Getting to grips with jargon is an important part of learning about any highly technical field. Finance and technology are both notorious for its use of highly specialized language. It should come as no surprise that crypto, as an emerging financial technology and combination of the two, is a minefield of confusing vernacular.

Crypto novices might soon stumble across words like “mainnet” and “testnet” after learning terms like “blockchain” and “distributed ledger.” These two words are abbreviations for “main network” and “test network.” So, what is a mainnet, and why is it important? And what about testnets?

In this guide:

- What is a mainnet in cryptocurrency?

- What are the characteristics of a mainnet?

- Why do we need a mainnet?

- Importance of testnets

- Mainnet vs. testnet: What are the differences?

- Launching a new cryptocurrency mainnet — the process

- Do mainnet launches have an impact on crypto prices?

- Mainnets are a huge milestone for a project

- Frequently asked questions

What is a mainnet in cryptocurrency?

Normally, when someone refers to the Bitcoin network, what they are actually referring to is bitcoin’s mainnet. They are referring to Bitcoin’s fully developed, live blockchain network that is actively broadcasting, verifying, and recording transactions. That pretty much summarizes the definition of a mainnet — a blockchain network that has been launched, is fully operational, and is actively processing transactions using distributed ledger technology.

What are the characteristics of a mainnet?

A mainnet is an independent blockchain that runs by itself, using its own technology and its own cryptocurrency. An ERC-20 cryptocurrency token such as shiba inu does not have a mainnet of its own given that it is traded on top of the Ethereum network. By contrast, dogecoin has its own independent blockchain, based on its own technology, and thus has its own mainnet.

Similarly, fully functional and live decentralized applications (DApps) built on top of the Ethereum network do not have their own mainnet. Rather, they operate on top of Ethereum’s mainnet. The crypto assets trading on a mainnet like ethereum are designed to have real-world value and utility.

Why do we need a mainnet?

The launch of a mainnet is what brings crypto technology from the stage of intellectual musing to the real world. Mainnets are what the entire emergent, decentralized crypto financial system is built on. Without the launch of mainnets, the crypto revolution would have never started.

Pseudo-anonymous developer Satoshi Nakamoto kicked things off in mid-2009 with the launch of the Bitcoin mainnet. The launch came just under a year after Nakamoto had released the first crypto “whitepaper” outlining the theory behind how Bitcoin would work. The Litecoin mainnet launched in 2011 and the Dogecoin mainnet in 2013. Ethereum’s mainnet, the first to support smart contracts, was launched in 2015.

Importance of testnets

So, now that we have an understanding of what mainnets are and why they are important; what about testnets?

Testnets are blockchains that run parallel to and are almost identical to the mainnet. Unlike a mainnet, users are not trading with tokens that have tangible value as they do on a mainnet. They exist so that crypto developers can test and hone their code in something akin to a sandbox environment. If development was taking place on the mainnet, there would be a risk of costly disruptions and developers would incur transaction fees whilst adding to network congestion. Testnets exist to avoid such hiccups.

Tokens can’t be sent between a testnet and mainnet. An attempt to do so essentially burns the coins by sending them to an unrecoverable address.

A good example of the importance of testnets in crypto developments is the recent Ethereum “Merge.” The Merge refers to the network’s transition from a proof-of-work consensus mechanism to proof-of-stake in mid-September.

Prior to implementing the mainnet Merge, Ethereum developers conducted three separate major dress rehearsals on public Ethereum testnets. The Ropsten, Sepolia, and Goerli testnets all went through with the upgrade between the months of May and July. Their success allowed the mainnet Merge to subsequently take place.

Mainnet vs. testnet: What are the differences?

Now we have an understanding of what a mainnet is and what a testnet is, let’s clarify the differences to avoid confusion. A mainnet is the blockchain that provides all the real-world utility. The digital assets trading on the mainnet have real value. It is the live blockchain that is actually being used by members of the public. It is the “finished” product of crypto development.

“Finished” is in quotation marks because most of these mainnet blockchains are under continual development in order to improve their capabilities, and will be upgraded over time. Testnets, on the other hand, exist solely for developers looking to enhance the mainnet. Testnets allow developers to test out their new code and applications without threatening the health of the mainnet or incurring fees.

The digital assets trading testnets are worthless, removing the risk that development errors incur costs.

Launching a new cryptocurrency mainnet — the process

Releasing a new cryptocurrency mainnet requires significant resources. These include paying for the product and community development, as well as promotion. As a result, before a mainnet launch, a crypto development team will often look to raise funds. This is usually done via an Initial Coin Offering (ICO) or Initial Exchange Offering (IEO).

In an ICO, crypto developers will sell blockchain-based tokens to early investors, who will then proceed to trade the tokens among themselves. While the process is very different, the general idea is the same as with an Initial Public Offering (IPO) — i.e., when a company raises money directly from the public stock market for the first time.

Ethereum popularized the ICO when it conducted its own in 2014. There was then a boom in ICOs in 2017. IEOs are a little different from ICOs, as an exchange (such as Binance) will take the lead regarding the sale of tokens.

Given that a team of cryptocurrency developers hasn’t yet launched their mainnet, but still want to sell tokens, they might choose to issue their tokens on top of an existing mainnet. For example, Ethereum supports the creation and trade of alternative tokens (such as the ERC-20 standard).

A team of developers hoping to soon release their own mainnet could raise funds by selling ERC-20 tokens with the promise that they would have future value when they launch their own mainnet. Once funding is secured, development and testing completed and hype built, developers are ready to launch the mainnet.

Do mainnet launches have an impact on crypto prices?

One might assume that a successful mainnet launch would always be bullish for a cryptocurrency’s price. After all, a successful mainnet launch signifies to investors that the project is coming to fruition. As is ever the case with financial markets, things are not that simple.

Crypto prices rise before mainnet launch and fall after

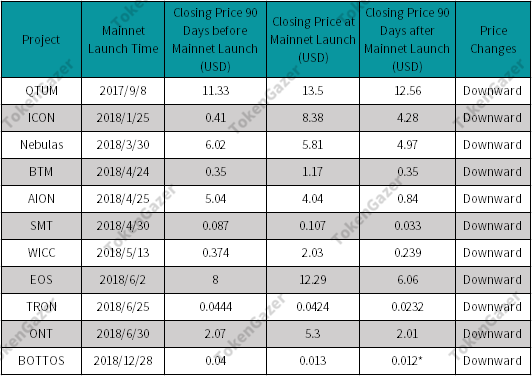

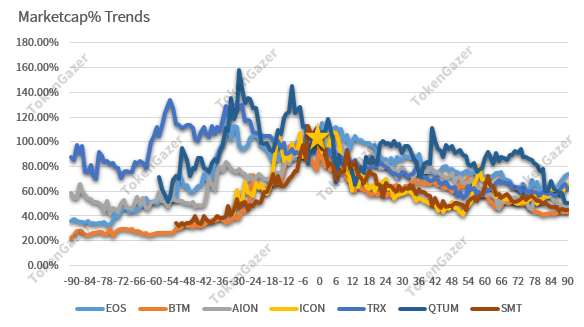

According to research conducted by crypto research house TokenGazer in 2019 of 11 mainnet launches between September 2017 and June 2018, token prices generally “increased before the mainnet launch and dropped after it.” Much of this can be explained by a downtrend in the broader cryptocurrency market at the time.

So TokenGazer instead looked at the respective token’s share of overall total cryptocurrency market capitalization. They found that, for most tokens, market cap was highest at the time of the mainnet launch. That means market cap increased in the run-up to the launch and then decreased afterwards.

Why might prices fall after a mainnet launch?

Cryptocurrency analysts attribute several potential reasons why a mainnet launch might not be bullish for a cryptocurrency’s price. A successful mainnet launch could encourage early investors to book profits. A successful mainnet launch might also unlock tokens held by members of the developments team, potentially adding a further source of sell pressure.

Meanwhile, the mainnet’s performance metrics might not live up to expectations — for instance, a mainnet may be unable to deliver as high tps rate as promised. Either way, investing in speculative cryptocurrencies ahead of mainnet release remains a highly risky business.

Mainnets are a huge milestone for a project

Understanding the difference between a mainnet and testnet and how the two are interlinked is a crucial stepping stone for investors wanting to understand how a cryptocurrency network evolves over time.

Testnets serve as a proving ground for the development team’s ideas, and can greatly help in refining the protocol. Mainnets act as a milestone for the project, which has been developed enough for the protocol to be released to the public — and with the actual tangible value being utilized.

Frequently asked questions

What is a mainnet?

What happens when a crypto goes mainnet?

How does a mainnet work?

Why is the mainnet important?

How to add the Polygon mainnet in MetaMask?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.