The U.S. Department of Justice wants only to allow Sam Bankman-Fried (SBF) to use a non-internet-enabled mobile and specific websites on his laptop.

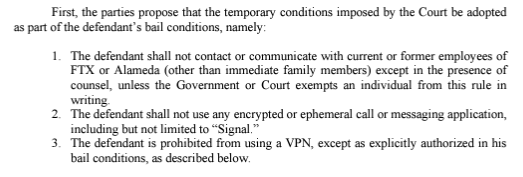

The U.S. District Attorney for the Southern District of New York asked Jusge Lewis Kaplan in a court filing to restrict Bankman-Fried’s mobile communication to a non-smartphone and only allow him to access whitelisted sights on his laptop using a specific VPN.

Sam Bankman-Fried Should Only Visit Certain Websites After Angering Judge

Additionally, the government and the court must know the mobile device’s IMEI, SIM, MAC, and IMSI numbers. They must also know a new laptop’s IP and MAC addresses.

Related to his defense, Bankman-Fried can only use the computer to access certain GSuite products. These include Google Drive, Google Docs, and read-only websites.

On a personal basis, he can visit news sites, including Bloomberg and the Wall Street Journal, and entertainment platforms like Spotify and Netflix.

His parents must sign an affidavit to install monitoring software on all devices in their home. Bankman-Fried must also agree not to purchase any new devices.

Judge Kaplan had previously banned SBF from using unauthorized VPNs to bypass government detection. Under the temporary conditions, Bankman-Fried cannot use encrypted messaging platforms to contact former FTX employees.

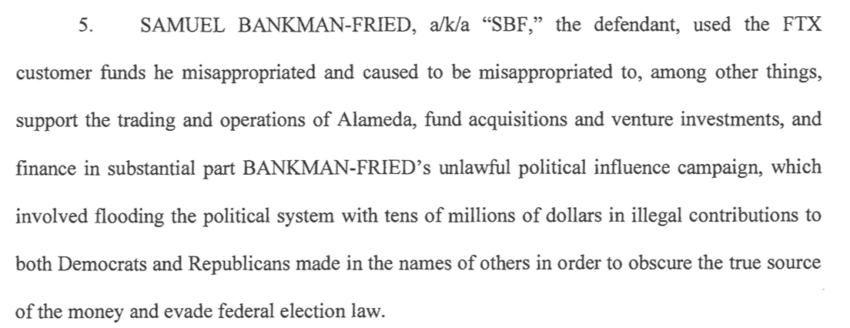

Prosecutors increased the charges against the founder of crypto exchange FTX, which collapsed in November last year, in a revised indictment filed on Feb. 23, 2023.

SBF now faces four fraud-related charges and four counts of conspiracy relating to how he ran FTX. The new indictment alleges that Bankman-Fried colluded with other FTX employees to illegally donate FTX customer funds to politicians during last year’s U.S. mid-term elections.

Bankman-Fried’s former engineering head Nishad Singh pleaded guilty to criminal charges related to FTX’s dealings with its affiliate market maker Alameda research.

FTX Asserts That Robinhood Shares Belong in Bankruptcy, Not With BlockFi

Even as Bankman-Fried feels the noose tightening on his fight for absolution, a dispute surrounding the status of his Robinhood shares is gathering momentum in Delaware.

Crypto lender BlockFi, which filed for bankruptcy in late November, has been fighting to claw back the shares amid its bankruptcy proceedings.

FTX filed for bankruptcy on Nov. 11, 2022, after a spate of customer withdrawals caused a liquidity crunch at the exchange. The bankruptcy filing was made with the Delaware chancery court, with lawyers Sullivan and Cromwell litigating on behalf of FTX.

Conforming with U.S. bankruptcy law, which protects insolvent firms from lawsuits, FTX recently argued that the Robinhood shares belong in its bankruptcy rather than with lender BlockFi until their ownership status can be resolved,

The shares were originally purchased by Antiguan entity Emergent Fidelity Technologies Ltd., where Bankman-Fried held a controlling interest. Bankman-Fried and former FTX CTO Gary Wang borrowed money from Alameda to buy the shares. Emergent later used the shares to collateralize a loan Alameda took from BlockFi before FTX filed for bankruptcy.

FTX has argued that the shares belong to Alameda. BlockFi, on the other hand, claims that Bankman-Fried owned the shares through Emergent Technologies.

The judge overseeing BlockFi’s bankruptcy case recently ordered troubled crypto bank Silvergate to return BlockFi’s $9.85 million deposit.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.