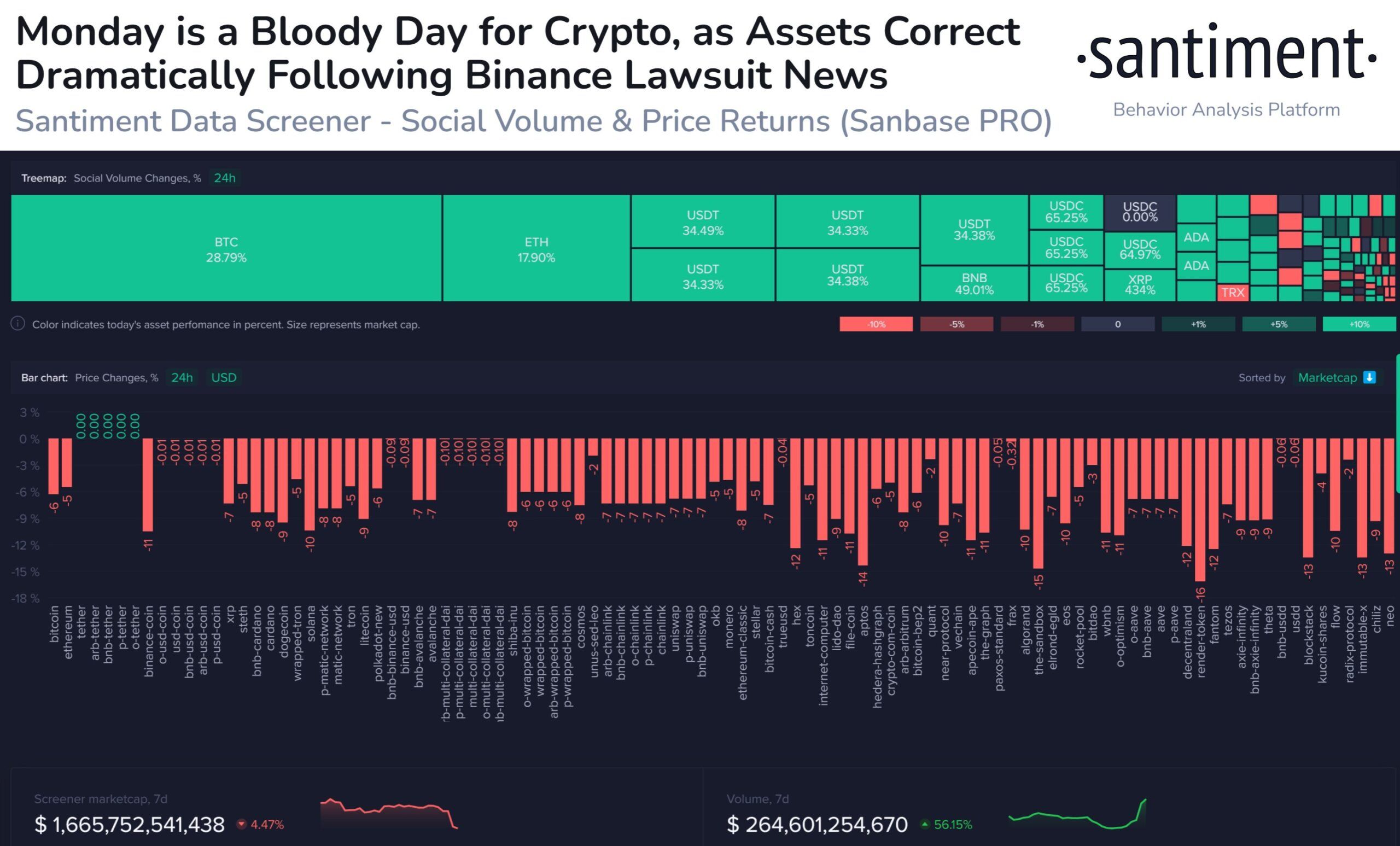

Altcoin ‘Securities’ Getting Hammered

At the time of writing, the market rout appears to have slowed, with a total of $46 billion having left the space. Total capitalization is down 4.5% on the day to $1.13, keeping it range-bound on the 90-day timeframe.

Bitcoin was down 4.2% to $25,742, while Ethereum had shed 3.2%, falling to $1,812. This is nothing unusual for crypto markets.

However, the altcoins that the SEC has deemed securities have tanked. BNB dropped 8.4% to $276 at the time of writing. Cardano (ADA), Solana (SOL), Polygon (MATIC), Algorand (ALGO), and Cosmos (ATOM), among others, had lost between 7-8%.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.