Crypto tax standards in the upcoming year may prove to be a trying time for the industry. Global tax regulators are applying more pressure on centralized and decentralized exchanges. This could even affect your own personal crypto holdings.

The primary source of income for most governments is taxation. Not surprisingly, crypto’s incredible growth has attracted the attention of tax agencies everywhere, and significant changes are coming very soon.

This article will shed some light on the recently passed global crypto tax plans and how they might affect the future of the industry.

Witnessing the Rise of Crypto

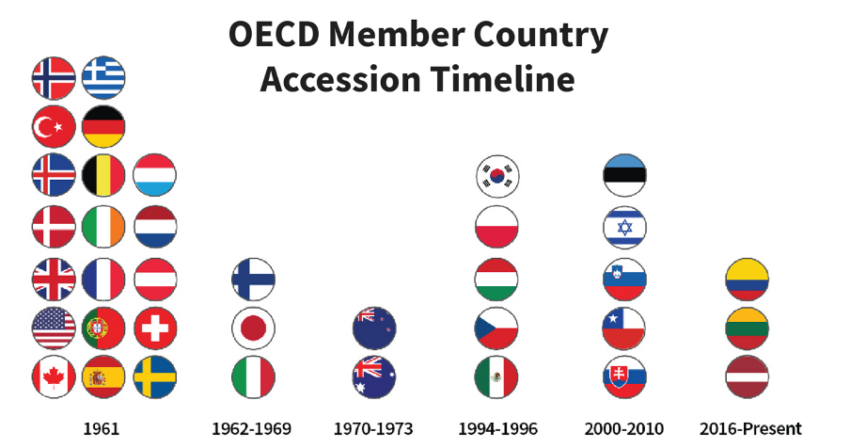

These global crypto tax plans come from an unelected international organization, the Organization on Economic Cooperation and Development (OECD). It consists of 38 of the most developed and wealthy countries. The OECD website states that its purpose is to “Build better policies for better lives.”

In practice, the organization proposes policy recommendations that have the potential to become regulations in its member countries. Currently, there are 38 OECD member countries.

The OECD’s interest in cryptocurrency taxation began in late 2020. This makes sense, given that this was when the previous crypto bull market started to explode. During this time, the regulatory organization noticed inconsistent tax regulations between its member countries.

Shortly after, the OECD announced that it would release global crypto tax standards in 2021, citing ‘rising interest by its member countries to tax cryptocurrencies.’

Taxing Crypto Earnings

There has already been some delay since the OECD’s initial draft of the global crypto tax standards. This draft, however, contains some concerning elements involving potential tax reporting rules related to DeFi protocols, stablecoins, and NFTs.

There are also concerns about whether compliance with the Crypto Asset Reporting Framework (CARF) would price out the competition. This is essentially what happened with the OECD’s previous global tax proposal for the traditional financial system. The OECD introduced the Common Reporting Standard (CRS) in 2014. It was challenging and expensive for existing financial institutions to comply with when it went into effect.

Complying with the CARF is likely going to be even more difficult and expensive. Mainly because of all the additional data that the OECD demands from crypto companies and platforms. After digesting comments and suggestions from experts and crypto industry leaders, the OECD released its finalized global crypto tax standards in October.

Multiple governments have since confirmed that they will apply these standards sometime next year, including member countries of the European Union.

Aligning With the Standards

BeInCrypto received exclusive comments from EU representatives over email that supported the taxation standards. Reiterating points from the Dec. 8 report, Paolo Gentiloni, Commissioner for Economy, a vital member of the EU, asserted:

“Our proposal will ensure that Member States get the information they need to ensure that taxes are paid on gains made in trading or investing crypto-assets. It is also consistent with the OECD initiative on the Crypto-Asset Reporting Framework and the EU Regulation on Markets in Crypto-Assets.”

The proposal takes the form of an amendment to the Directive for Administration Cooperation (DAC). It is consistent with the OECD initiative on CARF and CRS.

The finalized proposal specifies that ‘entities or individuals that provide services effectuating exchange transactions in crypto assets for or on behalf of customers would be obliged to report under the CARF.’

In theory, this means that the CARF only applies to crypto exchanges and platforms. However, the scope of the CARF could be broader in practice, which could have severe implications for the crypto market. The CARF also includes amendments to the aforementioned common reporting standards for the traditional financial system.

This is interesting because these amendments primarily relate to central bank digital currencies or CBDCs. This confirms that the OECD expects CBDCs to become more prevalent and widely implemented in the coming years.

OECD Tax Plans

The CARF consists of four pillars:

- Relevant cryptocurrencies: The cryptocurrencies the CARF applies to.

- Relevant entities: the individuals and institutions that must report tax-related information.

- Transaction reporting: The types of transactions they will need to register.

- Due diligence: The background checks they will need to do.

The CARF could eventually apply to personal cryptocurrency wallets. This includes hot wallets (wallets connected to the internet) and cold wallets (crypto wallets kept offline i.e. hardware wallets). The report also implies that just having a personal cryptocurrency wallet means a person is a risk for illicit activity and tax evasion.

There will likely be amendments to the CARF that amend rules pertaining to personal crypto wallets and DeFi protocols. The said report specifies that these regulations will cover any ‘new crypto technologies developed’ in the future.

The CARF currently only applies to stablecoins, tokenized real-world assets, and “certain NFTs.” This is surprising because the Financial Action Task Force or FATF excluded all NFTs from its own finalized cryptocurrency regulation recommendations.

Breaking it down

Notably, three types of cryptocurrencies do not fall under the CARF. The first is any cryptocurrency that’s not used as a means of payment or for investment. The second and third are CBDCs and centralized stablecoins.

When it comes to individuals and institutions, the report states that it applies primarily to any intermediary that provides crypto services of any kind. This includes crypto-to-fiat trading, crypto-to-crypto trading, crypto custody, crypto ATMs, and some decentralized exchanges. Regarding DEXs, the report sheds light on FATF’s finalized crypto regulation recommendations. That is, decentralized exchanges which aren’t truly decentralized will be heavily regulated.

Was it a good way of ensuring the crypto ecosystem stays decentralized longer term? Only time will tell. But there’s a grey area. In a so-called reporting Nexus for the individuals and institutions that fall under the CARF, relevant entities will need to provide extensive details about all their subsidiaries, their headquarters, where they operate from, and where they’re taxed.

This may raise concerns because many international exchanges have yet to establish their global offices. If they don’t do so before the CARF is implemented in OECD countries, they could be banned by all of them.

Missing Details

Crypto exchanges and platforms will have to scrutinize their users’ info heavily. But a few tax experts revealed that the CARF could be applied in up to 140 countries. This is significantly more than the G20 countries that the OECD is directed towards.

In an episode of the International Tax Bites, one of the tax experts also noticed that the OECD’s definition of a crypto asset could apply to smart contracts. And, therefore, to decentralized apps (dApps) and DeFi protocols. This is because the definition focuses on the transfer of value across a distributed ledger. Which smart contracts technically also do.

If that wasn’t scary enough, the CARF could be “done at a moment’s notice” and could be “easily slipped into bills working their way through parliaments.” Moreover, cryptocurrency exchanges and platform users would have up to 12 months to complete the tax self-certification form before being banned.

The tax experts stressed that any inconsistencies between the information on the self-certification form and any information on the crypto exchange could result in serious issues. The threshold for inconsistency will vary from country to country.

How the Landscape Might Look

Crypto exchanges and platforms will have to provide detailed reports. Including relevant transactions for every single coin and token they offer. Regarding the timeline, the tax experts asserted that it could start being rolled out in some countries by next year and differ from country to country. However, the experts warned that some of these exchanges and platforms could have serious troubles if they don’t get ahead of the game.

Overall, penalties are calculated based on the number of users, not violations. For instance, if the penalty for late CARF reporting is $1,000 per day, and a cryptocurrency exchange with 1 million users reports to tax authorities one day late. It would not be a $1,000 fine; it would be a $1 billion fine.

This is terrifying for crypto businesses.

What does the future hold?

Here’s the big question: What could the OECD’s CARF mean for the crypto market once it’s introduced?

The short answer is that it ultimately depends on whether cryptocurrency exchanges can set up their infrastructure to comply with the CARF before it’s rolled out.

As mentioned above, this will be much more difficult for so-called offshore cryptocurrency exchanges. It may be easier for cryptocurrency exchanges such as Coinbase. However, many of these so-called onshore exchanges already feel the bear market squeeze.

This is likely why the OECD waited until the end of 2022 to announce the CARF. Because its constituents knew that the cost of CARF compliance would further compress cryptocurrency exchanges.

After all, billions of dollars have already flowed from the traditional financial system into cryptocurrency exchanges and platforms. And a lot of this money came from big banks. This is why many banks started offering in-house crypto trading services in 2021.

At the same time, governments worldwide will soon be rolling out their CBDCs, and the last thing they want is competition from other digital currencies. This likely explains the inclusion of stablecoins in the CARF.

Any positives?

Most of the potentially damaging regulations would only affect centralized elements of the crypto industry. This could even be considered bullish for decentralized alternatives such as decentralized exchanges.

This ties into another implication of the CARF: the continued erosion of on-chain privacy. Reporting every transaction to and from personal cryptocurrency to tax authorities is a dangerous precedent.

This could result in the de-listing of privacy coins for tax compliance reasons. Requiring exchanges and platforms to keep track of these transactions is also arguably overkill.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.