The U.S. Producer Price Index (PPI) rose 0.2% between Sep. and Oct. 2022, beating analysts’ expectations of 0.4%, according to a report released by the U.S. Bureau of Labor Statistics.

According to the report, the increase in PPI, excluding food, energy, and trade services, was driven by a 0.6% rise in price for final-demand goods.

Cryptos get a brief respite from volatility

The PPI for final demand rose 0.2% from Aug. to Sep. 2022 and remained unchanged between July to Aug. 2022. It increased by 8% compared to the year ending in Oct. 2022.

A lower-than-expected PPI suggests that inflation could be cooling. Shortly after the announcement, the stock market responded positively, with Dow Jones futures up 412 points, Nasdaq futures increasing 3%, and the S&P 500 futures rising 2%.

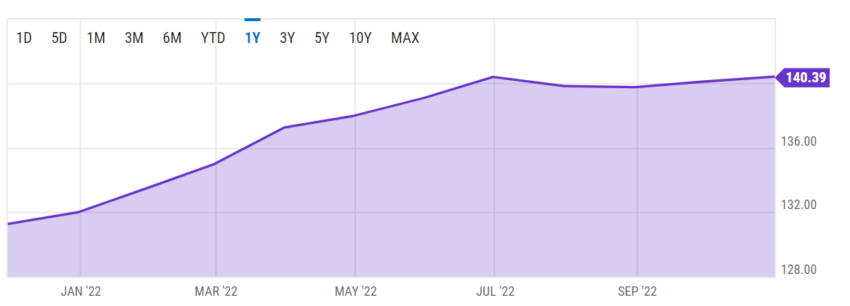

Crypto markets also rallied, with Bitcoin up roughly 3% to trade at $16,949.45 and ETH up 2.2% to $1,262.05.

The crypto industry has been under pressure since Bahamian exchange FTX faced a liquidity crunch on Sunday, Nov. 6, 2022, following a damning financial report about its sister company Alameda Research.

Bitcoin’s price briefly dipped below the $16,000 mark on Nov. 10, 2022, while on Nov. 14, 2022, the number of active ETH addresses had declined sharply, suggesting consumer pullback in the face of uncertainty.

Peter Schiff: Not so fast

A lower month-on-month PPI reflects a decrease in what producers pay to manufacture their goods. If input costs decrease, the producer makes more money and can pass on some cost savings to the consumer through lower prices. So a lower PPI means more money in the consumer’s pocket.

Crypto and traditional investors hope that more money in the consumer’s pocket means that the Fed will slow down the size and speed of its aggressive interest rate hikes, intended to combat record inflation in the U.S.

But Bitcoin critic Peter Schiff warns that it is too early to hope for a respite from rate hikes. He argues that consumer and producer prices will soon go up because the U.S. dollar index has fallen 8% in the last eight weeks. These increases would negate the “perceived progress” that the Fed is making, prompting sustained tightening.

Jurrien Timmer, Head of Global Macro at Fidelity Investments, issued a similar warning on Bloomberg TV after the PPI numbers were released.

“When stocks rally and bonds rally and the dollar goes down, financial conditions loosen, which is the opposite of what the Fed wants to see during the campaign because it wants financial conditions to tighten. [There’s a] risk that the Fed will start throwing cold water on this rally,” he said, referring to recent rallies in cyclical stocks like Caterpillar and PPG Industries. These stocks respond acutely to changes in economic growth.

Negative yield spreads point to 2023 recession

Earlier this year, the Federal Reserve, the central bank of the U.S., embarked on a tightening spree to combat inflation that many feared would tip the U.S. economy into a recession. The central bank imposed consecutive interest rate hikes of 0.25% in March 2022 and 0.5% in May 2022, followed by four hikes of 0.75% in June, July, Sep., and Nov. 2022.

In the most recent Federal Open Market Committee meeting, Fed chair Jerome H. Powell said that the window is narrowing for the economy to have a “soft landing,” a euphemism for avoiding a recession.

In the long run, this is not good news for crypto investors since other previously reliable predictors indicate an impending recession in 2023.

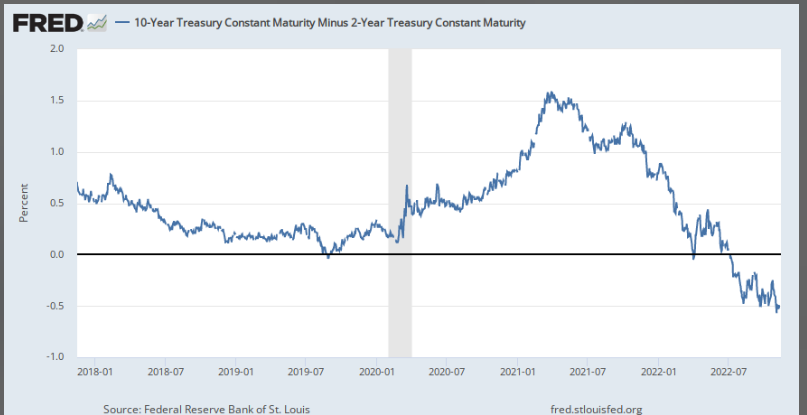

There is a deepening gulf between the yields of the 10-year (10Y) and three-month (3M) U.S. government Treasury instruments.

When it needs to borrow money, the U.S. government issues short and long-term Treasury instruments to its citizens. It pays them a return after a certain maturity period has passed.

Treasury notes have a maturity period of greater than one year but less than ten years, while Treasury bills mature within a year.

When the difference in yield between a longer-term instrument and a shorter-term instrument turns negative, e.g., the 10Y – 3M spread is less than zero, it is a sign that investors expect returns on longer-term instruments to grow increasingly lower. Investors looking for lower-risk investments drive down 10-year yields through demand.

At press time, the yield spread between 10Y and 3M treasuries was roughly -0.46%, while the spread between 10Y and 2Y yields was about -0.5%.

Unfortunately for crypto investors, history has shown that increasingly negative Treasury yield spreads have foreshadowed recessions. Threats of a recession could deepen the crypto winter.

Got something to say? Write to us or join the discussion on our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.