The HEX PulseChain has launched to mainnet but not without a few hiccups. Complaints about network fees and a tanking HEX token price are among them.

On May 14, the HEX PulseChain went live as a hard fork of Ethereum. The project is part of controversial crypto proponent Richard Heart’s HEX ecosystem.

PulseChain Fees Surge

PulseChain has been touted as another “Ethereum killer” for its high throughput and low fee system. However, little of that was evident on launch day as the problems piled up.

On May 14, Eric Wall tweeted screenshots of some of the issues users were facing with PulseChain.

“PulseChain raised $1 billion dollars to ‘reduce Ethereum fees’ by copying Ethereum without the Layer 2s,” he said.

Network gas fees skyrocketed due to demand on launch day. The FreePulse account tweeted, “withdrawals are too expensive to run the faucet properly.”

“People are posting screenshots where fees are ~$100 if you price PLS in what people paid for them in the ICO,” commented Wall.

He explained that Ethereum’s next upgrade, EIP-4844, will provide tremendous scaling benefits for Ethereum layer 2 networks, adding:

“PulseChain will copy these upgrades to stay up to date, but since PulseChain doesn’t use Layer 2s, there will be no scalability upgrade. Just more complex code.”

Richard Heart said gas fees were working as intended, “If someone else wants to pay more than you to get into a block, they get in and you do not.”

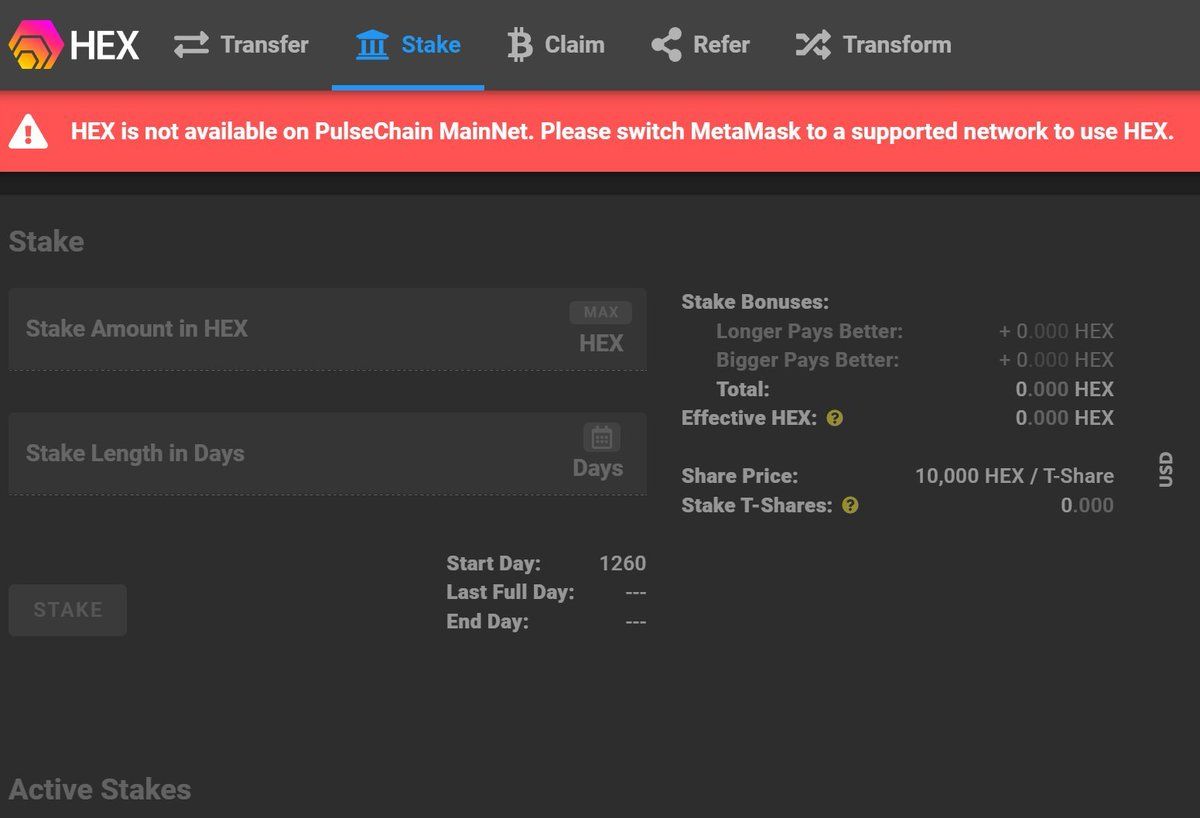

There were also issues connecting PulseChain to HEX, with some users reporting errors. Heart simply suggested uninstalling and reinstalling MetaMask or using a different browser.

Users were also posting their error messages and problems on Reddit.

PulseChain was forked from Ethereum in an effort to alleviate high transaction fees. However, if the first day is anything to go by, it has failed miserably at that task.

Furthermore, PulseChain replaces ERC-20 token standards with PRC-20 and its own native token PLS. The launch and PLS airdrop has been heavily promoted on Twitter recently, leading to a surge in interest.

Heart’s HEX project has often been labeled as a Ponzi scheme, and token prices have tanked 94% from their all-time high.

HEX Price Takes a Dive

HEX prices have tanked a whopping 60% over the past five days. On May 11, the token was trading at $0.08, but today it has fallen to $0.03.

In September 2021, HEX reached a peak price of $0.51 but has not been anywhere near that level since. PLS has yet to be listed on any of the analytics platforms.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.