The Bitcoin (BTC) price action contained a breakdown on May 11. While the price bounced afterward, it failed to reclaim the breakdown level.

Unless the Bitcoin price manages to do so in the near future, the ongoing decrease will be expected to continue.

Has the Bitcoin Correction Begun?

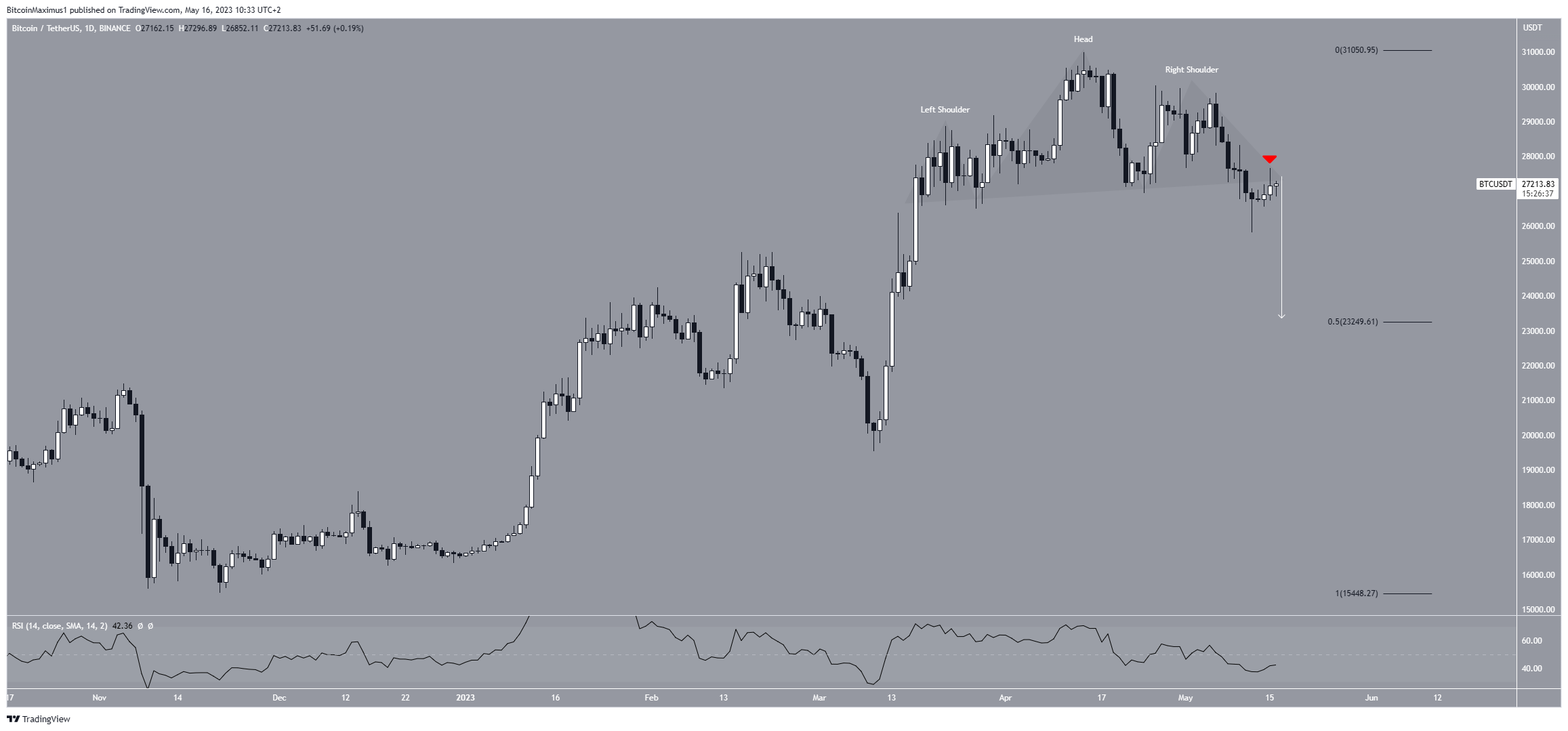

The technical analysis from the daily time frame gives a bearish Bitcoin price prediction. This is due to the creation of and breakdown from a head and shoulders, which is considered a bearish pattern.

The pattern starts with a high point, followed by a higher peak, and then a second peak of similar length to the first one. Subsequently, a drop occurs, breaking the neckline and triggering a steep decline.

The price broke down from the pattern on May 11, confirming its validity.

Based on the Fibonacci retracement principle, after a significant price change in one direction, the price often retraces or returns partially to a previous price level before continuing in its original direction.

After a subsequent bounce, the BTC price validated the neckline as resistance (red icon) on May 15 and fell over the next 24 hours. If the pattern is correct, this could lead to more downside.

The daily Relative Strength Index (RSI) supports the continuing decrease. The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite. The current reading is below 50, a sign of a bearish trend.

BTC Price Prediction: What Does the Wave Count Say?

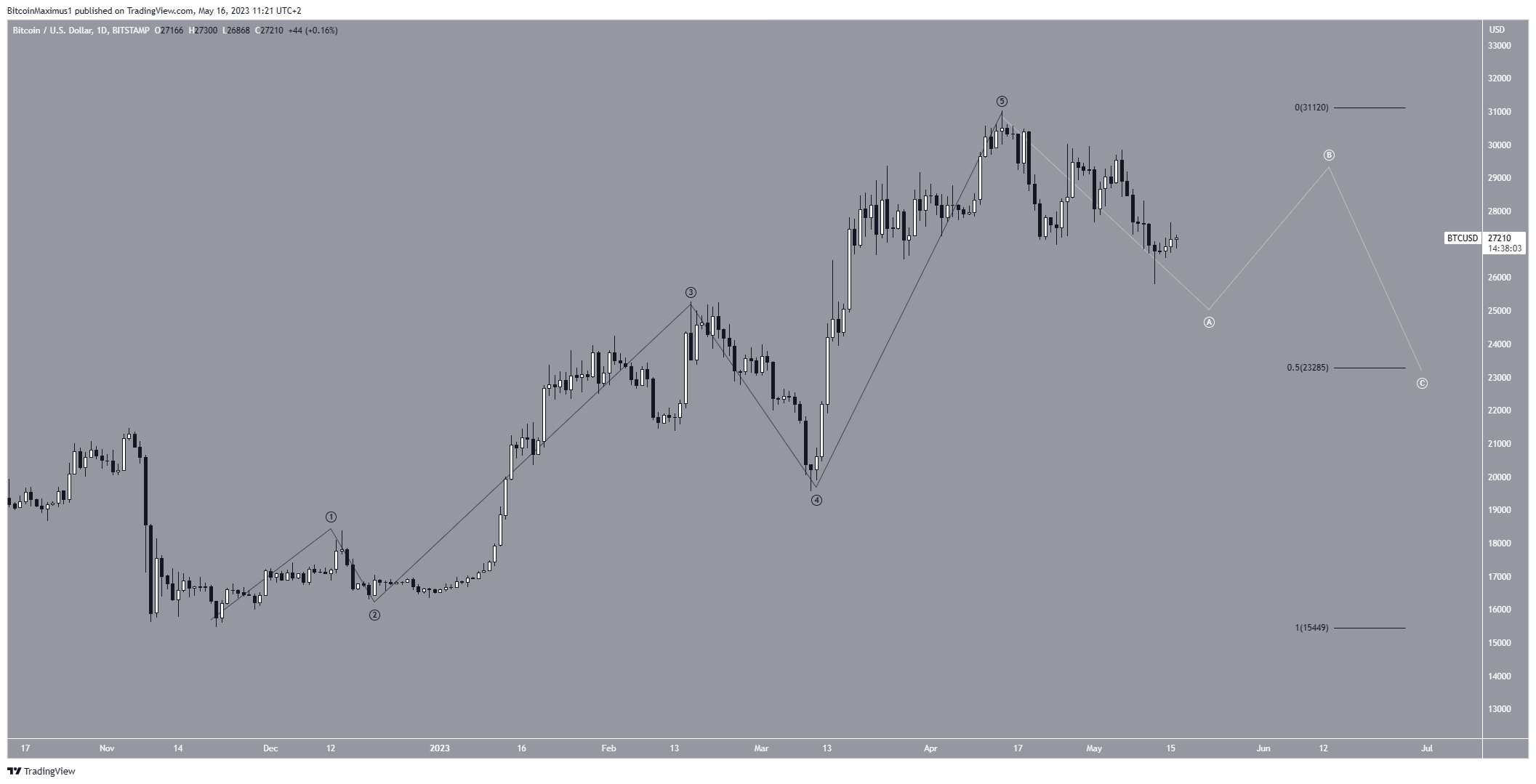

There are two potential wave counts for future movement. The Elliott Wave theory, employed by technical analysts, involves the analysis of recurring long-term price patterns and investor psychology to determine the direction of a trend.

The bearish count suggests the BTC price completed a five-wave upward movement (black). If so, it is now in an A-B-C correction (white).

As indicated previously, if the potential price breakdown follows the entire height of the pattern (indicated in white), it could lead to the digital asset falling to a minimum price of $23,400.

This corresponds to the support level of 0.5 Fibonacci retracement (indicated in black). This outline fits perfectly with the corrective structure, meaning that the bottom can coincide with the Fib level.

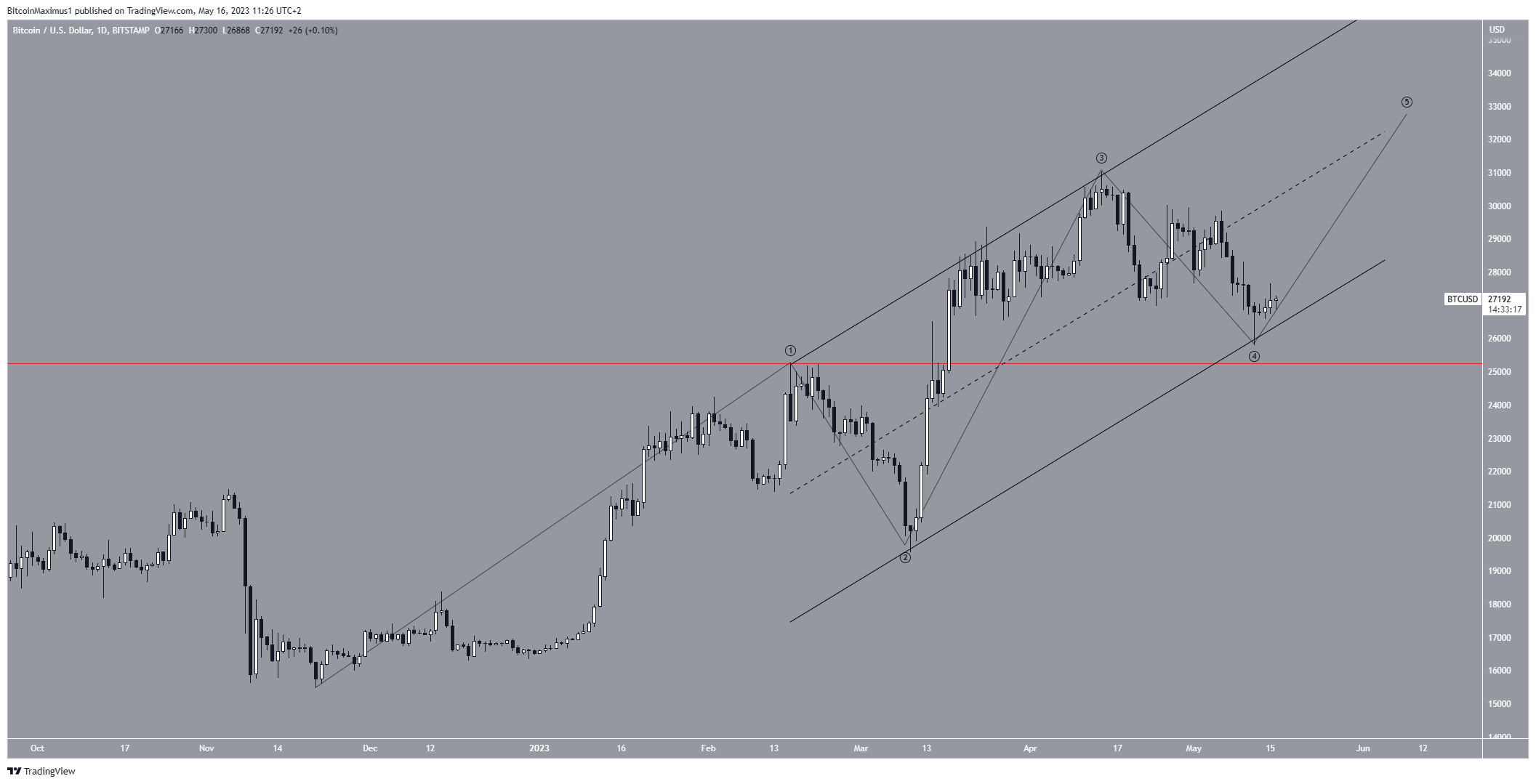

The bullish count suggests BTC is currently in wave four of a five-wave upward movement. So, another increase toward an average price of $33,000 is expected.

While this does not fit with the head and shoulder pattern, it fits with a channel connecting the highs of waves one and three. If it occurs, it will likely cause the continuation of the bull run for the rest of the cryptocurrency market.

A BTC price decrease below the $25,270 high (red line) will confirm that the bearish count is in play. This is because Elliott wave guidelines indicate that wave four cannot go into the territory of wave one (red line).

Also, this would cause a breakdown from the potential channel. So, if this occurs, the BTC price prediction would suggest a drop to $23,200 is expected.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.