Christine Lagarde once argued that CBDCs could satisfy public policy goals linked to financial inclusion, consumer protection, and fraud prevention. The ex-IMF chief, however, failed to mention that CBDCs are mere digital versions of fiat currencies and can be weaponized as a total state surveillance and control tool.

In the extreme, central bank digital currencies (CBDCs) simply maintain the status quo. As Bitcoin took a foothold in unmediated economics, shocked governments brought up CBDCs off-schedule to lull the crowd back to their disturbed dream of fiat hegemony.

“I believe we should consider the possibility to issue digital currency,” Lagarde said at a conference in Singapore in 2018.

“There may be a role for the state to supply money to the digital economy. The advantage is clear. Your payment would be immediate, safe, cheap and potentially semi-anonymous. And central banks would retain a sure footing in payments,” she added.

CBDCs: Absolute central bank control

Lagarde comes from the same school of thought as Agustin Carstens of the Bank for International Settlements (BIS). Carstens told a 2020 IMF meeting that “central banks will have absolute control on the rules and regulations” that determine the use of CBDCs.

While crypto aficionados digested the right-wing tropes tied to CBDCs and soaked up the remote sounds of big Bitcoin skeptics, Ethereum quietly became state-compliant.

Ethereum merged on Sept. 15. It gave power to a small group of entities that are powerless to resist US government sanction committees. Ethereum potentially desecrated the Mecca of old-style Bitcoin purists on privacy. Just like CBDCs.

“Primarily, [with CBDCs] we do not have the same guarantee of transaprency that major stablecoins naturally provide (via the use of commonly used tools such as Etherscan, for example),” Jared Polites, partner at Rarestone Capital, told BeInCrypto.

“We do not know how governments will use the data, which data they will collect, how to accurately attribute data to people in edge cases, how third party applications and other services will integrate and provide security, etc.”

Polites added, “we simply do not have a clear enough picture of how CBDCs will be rolled out. And applied to guarantee they will be more efficient to the current majors such as USDC [stablecoin].”

Central bank involvement in digital currencies may be viewed as intrusive. Governments could impose unnecessary controls that hinder transaction speeds while sacrificing freedom and lower costs.

What is a CBDC?

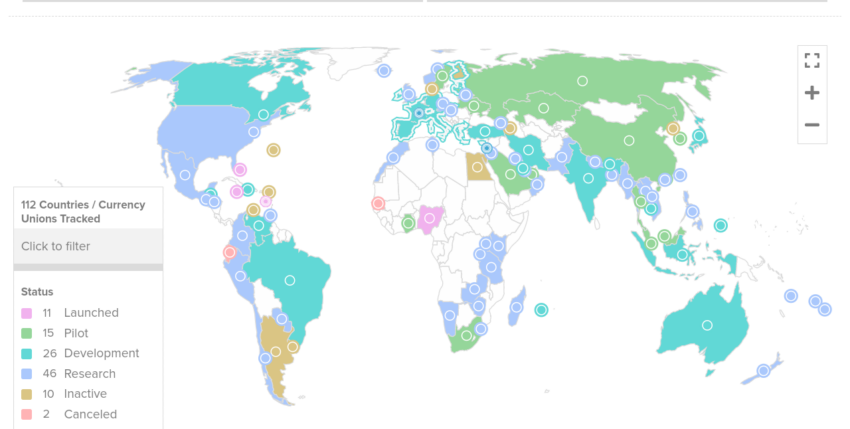

Central banks issue CBDCs. They were created in part to neutralize Bitcoin. About 105 countries, representing 95% of global GDP, are actively exploring the possibility of issuing state-backed cryptocurrencies, according to the Atlantic Council’s CBDC tracker.

In May 2020, only 35 countries considered a central bank digital currency, it said. At least 50 countries are in an advanced phase of exploration, which means development, pilot, or launch. About a dozen states and countries have already fully launched a digital currency.

China’s digital yuan pilot will expand throughout 2023. Jamaica is the latest country to launch a CBDC, the JAM-DEX. Nigeria, Africa’s largest economy, launched its CBDC in October 2021, which has struggled to gain traction.

According to a previous BIS study, central banks can issue two types of digital currencies – wholesale and general purpose. Wholesale CBDCs are generally limited to specific tasks such as interbank payments.

General-purpose digital currencies are designed to replace cash. They will be made available to the public. Some central banks from Canada, Singapore, and South Africa replicated wholesale payment systems using distributed ledger technology.

This is the same tech behind major independent crypto assets like Bitcoin. All of the above countries initially refused to acknowledge the impact of cryptocurrency in their economies. Central bankers regarded crypto as a niche pursuit rather than as the future of money.

Changing attitudes

Cashless transactions soared around the world in recent years. Many of the control freaks who work for various governments have become unsettled.

For example, Bitcoin challenges the conventional financial system. It aims to return the ownership of money to the people beyond the reach of the state. Steeped in tradition, global financial gurus did not endear themselves with Bitcoin’s vision.

Unsurprisingly, many governments have raised concerns about crypto assets. They have also called for tighter regulation while angling to issue their own versions of centralized digital currencies.

Christine Lagarde, the former IMF managing director, said previously that a state-issued cryptocurrency would be a liability of the state, just like fiat money. She also stated that CBDCs could reduce the cost of transactions while maximizing security and spreading adoption.

But they would not be censorship-resistant cryptocurrency in the true sense, according to observers. Stablecoins such as Tether’s USDT and Circle’s USDC compare favorably to CBDCs.

“Current stablecoins are global so in nature more decentralized,” Jared Polites, the Rarestone Capital partner, told BeInCrypto, adding:

“They are fully transaprent and are built with the same technology that powers most of the ecosystem, making them a natural fit for new products and services. Most, if not all, major reporting and tracking tools are compatilble, meaning there is full transaprency without jeaopordizing individual privacy on the surface level.”

Privacy threat

Crypto’s short history is a place for finding roots, constants, and recognitions. Pilgrims withdraw from modern times to contemplate the “noblest periods, the highest forms, the purest individualities,” as French philosopher Michel Foucault puts it.

But government snobs never seem to stand for libertarian, human-centered ideals for too long. A UK Parliament’s Economic Affairs Committee report found that “a CBDC could present significant challenges for financial stability and the protection of privacy.”

“Any CBDC system could not support anonymous transactions in the same way that cash can be spent anonymously,” said the report.

“While there are design options that would provide some privacy safeguards, technical specifications alone may be insufficient to counter public concern over the risk of state surveillance. The Bank of England risks being drawn into controversial debates on privacy.”

According to analysts, CBDCs may censor non-ordained addresses, and central banks will continue to control the monetary policy. On the surface, it seems like a digital dollar, yuan, or pound might displace Bitcoin’s growth because they are all digital. But it fails to address these principal concerns.

South Korea’s central bank warned in the past that adopting a state-backed cryptocurrency as an official form of legal tender would threaten the country’s financial stability. In a report, the Bank of Korea said a CBDC could result in a spike in interest rates and a liquidity crunch.

The idea is that as depositors withdraw money from the bank, commercial banks will fall into a liquidity trap, forcing the money supply to drop. This will ultimately see interest shooting up.

Ethereum centralization

Centralization concerns have plugged Ethereum since its mainnet merged with the Beacon Chain in September. Observers worry the new chain could give major stakers power to block transactions in compliance with regulatory demands.

This goes against the cryptocurrency ethos of privacy and decentralization, they say. Jared Polites told BeInCrypto that the crypto community had split opinions on the current state of Ethereum.

“One side sees it as a threat to the decentralized goals of the network, others find it a natural progression to a more used Ethereum ecosystem across the globe,” Polites stated. “The risk is there are nuances that make compliancy very tricky.”

For example, someone with OFAC violations decides to send or ‘dust’ famous wallets owned by high-profile compliant individuals. By nature, he said this interaction would classify the receiver wallet as violating OFAC sanctions or compliance.

“This does not make sense as they were not in direct communication, business, or dealings with the violator. There needs to be clear policies in place to allow CBDCs a chance to gain the trust of the crypto community as well as make compliancy easy for users that fall within certain jurisdictions,” Polites added.

Financial freedom

The Beacon Chain coordinates a network of stakers and introduced PoS to Ethereum. The switch to this new chain started in November 2020, as a one-way bridge began taking deposits. It secured millions of ETH from several validators (stakers).

Only four entities – Binance, Coinbase, Lido, and Kraken – control about 66% of all the ETH staked on Beacon Chain.

In our time, we take for granted the idea that Bitcoin, as a proxy for cryptocurrency, is a voice. For Bitcoin fundamentalists, political and financial freedom is nothing if not the handmaiden of privacy and decentralization.

We want to lean into Bitcoin to imagine an alternative reality. But Bitcoin is already positioned to do this as a self-existing universe. Rather than as a conditioned speech act, as epitomized by central bank digital currencies.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.