Be[in]Crypto takes a look at the five cryptocurrencies that increased the most last week, more specifically, from Sept. 23 to Sept. 30.

These cryptocurrencies are:

- Quant (QNT): 31.63%

- Maker (MKR): 17.05%

- Helium (HNT): 11.87%

- Uniswap (UNI): 11.15%

- Chainlink (LINK): 10.47%

QNT approaches crucial resistance

QNT has been moving upwards since breaking out from a long-term descending resistance line in the beginning of June. The upward movement has been following an ascending support line and so far, led to a high of $145.8.

QNT has reached the long-term $145 horizontal resistance area, which is the most important resistance until the all-time high price.

Therefore, a movement above it could greatly accelerate the rate of increase towards $283, the 0.618 Fib retracement resistance level.

MKR bounces at wedge support

MKR has been decreasing inside a descending wedge since Aug. 2021. The wedge is considered a bullish pattern, meaning that an eventual breakout from it would be the most likely scenario. Both the resistance and support lines of the wedge have been validated numerous times, increasing the legitimacy of the pattern.

The price bounced at the support line of the wedge on Sept. 21 and has been increasing since. If it manages to break out from it, the next closest resistance area would be at $2,000.

HNT reaches resistance

HNT has been increasing alongside an ascending support line since Sept. 6. The line has been validated three times (green icons), most recently on Sept. 28.

When combined with the $5.40 resistance area, this creates an ascending triangle, which is considered a bullish pattern. However, HNT was rejected by the resistance area on Sept. 30 (red icon).

Whether HNT breaks down from the support line or moves above the $5.40 resistance will likely determine the direction of the future trend.

UNI bounces after completion of downward movement

Beginning on July 28, UNI completed a five-wave downward movement, which led to a low of $5.14 on Sept. 21. The price has been moving upwards since, so far reaching a high of $6.76.

UNI is currently facing resistance at $6.80. If it is successful in moving above it, the next closest resistance area would be at $8.15.

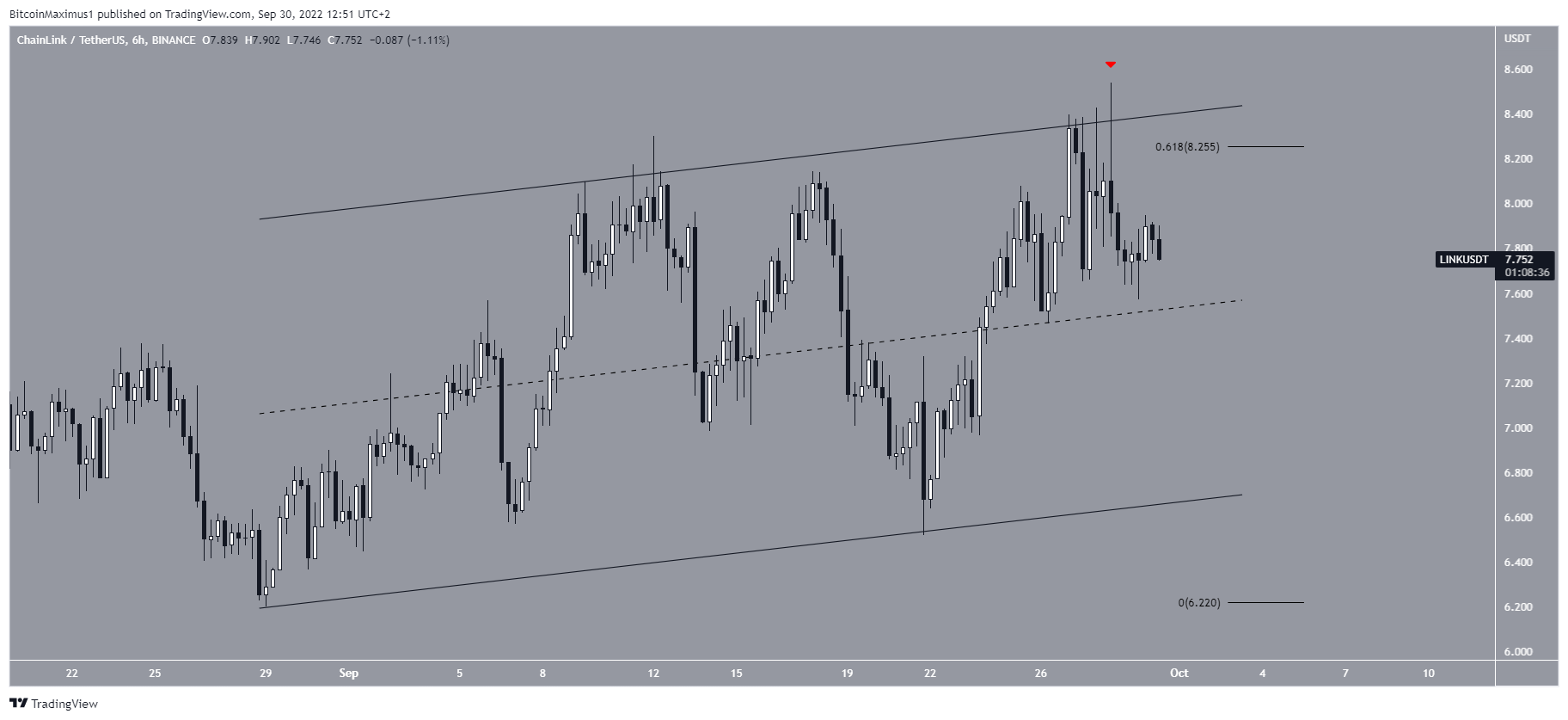

LINK is rejected by channel resistance

LINK has been increasing inside an ascending parallel channel since Aug. 28. The movement inside it led to a high of $8.54 on Sept. 28. However, LINK was rejected by the resistance line of the channel and the 0.618 Fib retracement resistance level. This created a long upper wick (red icon) in the process.

Currently, LINK is approaching the middle of the channel at $7.50.

Since ascending parallel channels usually contain corrective movements, an eventual breakdown from it would be the most likely scenario. The chances of this happening would be further increased by a movement below this channel.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.