What is crypto staking

Crypto staking is one of the options for passive income. Here’s how it works: users lock their coins for a specific period. In return, they become validators who help verify transactions and maintain the network’s operations. Validators check transactions within the blockchain and support its functionality. To lock their cryptocurrency in staking, they receive rewards.

In essence, when you stake, you lock your assets in the blockchain, thereby supporting its operations, and in return, you earn profits.

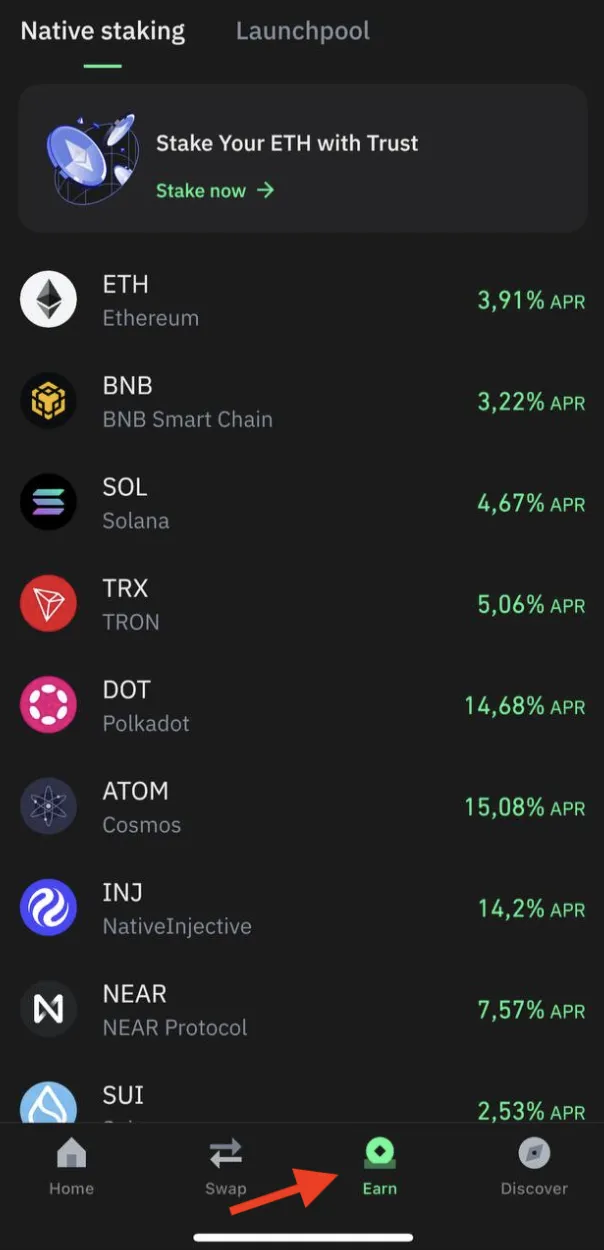

Some networks use staking as a consensus mechanism. With it, they build a well-functioning ecosystem. Among such networks are Ethereum, Solana, Cosmos, and Sui. They operate on the Proof-of-Stake (PoS) model.

How to Choose the Best Cryptocurrency Staking Sites

There are many staking sites in the crypto industry, so choosing the best one might seem difficult. To help you with that, we have compiled a list of aspects you should consider when selecting a platform for earning passive income through staking:

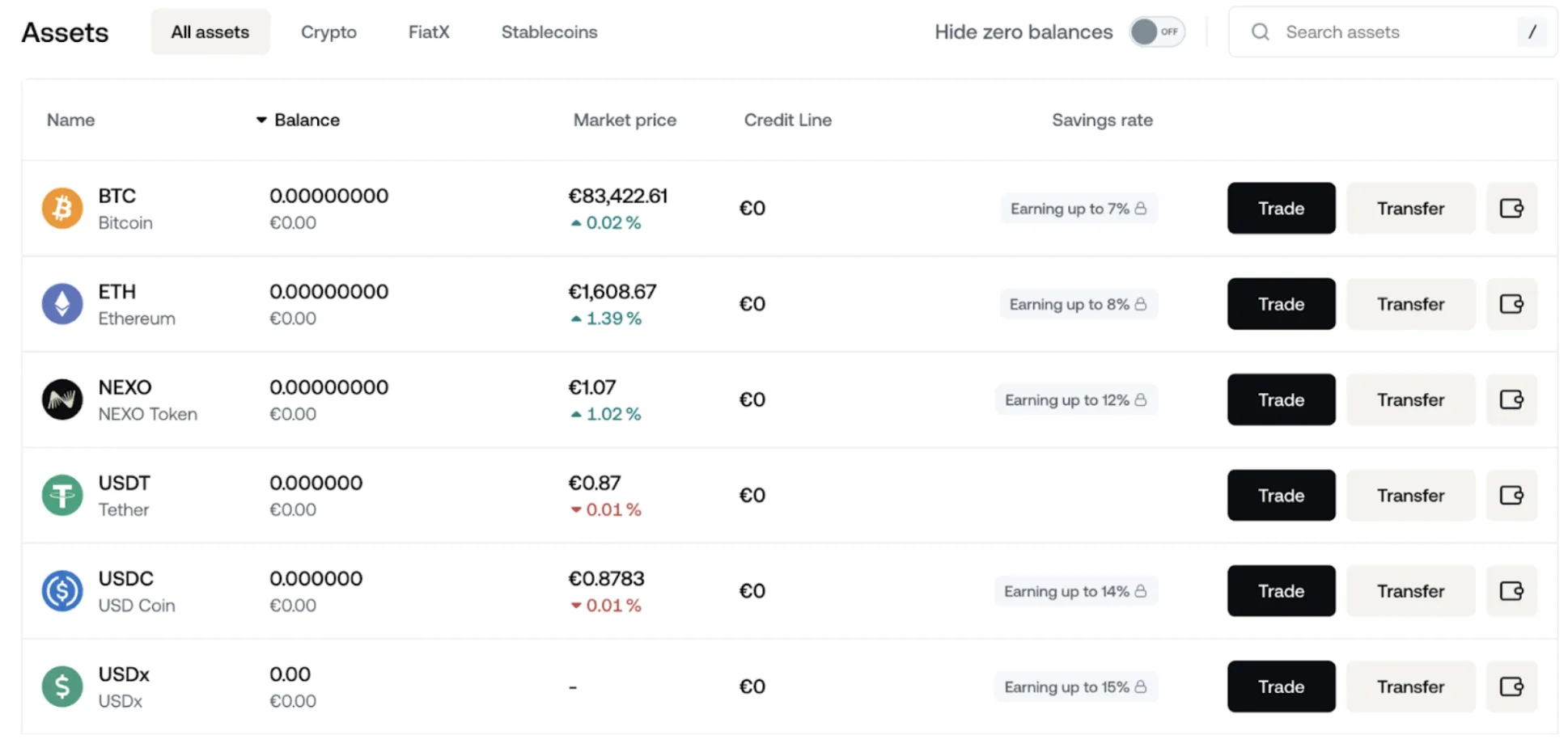

- Supported assets for staking: Make sure the site or platform supports the cryptocurrencies you want to stake.

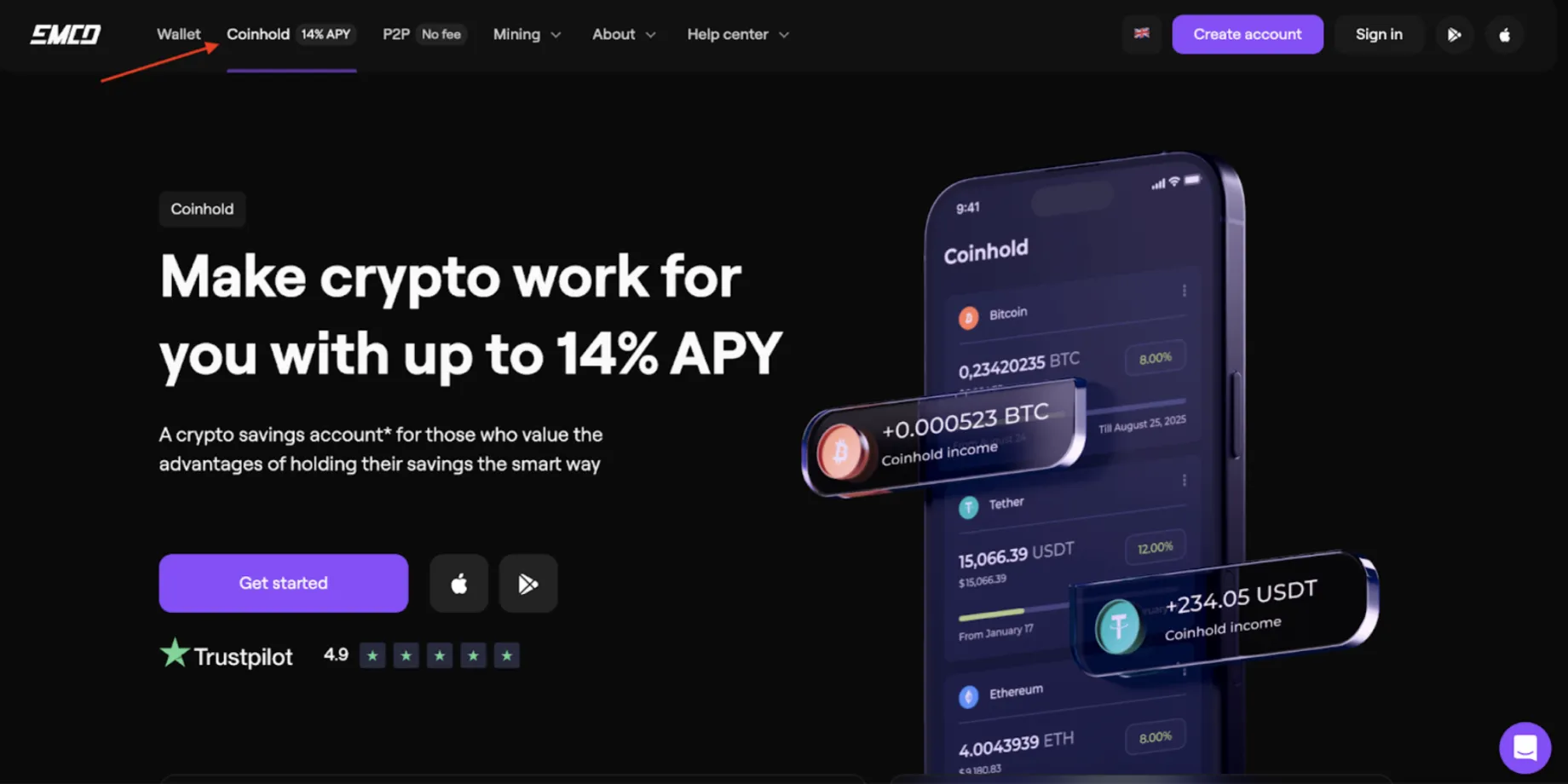

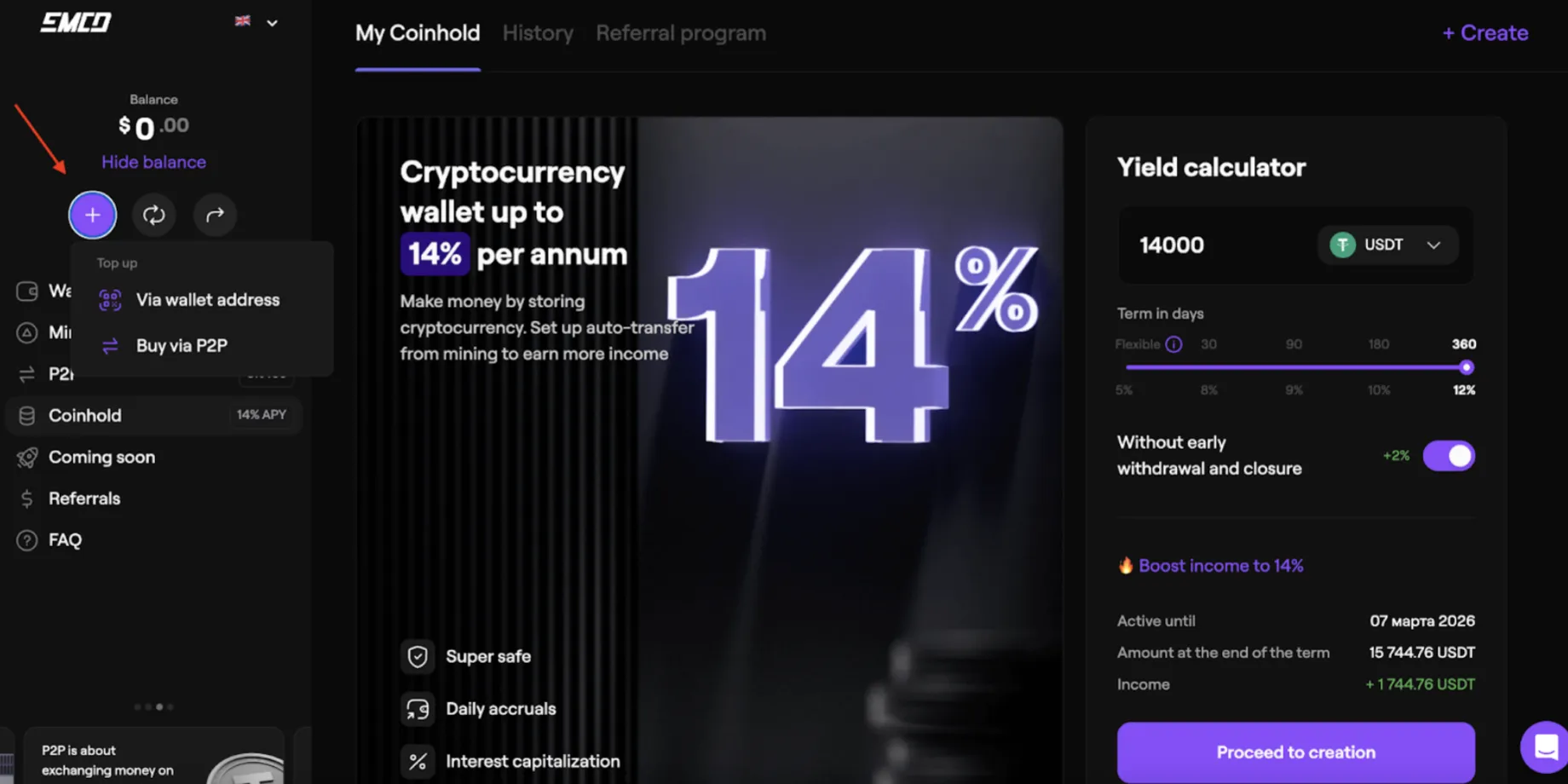

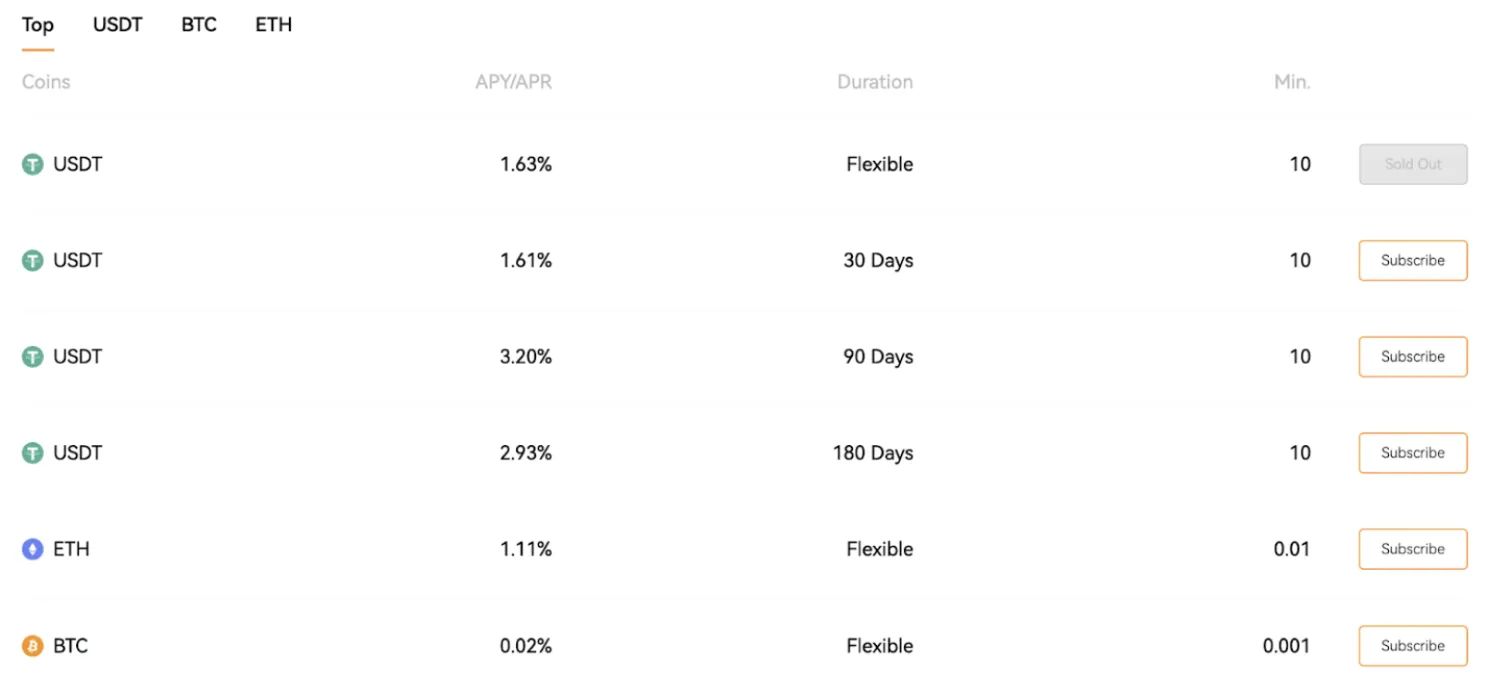

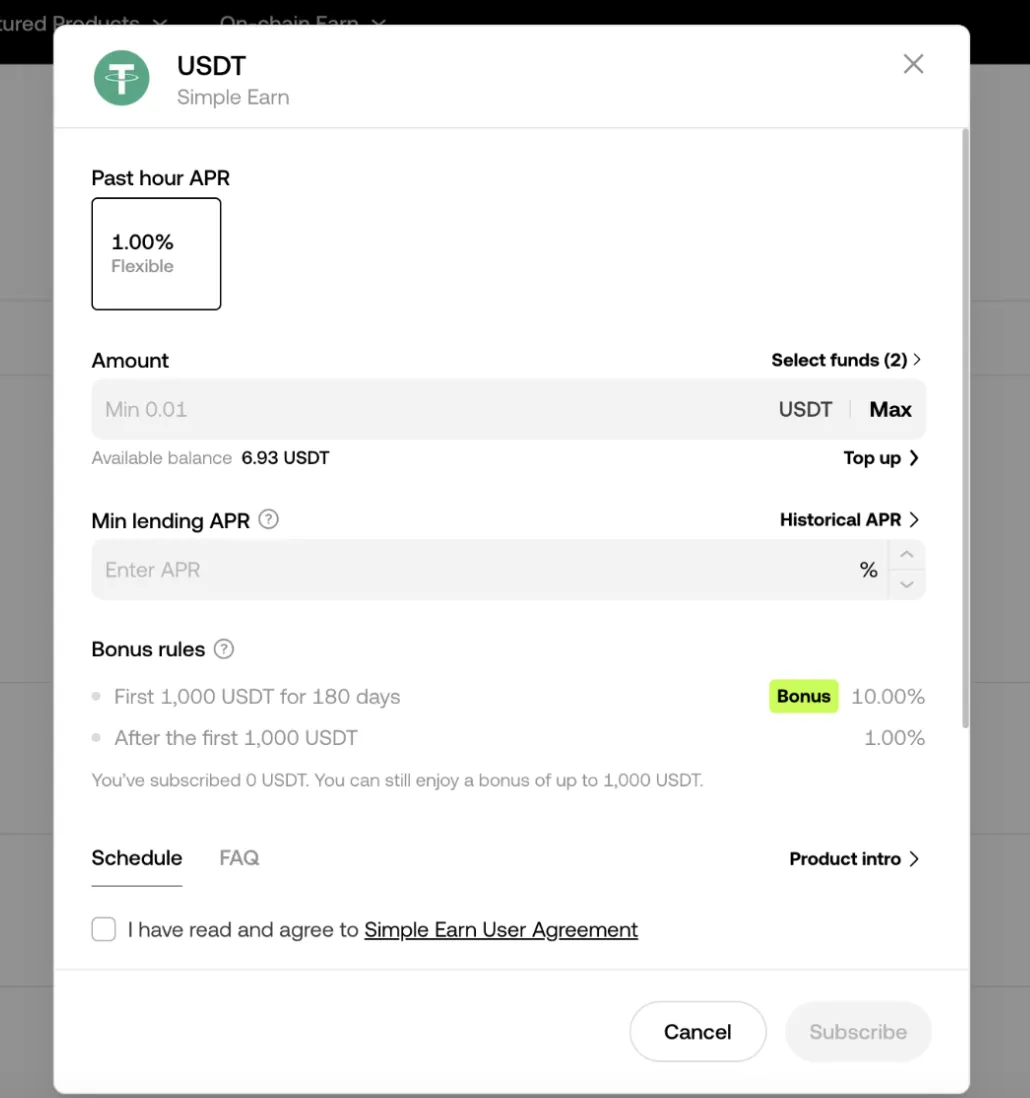

- APY: This is the Annual Percentage Rate, or how much money you can get by staking the chosen asset. Some platforms offer higher returns, while others provide lower numbers.

- Security: This one is always of the highest priority. Check if the site or platform employs all the latest security measures, such as two-factor authentication (2FA), encryption, cold storage holding, etc.

- Fees: Commissions that some platforms charge sometimes can be the deciding factor. Compare fees that different sites offer and only then make a final decision. Without this, you could easily miss a more profitable option.

- Liquidity: Some platforms may offer fixed terms for staking, while others allow you to exit your position anytime. If liquidity is important, look for platforms with more flexible conditions.

- Reputation: Get acquainted with other users’ reviews regarding the platform you put your eyes on.

How to Maximize Your Staking Rewards

There are several strategies you can consider to maximize your staking rewards. Let’s explore them.

Choose assets with highest APY

APYs change from one platform to another. They also depend on the staking asset. Compare all the available offers in the market and choose the one with the most appropriate conditions for you. But remember that extremely high returns are usually associated with certain risks. Do a thorough research before investing.

Reinvest profits

Instead of withdrawing all your earnings immediately, consider reinvesting them into staking again. This will help you increase the budget working for you and maximize your profits through compounding.

If you stake $1,000 in Ethereum with a 6% APY, your balance will grow by $60 after one year. If you reinvest those $60 into staking, your earnings in the second year will be calculated not on $1,000 but on $1,060, thereby increasing your profit for the following year.

Diversify

Diversification is a strategy for spreading assets across different cryptocurrencies or staking platforms to reduce risks. This allows you to minimize losses if one of the assets or pools underperforms.

Instead of staking all your funds in a single cryptocurrency, you can distribute them like here:

- 40% in ETH for stable returns.

- 30% in DOT for higher yields.

- 30% in SOL for diversification and potential growth.

Leverage Liquid Staking

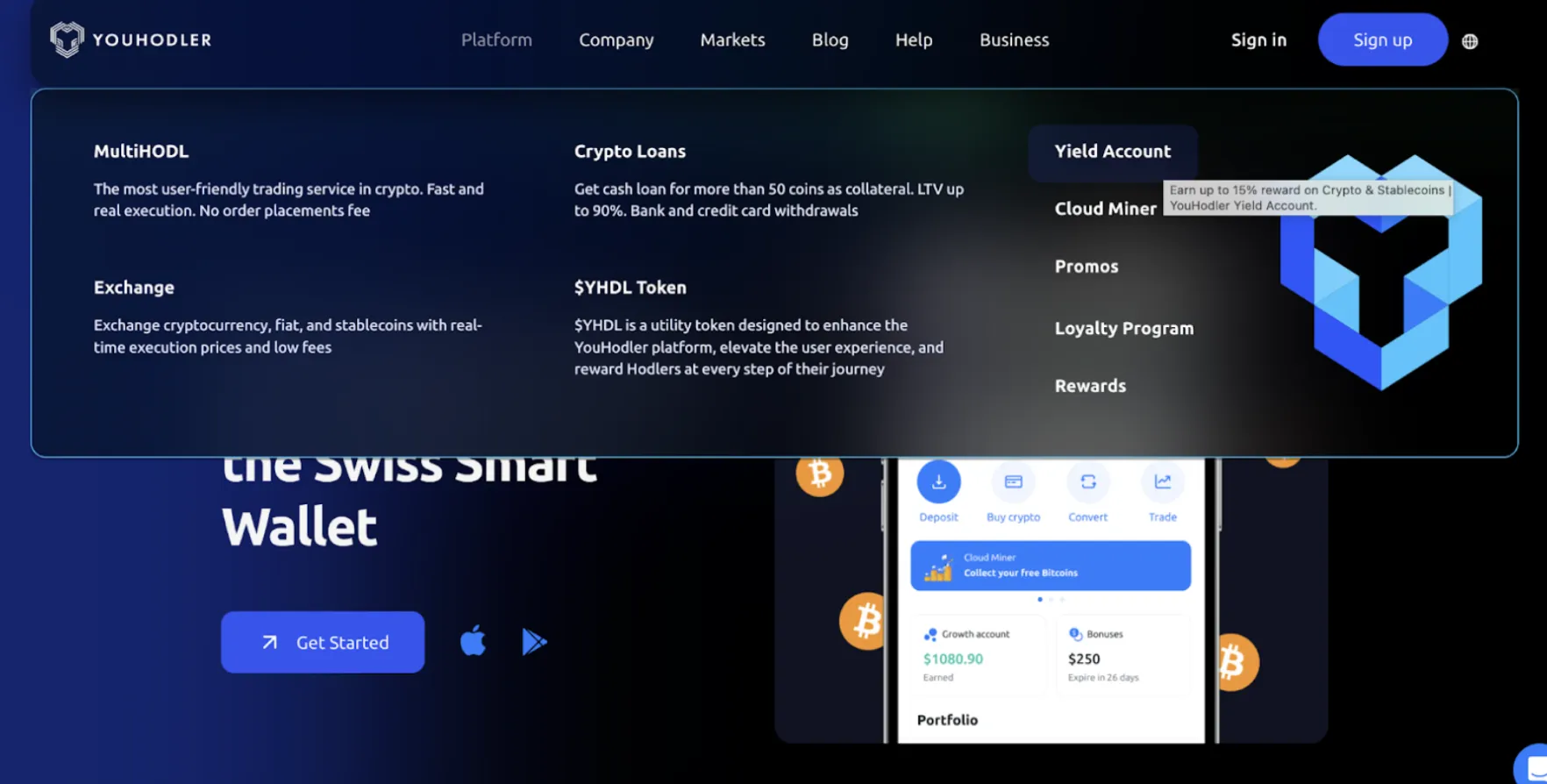

This strategy allows you to stake cryptocurrency and borrow funds to increase your position. In other words, it combines liquid staking with leverage. Platforms like Margex, as mentioned earlier, offer this feature.

Here’s how leverage liquid staking works:

- You stake your cryptocurrency and receive liquid staking tokens, which can be used to borrow funds or for restaking.

- Using borrowed funds increases your staking position and earns more rewards.

Use Long-Term Staking Products

Many platforms offer long-term staking products that provide higher yields by locking funds for a specific period. For example, you can choose staking for 6 or 12 months, which allows you to earn higher interest, but you won’t be able to withdraw your funds before the term ends.

Conclusion

Crypto staking is one of the most popular and effective ways to earn passive income. Users can receive rewards for supporting blockchain networks by locking their assets. Many staking platforms are available, and when choosing one, it’s important to consider factors such as supported assets, APY, security, fees, and liquidity. Also, check the platform’s reputation and determine if it’s trustworthy.

To maximize your earnings from crypto staking, you can employ several strategies. For example, reinvest your profits, diversify your portfolio, leverage liquid staking and explore long-term staking products offered by some platforms. However, it is always important to remember that higher returns often come with higher risks, so conducting thorough research before investing is essential.

Frequently Asked Questions (FAQ)

Crypto staking is generally safe but it comes with some risks. Users could lose funds because of hacks, problems with exchanges or smart contract issues.

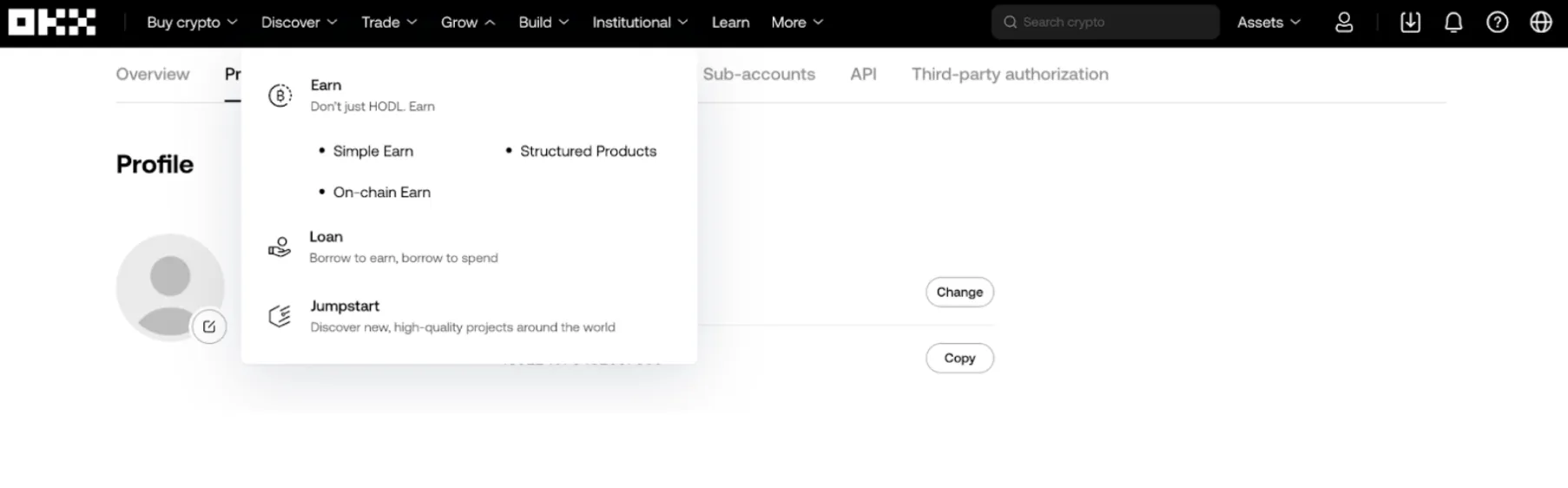

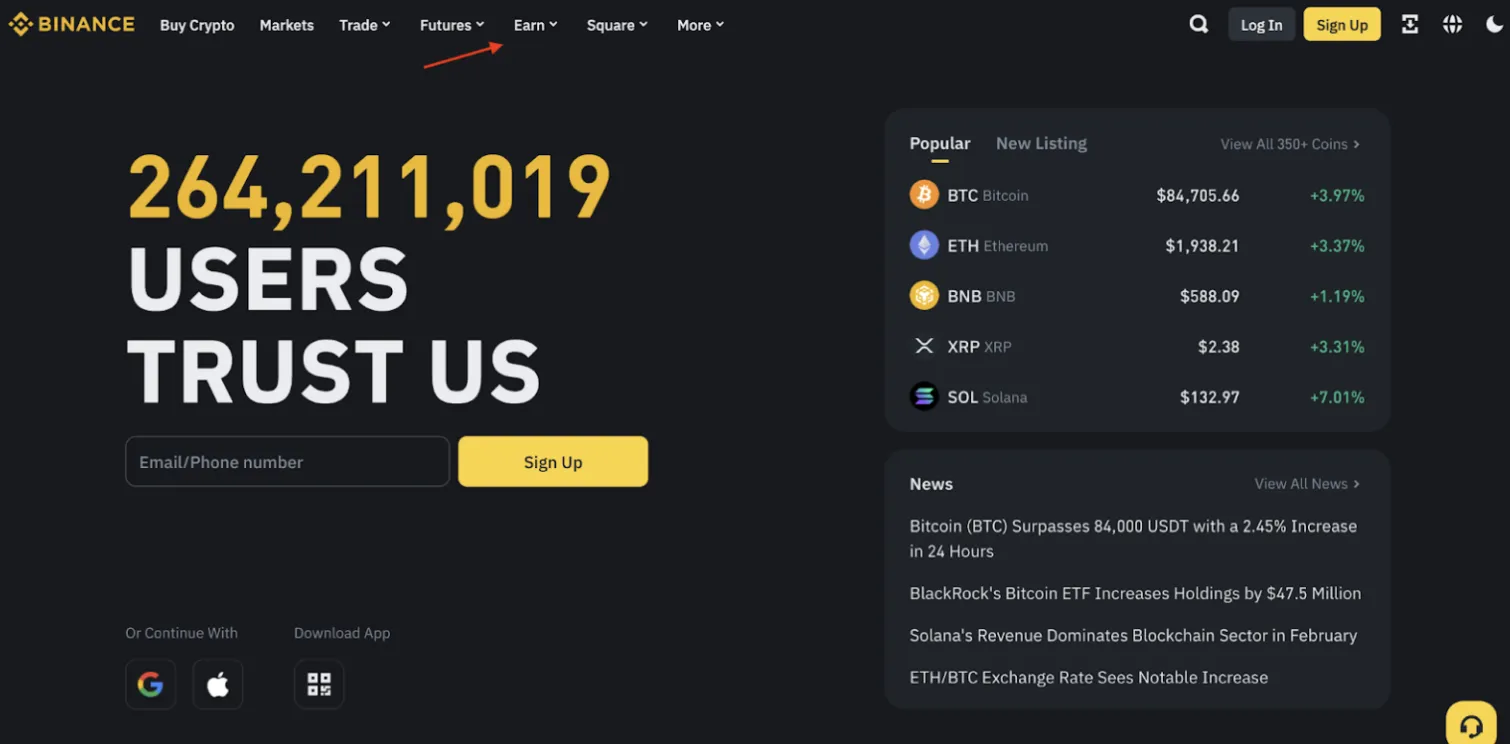

What crypto platform is best depends on your own preferences. The most popular choices are definitely Binance, Coinbase and OKX as these are the world’s biggest crypto exchanges. However, many users prefer staking with Trust Wallet, Uphold or Wirex, because they offer high yields and wide functionality.

Yes, you can. The main risk comes from volatility, which is inherent for all cryptocurrencies. If the value of your staked asset drops, your overall holdings decrease as well. Another big risk is a hacker attack on the platform you use for staking.

Binance has the highest APY of up to 100%+ for limited periods.

You can stake all cryptos that work on the Proof-of-Stake (PoS) consensus mechanism. The most popular ones include Ethereum (ETH), Solana (SOL), Cosmos (ATOM), Cardano (ADA), Polkadot (DOT) and many more.

It depends on the staking platform you use. If you stake cryptocurrencies on Binance, Coinbase, OKX or KuCoin, you can rest assured that your assets are safe, because those are widely known and trusted exchanges. The same goes for such platforms as Trust Wallet, EMC, Uphold and Wirex. However, no one in the crypto ecosystem is 100% immune to hacks.

Crypto staking platforms generate rewards by allowing users to lock up their tokens to help secure the network and validate transactions. Validators are chosen based on the amount of tokens staked, and in return, they earn rewards, which are distributed among stakers, often after platform fees.