Ethereum total value locked (TVL) increased significantly in July due to a recovering market that saw investors pour more liquidity into decentralized finance (DeFi).

Ethereum was one of the best-performing blockchain projects in the last month. According to Be[In]Crypto research, Ethereum gained 24% in total value locked in the seventh month of 2022.

On July 1, Ethereum had a TVL of approximately $46 billion and soared to about $57 billion on July 31.

Why the rise in TVL?

Ethereum TVL was up in July due to the growth in liquidity poured into decentralized applications (dApps) in its ecosystem.

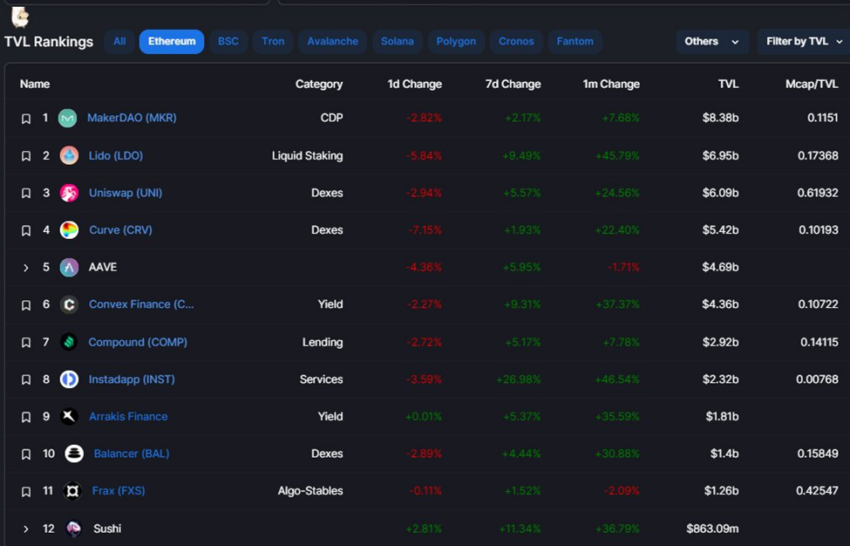

MakerDAO (which has the most TVL in Ethereum) rose by more than 7% in the last month. Lido Finance spiked more than 45% within the same period. Convex Finance and Uniswap saw a 37% and 24% improvement in liquidity in their respective total values locked. Curve was also up by more than 22%. Balancer, Arrakis Finance, and Instadapp also made significant contributions to TVL.

Ethereum remained the largest chain with the most value locked in July.

ETH price reaction

ETH opened on July 1, with a trading price of $1,068.32, reached a monthly high of $1,759.88, tested a monthly low of $1,033.96, and closed at $1,681.52. Overall, this equates to a 57% increase between the opening and closing price of ETH in July.

What do you think about this subject? Write to us and tell us!

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.